A leading financial institution wanted to achieve organic growth for its credit card portfolio by revamping its card origination risk decision framework. The firm wanted to develop a customized risk score model for new account origination, including exploring new modeling technology and incorporating alternative data to help power the model.

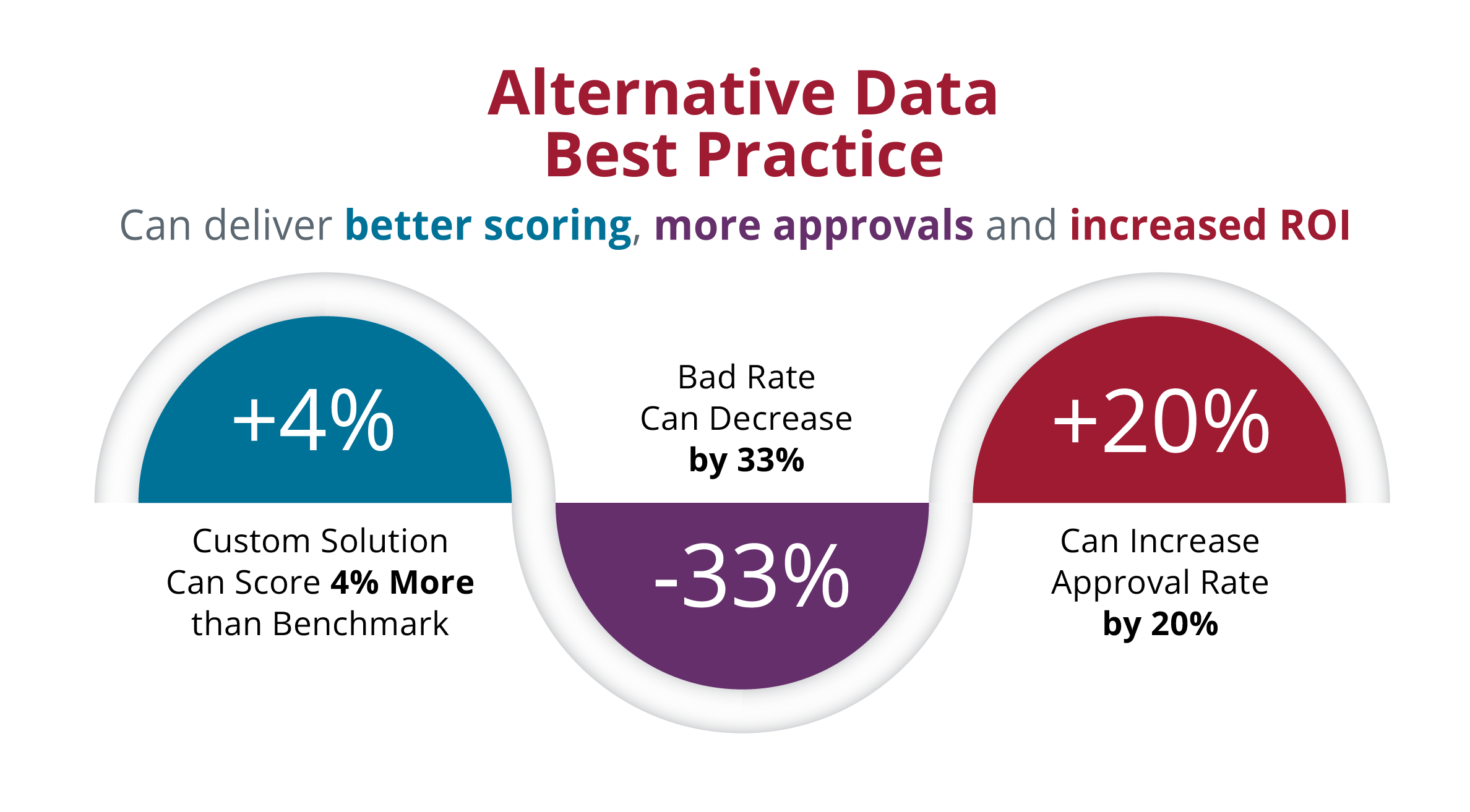

By using new technology and alternative data from Equifax, a customer acquisition risk model can better evaluate the credit risk of borrowers — including credit invisibles — to expand approvals and increase revenue while managing risk.

Related Page

Visit Fintech