Identity Theft: What it is, What to Do

Highlights:

- Familiarize yourself with the warning signs of identity theft so you know what steps to take.

- If you believe someone stole your personal information, there are some steps you can take.

- Consider placing a fraud alert or security freeze on your credit reports - both are free.

Identity theft occurs when someone gets or steals your personal information. The thief can use this information to open credit accounts in your name. In some cases, they can even steal benefits for employment, insurance or housing. Identity theft can impact your credit reports and credit scores.

Signs of Identity Theft

There are a few signs of identity theft you need to be on the lookout for. Pay attention to all your bills. Look for items you did not buy, accounts you don't recognize, or medical services you did not use. Also, look for charges on your credit card or bank statements you don't believe are yours. Be sure to pay attention to unexplained withdrawals from your bank account. And if you stop receiving bills or other mail, this could also be a red flag. Other things to look out for include:

- Notification from a collections agency about an unfamiliar account.

- Notification that more than one tax return was filed in your name.

- Denial of credit because of the fraudster's actions.

Identity Theft Victim? Steps to Take

If you believe someone stole your information, it can be hard to know what to do and where to report it. So, here are a few things to consider if you believe you're a victim of identity theft:

- Contact the company or companies where you believe the fraud occurred. Let them know you believe someone stole your identity.

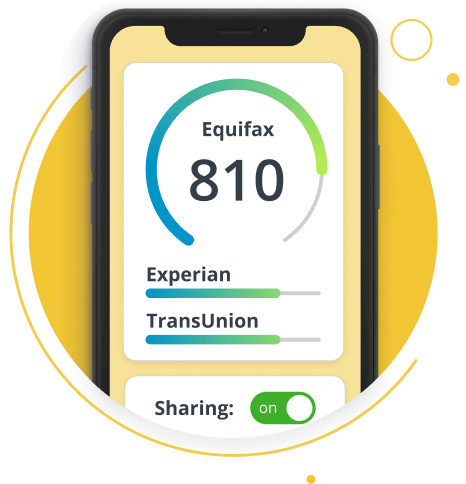

- Check your credit reports. Look for any unrecognized accounts or credit inquiries. This could be a sign of identity theft. Request your credit reports from all three nationwide credit reporting agencies (NCRAs) — Equifax®, Experian® and TransUnion® — through www.annualcreditreport.com. You can also create a myEquifax™ account to get free Equifax credit reports. Click "Get my free credit score" on your myEquifax dashboard and enroll in Equifax Core Credit™. This provides you with a free monthly Equifax credit report and a free monthly VantageScore® 3.0 credit score, based on Equifax data. A VantageScore is one of many types of credit scores.

- Place an initial one-year fraud alert on your credit reports. A fraud alert is a notice on your credit reports. It signals to lenders that you may have been a victim of fraud. They encourage companies to take extra steps to verify your identity before approval. Fraud alerts are free. You only need to contact one of NCRAs to have a fraud alert placed on your credit reports. That NCRA will contact the other two. Place an initial fraud alert when you believe you are, or may become the victim of fraud. An initial fraud alert is free and lasts for one year. You can place an initial fraud alert online with a free myEquifax account. You can also visit Consumer Care to learn how to submit requests by phone or mail.

- Place a security freeze on your credit reports. A security freeze limits access to your credit report if someone tries to open credit in your name. Unless you lift or remove a security freeze, no one can access your credit reports to open new accounts. Of course, there are certain exceptions. Find out more information about security freezes, fraud alerts and credit report locks.

- Submit an identity theft report with the Federal Trade Commission at www.identitytheft.gov. By reporting your theft online, you can receive an identity theft report and a recovery plan. If you create an account on the website, you can update your plan and track progress. You can also receive form letters to send to creditors.

- File a police report with your local law enforcement agency. A police report provides you with a document saying you've been a victim. This can help you when requesting a 7-year extended fraud alert on your credit reports. This type of fraud alert requires a police or FTC Identity Theft Report. To request an extended fraud alert on your Equifax credit report, download this form.

The Federal Trade Commission advises you to keep a record of the calls you make and the people you speak to. Keep copies of any letters you send or receive. Be sure to also keep a written record of all actions you take, such as closing accounts or disputing charges.

What Does Being a Victim of Identity Theft Mean for Me?

Unfortunately, being a victim of identity theft can cause your credit scores to drop. Thieves could open new lines of credit or credit cards in your name and fail to pay the bills. As debt adds up, your credit scores may take a hit. After you report the fraud, work with collection agencies and banks to get rid of the fraud. They can remove fraudulent accounts and payments from your credit reports. You can also file a dispute with the three NCRAs nationwide credit bureaus. Visit our dispute page to learn how to file a dispute on your Equifax credit report.

The Fair Credit Billing Act (FCBA) protects consumers from unfair credit billing practices. Through the FCBA, most credit companies have protections for victims of identity theft. The law also sets the maximum liability for unauthorized charges at $50. The Electronic Transfer Fund Act protects you from ATM and debit card fraud. It's important to act fast to avoid charges. You have to be vigilant against signs of identity theft. Catching the theft or fraud early can help limit the damages.

Gain greater peace of mind by monitoring your family's credit card numbers, social security numbers, & bank accounts with Equifax Complete™ Family Plan.