Understanding credit begins with understanding your credit reports. Credit reports are a summary of your credit history, reported to nationwide credit reporting agencies. They contain:

-The main factors typically involved in calculating a credit score are:

-The number of accounts you have

-The types of accounts you have

-Your used revolving credit vs. your available revolving credit

-The length of your credit history

-Your payment history

If you look at your credit scores based on data from each of the three nationwide credit bureaus – Equifax, Experian, and TransUnion – you may see three different scores. This is completely normal. Your scores may not all be the same because not all creditors and lenders report to all three bureaus. Many creditors report to all three, but you may have an account with a creditor that only reports to one, two, or none.

There are many different credit scoring companies and credit scoring models, or differing methods of calculating credit scores. Credit scores are calculated based on the information in your credit reports. Two of the biggest companies when it comes to credit scoring models are FICO and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus – Equifax, Experian and TransUnion.

There are many different scoring models used to determine a credit score. Here is a general breakdown of the factors used to calculate your VantageScore® 3.0 credit score:

Payment history: 35% - Your credit history includes information about how you have repaid the credit you have already been extended. It includes the number and type of credit accounts that you paid on time, details on late or missed payments, and how many of your credit accounts are delinquent in relation to all of your accounts on file. It also includes details on public record and collection items, including bankruptcies, foreclosures, wage garnishments, and any delinquencies that were reported to collection agencies.

Used credit vs. available credit: 30% - Your credit score reflects an analysis of how much of your total credit amount is being used, and how much you currently owe.

Type of credit used: 15% - Your credit score reflects the different types of credit accounts you have, including revolving debt (such as credit cards) and installment loans (such as mortgages, home equity loans, auto loans, student loans, and personal loans). Lenders and creditors look at how many of each type of account you have, to determine if you may be able to manage multiple accounts of different types.

New credit: 10-12% - Your credit score reflects how many new credit accounts you’ve opened compared with the total number of accounts in your credit report. It takes into account how many recent requests for credit you initiated, as indicated by inquiries by creditors to credit reporting companies. Your credit score does not take into account requests a creditor has made for your credit report in order to make a preapproved credit offer, or to review your account you already have with them, nor does it take into account your own request for a copy of your credit history. Your credit score will factor in the length of time since creditors made credit report inquiries.

Length of credit history: 5-7% - This section details how long you’ve had your credit accounts. The credit score calculation includes both how long your oldest and most recent accounts have been open. In general, creditors like to see that you’ve been able to properly handle credit accounts over a period of time.

What are the benefits of knowing your VantageScore 3.0 credit score?

Reading time: 2 minutes

Continue Reading

Credit card companies and mortgage lenders pull credit scores to use as one of the factors to determine your creditworthiness or credit risk.

Financial services companies tend to group borrowers into segments according to their credit score. These credit score ranges may determine how much you’ll be charged, the interest rate you will pay on your mortgage, student loan, or automobile loan, or the type of credit card you’ll be offered.

You can check your monthly VantageScore credit score for free with an Equifax Core Credit™ account.

Find out how credit scores are calculated

There are time frames for how long different types of information may remain on your credit report.

- Negative information, such as late payments or collections, may stay on your credit report for approximately seven years. Bankruptcies can stay on your credit report for up to 10 years, depending on the type of bankruptcy.

- Positive information generally remains on your credit report for a longer period of time. Credit accounts that you pay as agreed may stay on your credit report for up to 10 years from the last update we receive from the lender. Revolving credit accounts, such as credit cards that have been paid as agreed, may stay on your credit report as long as you keep the account open.

How Long Does Information Stay on My Equifax Credit Report?

Reading time: 3 minutes

Continue Reading

There are a few ways to get your free credit reports.

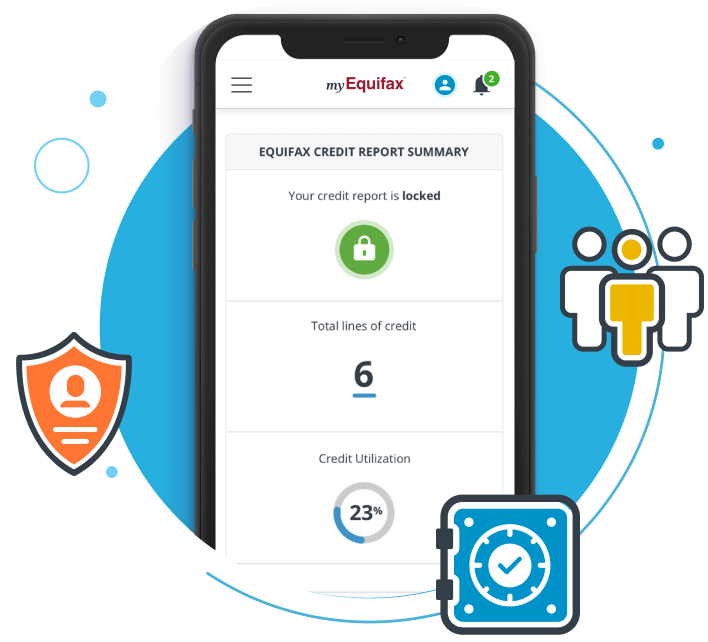

You can access your Equifax credit reports online with a free myEquifax account.

You can also get a free monthly Equifax VantageScore credit score by enrolling in Equifax Core Credit™.

You can also receive your Equifax credit report by calling Equifax Customer Care at 888-EQUIFAX.

Your free credit reports from each of the nationwide credit reporting agencies - Equifax, Experian and TransUnion - are available at annualcreditreport.com. These free credit reports can be requested online, by phone, or by mail. Please note that credit reports do not include your credit scores.

¿Desea su informe de crédito de Equifax en español? Equifax se complace en ofrecer un informe de crédito traducido al español una vez cada siete días.

Another way you can receive a copy of your free credit report from the three nationwide credit reporting agencies is if you meet one of the requirements listed below, as outlined in the Fair Credit Reporting Act. This law indicates that if you meet one of these requirements, You may be able to receive additional copies of your credit reports, if:

- You are unemployed and intend to apply for employment within 60 days;

- You are receiving public welfare assistance;

- You believe your credit report has inaccurate information due to fraud;

- You have been denied credit or insurance within the past 60 days;

- You have placed a fraud alert on your credit reports; and

- Your state offers a free or reduced-price credit report.

If any of these situations apply to you, you can request your additional free copy of a credit report.

Find out what information goes into a credit report

You did great, you got from out of 0 correct.

Understanding credit begins with understanding your credit report, what’s in it, and watching for changes on your credit report.

Now take the next step toward helping to better monitor your credit.

Feel more secure with the ability to lock your Equifax credit report and receive ID restoration services in the event of identity theft with Equifax Complete™.

Understanding your credit scores is an important part of getting a better understanding of your credit reports. A credit score is a three-digit number, typically between 300 and 850, which is designed to represent your credit risk, or the likelihood you will pay your bills on time. In general, a higher credit score represents a higher likelihood of responsible financial habits.

Financial services companies tend to group borrowers into segments according to their credit score. These credit score ranges may help determine how much you’ll be charged, the interest rate you will pay on your mortgage, student loan, or automobile loan, or the type of credit card you’ll be offered.

Credit scores are calculated using the content of your credit report. Each of the three nationwide credit bureaus uses a slightly different method of determining your score.

There are many different credit scoring companies and credit scoring models, or differing methods of calculating credit scores. Two of the biggest companies when it comes to credit scoring models are FICO and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus – Equifax, Experian and TransUnion.