Your Mid-Year Financial Checklist

Highlights:

- Looking at your financial habits can help you stay on track to reach annual financial goals.

- If you're saving more than you thought you would, consider paying off debt or making an investment.

- Reviewing your credit reports helps you to make sure your personal information is correct and there is no inaccurate or incomplete account information.

Checking your finances throughout the year can help with your annual financial goals. Here are steps you can take for a mid-year review.

Review and Update Your Budget

Planning and sticking to a budget can be hard. Use this time to make sure you're staying on track with your saving, spending and income goals. Start by reviewing your credit card and bank statements. Make sure to divide your expenses into two categories—mandatory and discretionary. Mandatory expenses are those that are necessary and can't go without. These include: food, rent, utilities and transportation costs. Discretionary spending are nonessentials such as: dining out, entertainment, memberships and charitable donations. If you save more than you thought you would, use your extra funds to pay off debt or make an investment. If you're spending more than planned, brainstorm ways you can cut back. Either way, make sure your budget going forward is both realistic and flexible.

Check on Your Emergency Fund

While reviewing your budget, also assess how much you have saved in your emergency fund. You should have enough money to cover three to six months' worth of living expenses. This money should be in an interest-bearing savings account. If you haven't built up an adequate emergency fund, it's not too late to start. Reassess your budget. Come up with a saving plan to reach the three- to six-month target in a realistic timeframe.

Revisit Your Credit Reports

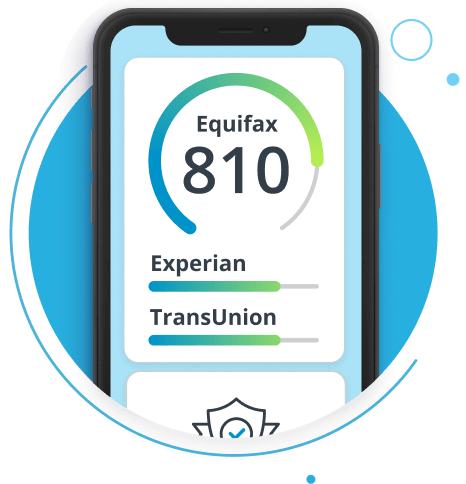

Checking your credit reports a couple of times a year is a good financial habit. Reviewing your credit reports helps you to make sure your personal information is correct and there is no inaccurate or incomplete account information. Plus, it allows you to discover potential fraudulent activity. Create a myEquifax™ account to get free Equifax® credit reports. You can also get your free weekly credit reports through www.annualcreditreport.com.

Review Your Retirement Savings

If your budget allows, consider adjusting your retirement savings contributions plan. Look for ways to adjust your budget to get as close as possible to these limits. In the process, you'll set yourself up for a more secure future.

Change Your Passwords and Other Sensitive Data

Changing your passwords is an inconvenient, but necessary, step. This tiny step can better protect yourself against fraud and identity theft. Make sure you have strong, unique passwords for anything using your financial information. Strong passwords combine uppercase and lowercase letters with numbers and symbols.

To protect yourself further, enable two-step verification on all your financial accounts. This security feature makes it harder for anyone else to access your accounts.

Manage Your Subscriptions

Check your credit card and bank statements to see what monthly subscriptions you pay for. If you're not using those subscriptions, it may be time to cancel them. You should also look to see if there are any discounts for the subscriptions you do use often. These can help you save money for a few months.

Review Your Tax-Deductible Expenses

Look over expenses that are tax-deductible halfway through the year. This review can make things easier for you later on. Consider looking at the following examples:

- Medical and dental expenses

- Student loan interest

- Home mortgage interest

- Property taxes

- Charitable contributions

Reviewing these deductions now can save you time when your tax return is due next April.

Plan for the Holidays

The holiday season can be stressful for many reasons. If possible, aim to avoid financial stress. Are you considering taking a vacation or buying something expensive during the holidays? If so, now is the time to start budgeting for these expenses. Saving now can make your plans this November and December much more achievable.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.