The New Normal: June Auto Data and Implications for Lenders

The New Normal

The automotive industry is in radical transformation. Who will succeed? The automotive industry’s success depends on how well companies adjust to what consumers want when buying and owning cars. A few examples:

More and more, people are buying cars from manufacturers. They do so instead of working with traditional dealerships. The shift is shaking up how automobiles get from factories to buyers–forcing car makers to speed into new ways of doing business.

About a third of U.S. auto purchases are online.1 This means dealerships have to be digital too; not just in physical locations. The move to digital sales brings new risks, like online scams. Finding the right balance between smooth online sales and strong fraud protection is crucial to keep customers happy and safe.

In a crowded auto market, dealerships take advantage of how few cars are available. This is true once you account for both brick-and-mortar business and online sales. In response, dealerships are increasing their marketing budgets for online sales tools.

As cars – and how they are sold – evolve, companies must find innovative ways to stay ahead of the competition.

Overall Auto Industry Trends

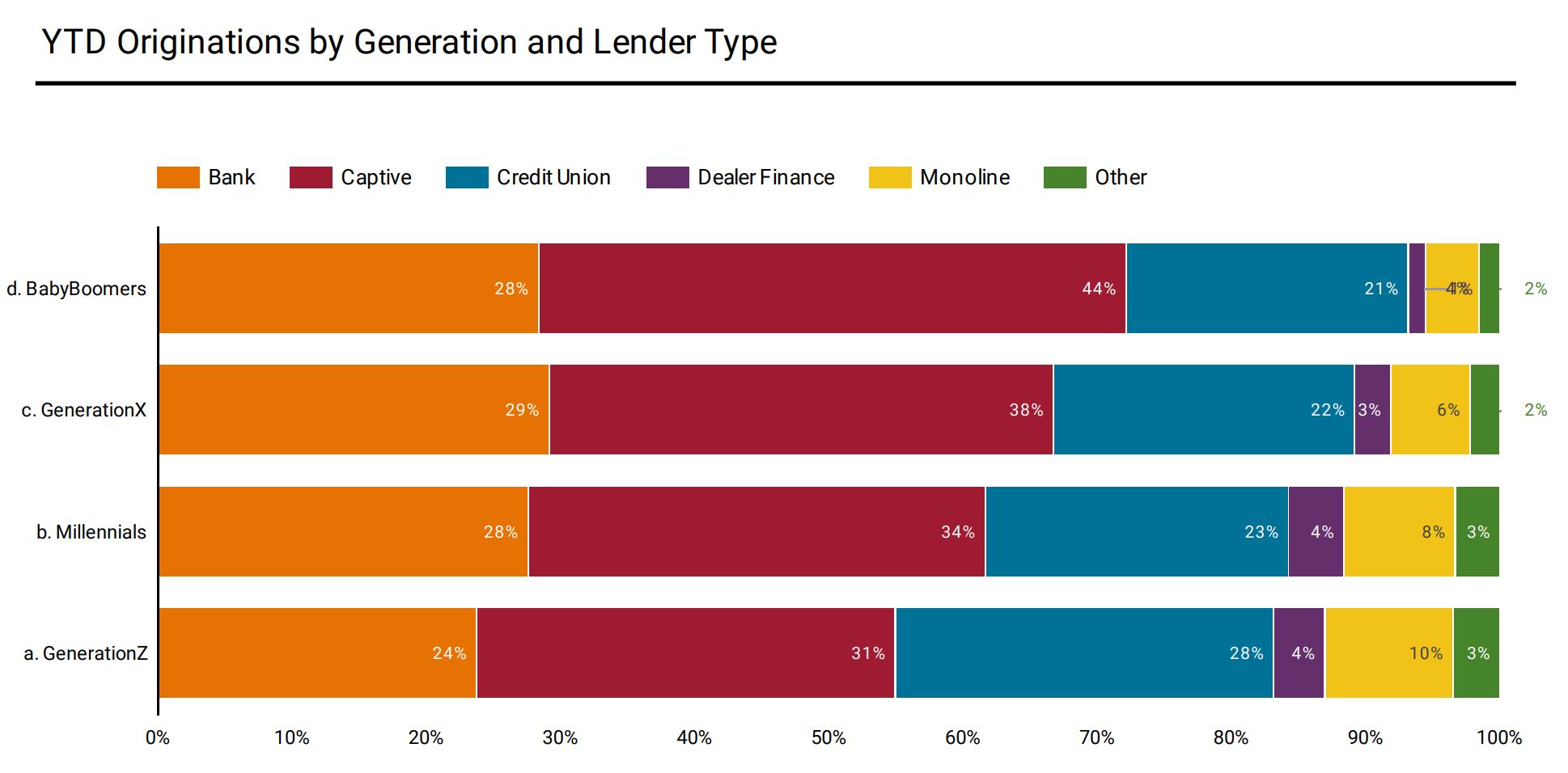

New industry lending trends reflect ongoing shifts in the auto financing landscape. Highlighting preferences and changes in borrowing habits across different market segments:

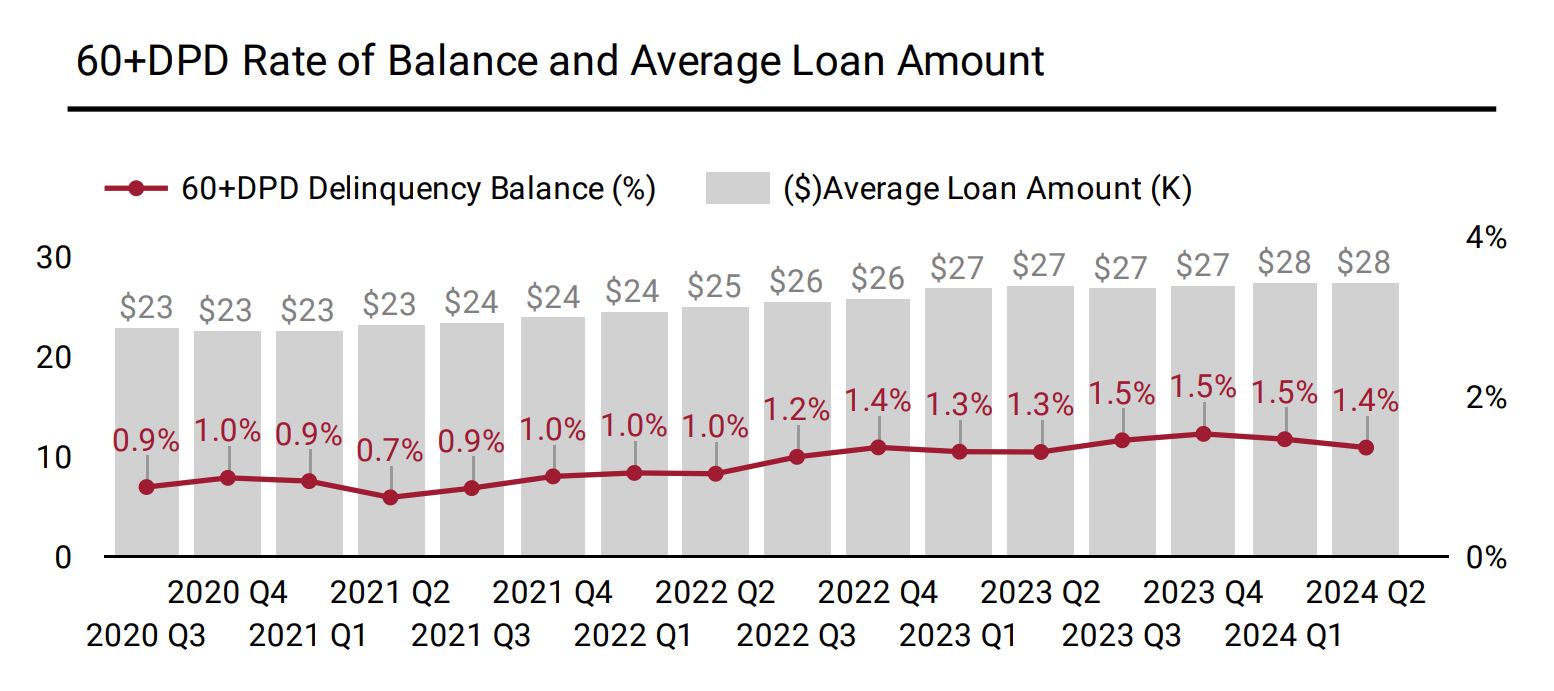

The average loan amount tends to increase alongside both income and financial stability.

Captive lenders maintain their spot as the preferred lender type across all generations. Underscoring their significant role in the auto financing market.

Delinquencies

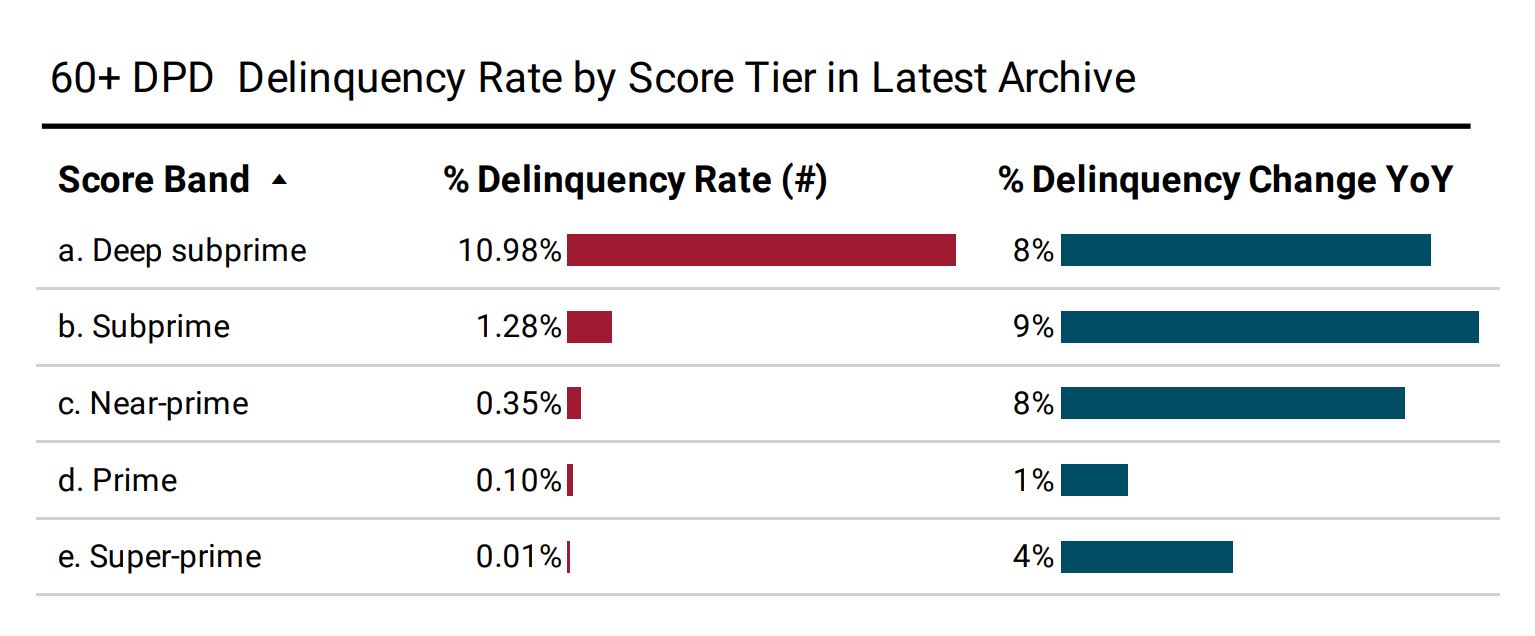

Delinquencies rose across all lenders. Notable year-over-year increases are found in Credit Unions and Captive lenders. The steepest rises in delinquency rates are observed among specific borrower categories:

Deep subprime

Subprime

Near-prime

Traditionally, delinquency rates tend to dip in the second quarter, possibly due to tax refunds. However, 60+ Days Past Due (DPD) rates for loans originated in 2022Q2 reached their highest level. And, 2023Q2 is showing only slight improvements in bad rates compared to the previous year.2

Specialty Finance

Generational shifts: GenX and Millennials show a strong preference for Specialty Finance. In fact, more than half of GenX and Millenials who took out auto loans in late 2023 were part of this financial system.2 Interestingly, consumers with higher credit scores use Specialty Finance less. This is compared to borrowers with lower scores.

Notably, having delinquency in Specialty Finance often correlates with delinquency in auto loans. Even among consumers with similar credit scores. This fact underscores the interconnected risks within different financial behaviors and credit standings.

More Auto Insights

Read the June Auto Insights Report. We share how to empower clients to acquire in-market shoppers, enable the end-to-end consumer buying journey through digital retailing platforms, and recapture Captive and CU lender market share.

Uncover Three Ways Savvy Auto Lenders are Using Analytics by our FinTech Leader.

Hear practical ways to navigate industry trends from a panel including Cox Automotive, Connections Insights, and Automotive Ventures.

(c) Equifax Inc. All Rights reserved. The statistics and information contained in these materials are illustrative for informational purposes only, and shall not be used for any other purpose.

Sources

1. Online car buying statistics 2024, Consumer Affairs Journal of Consumer Research, March 2024

2. Market Pulse Auto Insights Report, Equifax, June 2024