What You Need To Know:

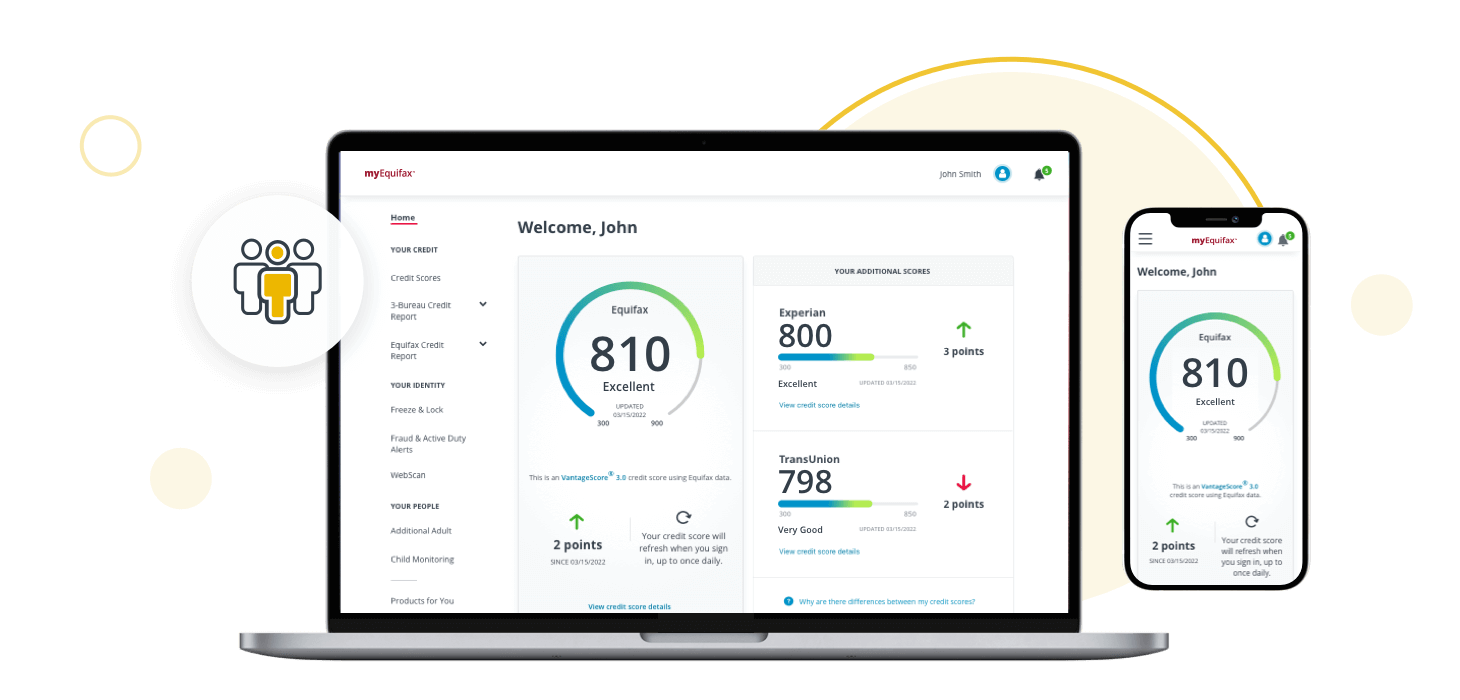

The credit scores provided are based on the VantageScore® 3.0 model. For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

Receive a product subscription at no cost for an additional adult and help better protect up to 4 children by creating, locking, and monitoring their Equifax credit report.

With monitoring2 from all 3 major credit bureaus, we help connect the dots of credit and identity protection for your family.

Annual access to your 3-bureau credit scores and report in one place let's you see a whole picture at a glance.

Access your credit status wherever you are

Dark WebScan3

Identity restoration

Up to $2 million in identity theft insurance4

Equifax Complete™ Family Plan ID theft & credit monitoring product features

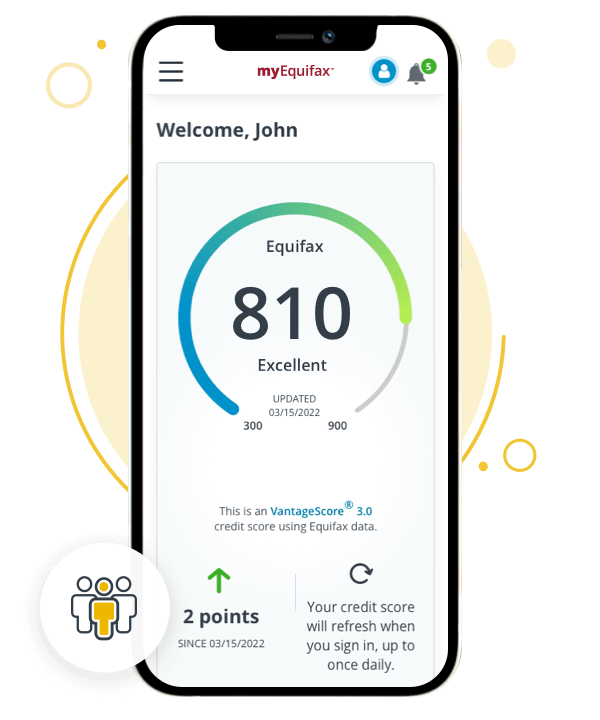

Your credit scores can fluctuate, and it’s important to know where you stand. Stay in the know with daily access to your VantageScore credit score.

You’ll know if key changes occur to your 1‑bureau VantageScore credit score, because we’ll be monitoring it and notifying you with custom alerts.

Your annual 3-bureau VantageScores will give you a way to assess your credit.

You’ll know if key changes occur to your Equifax, Experian and TransUnion credit reports, because we’ll be monitoring all three and provide you with alerts.

You’ll know if key changes occur to your Equifax credit report, because we’ll be monitoring it and notifying you with custom alerts.

Your annual Equifax 3-bureau credit report will give you an in depth way to assess your credit.

Your credit reports are a summary of your credit history. Feel confident with the ability to check your Equifax credit report anywhere, anytime.

We are here to help if you become a victim of ID theft. We provide up to $2 million in coverage for certain out-of-pocket expenses related to having your identity stolen.

Recovering from identity theft on your own can be time consuming. Let us help make it less of a pain. Our dedicated ID restoration specialists will work on your behalf to help you recover from ID theft.

Lost funds due to identity theft can be difficult to replace. As part of your ID theft insurance policy, we'll recover dollar-for-dollar up to $1 million of stolen banking and checking funds and credit/debit card deductibles that are unrecovered through your financial institution.

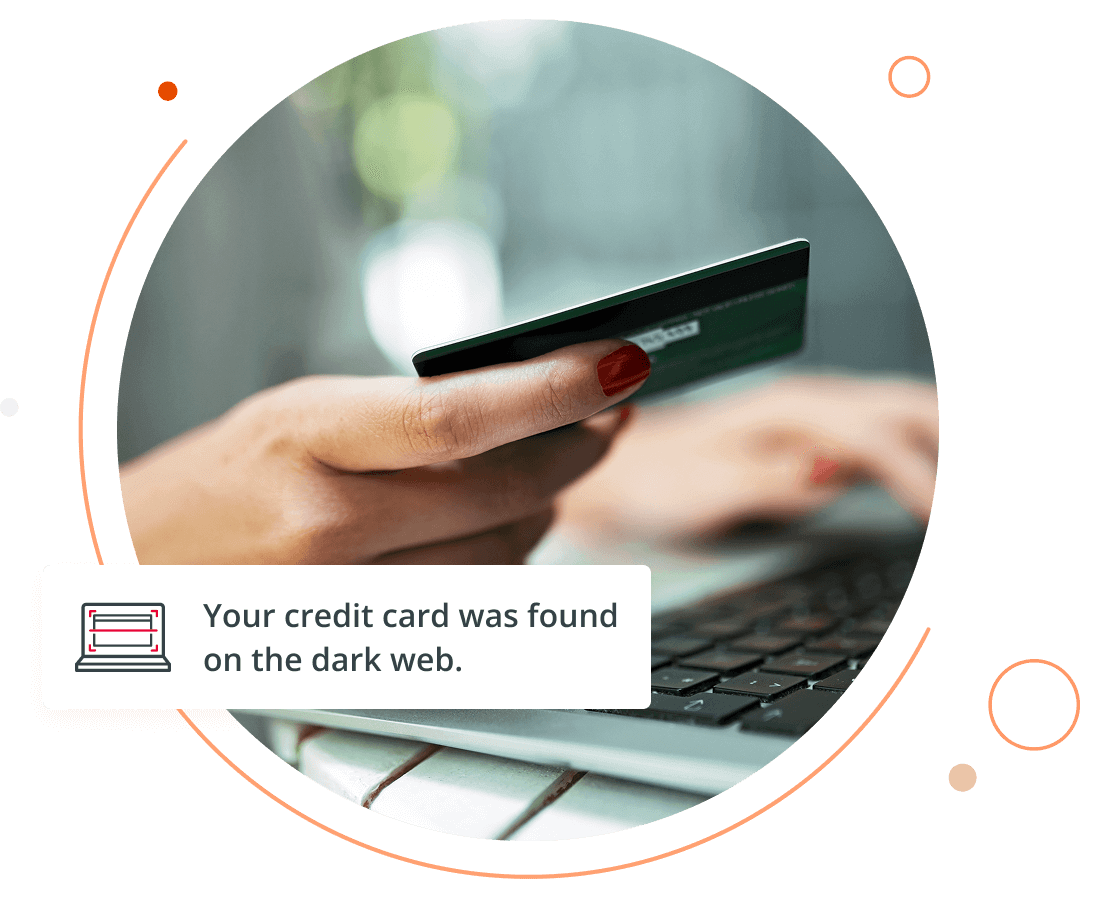

Your personal information shouldn’t be on the dark web. We scan suspected fraudulent websites and alert you if we find your Social Security, credit card, debit card, banking, medical ID, or passport numbers.

Share access to all the Equifax Complete™ Premier features with an additional adult of your choice, and choose to share credit monitoring alerts with them.

If you believe you’re a victim of fraud, you can activate automatic fraud alerts and we'll place an initial alert on your credit report. This alert encourages lenders to take extra steps to verify your identity before extending credit. On an annual basis, we'll automatically renew your fraud alert, so you don't have to.

Help look after your family by adding 4 children to your product. Each child’s Equifax credit report will be locked and monitored for an added security measure.

Feel more secure knowing your Equifax credit report is locked down from being accessed (with certain exceptions) for the purposes of extending credit.

Losing your wallet is a headache. We make it a less painful ordeal by helping you cancel and reissue your credit and ID cards.

Select theft ID protection features, such as alerts, if we find your child's Social Security number on the dark web are available as added security measures.

Your partner & money talks

Whether you decide to combine bank accounts or keep your finances mostly separate it's a good idea to discuss money matters such asd household budget, saving for retirement and more.

How can I teach my children good credit habits?

It's never too early to teach your child how to save, budget and use credit responsibly.

We will require you to provide your payment information when you sign up. We will immediately charge your card the price stated and will charge the card the price stated for each month you continue your subscription. You may cancel at any time; however, we do not provide partial month refunds.

Credit monitoring from Experian and TransUnion will take several days to begin.

WebScan searches for your Social Security Number, up to 5 passport numbers, up to 6 bank account numbers, up to 6 credit/debit card numbers, up to 6 email addresses, and up to 10 medical ID numbers. WebScan searches thousands of Internet sites where consumers' personal information is suspected of being bought and sold, and regularly adds new sites to the list of those it searches. However, the Internet addresses of these suspected Internet trading sites are not published and frequently change, so there is no guarantee that we are able to locate and search every possible Internet site where consumers' personal information is at risk of being traded.

The Identity Theft Insurance benefit is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company, under group or blanket policies issued to Equifax, Inc., or its respective affiliates for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions.

The Automatic Fraud Alert feature is made available to consumers by Equifax Information Services LLC and fulfilled on its behalf by Equifax Consumer Services LLC.

Locking your Equifax credit report will prevent access to it by certain third parties. Locking your Equifax credit report will not prevent access to your credit report at any other credit reporting agency. Entities that may still have access to your Equifax credit report include: companies like Equifax Global Consumer Solutions, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service; companies that provide you with a copy of your credit report or credit score, upon your request; federal, state and local government agencies and courts in certain circumstances; companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes; companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe; companies that authenticate a consumer's identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers, visit www.optoutprescreen.com.

Under certain circumstances, access to your Equifax Credit Report may not be available as certain consumer credit files maintained by Equifax contain credit histories, multiple trade accounts, and/or an extraordinary number of inquiries of a nature that prevents or delays the delivery of your Equifax Credit Report. If a remedy for the failure is not available, the product subscription will be cancelled and a full refund will be made.