The Economy’s Effect on the Future of the Auto Industry

During our August 11, 2022 Market Pulse webinar, presenter Jeff Jensen, Vice President at Keybridge went over the recent economic trends and how these trends are impacting the future of the automotive industry. Below is a recap highlighting the key economic updates Jensen presented on past recessions, and what he believes will happen in the automotive industry for the second half of this year and beyond. For more, watch our full webinar recording here.

Automotive Overview

We have seen a massive decline in auto production, as production was halted for over a month. However, recently we came back and we've seen a recovery, but certainly far below where we were pre-pandemic in terms of domestic auto production. Auto dealerships are keeping inventory. One example of a change we observed is how many different versions of a car they have on the lot. However, it is not necessarily going to unwind, and so the auto segment is definitely going to look different moving forward.

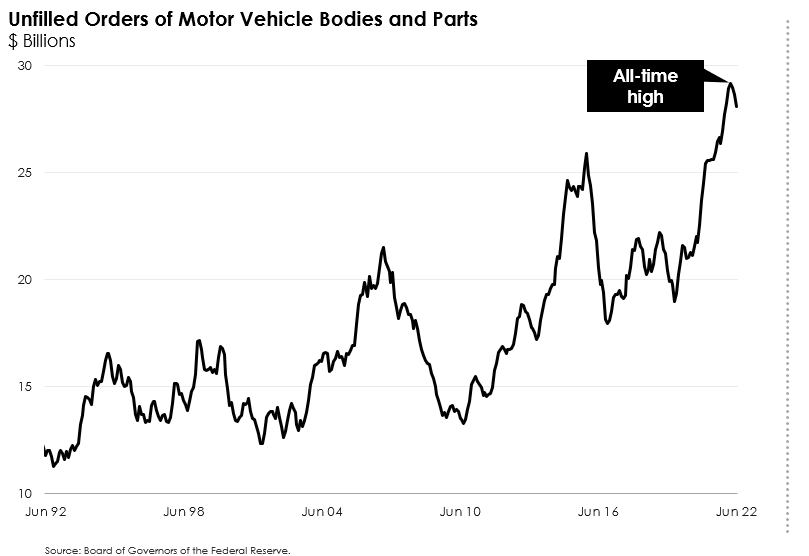

Another factor is the semiconductors and battery materials shortage. We have seen a lot of unfilled orders, which is shown in Figure 1. According to Jensen, for motor vehicle parts there's a lot of demand still for automobiles, but we're having a hard time finishing production because of missing chips.This goes back to supply chain constraints, which we have talked at length about over the last few months.

Figure 1

Current supply chain constraints are driving prices up. When there is a high demand for supply, you're going to expect to see prices rise. This has been one of the key drivers of inflation, especially last year in the new car market, but also in the US market. In the US market, the average monthly car loan has increased substantially 20% to 30% depending on a new versus used car. This leads to a lot of financial stress for consumers.

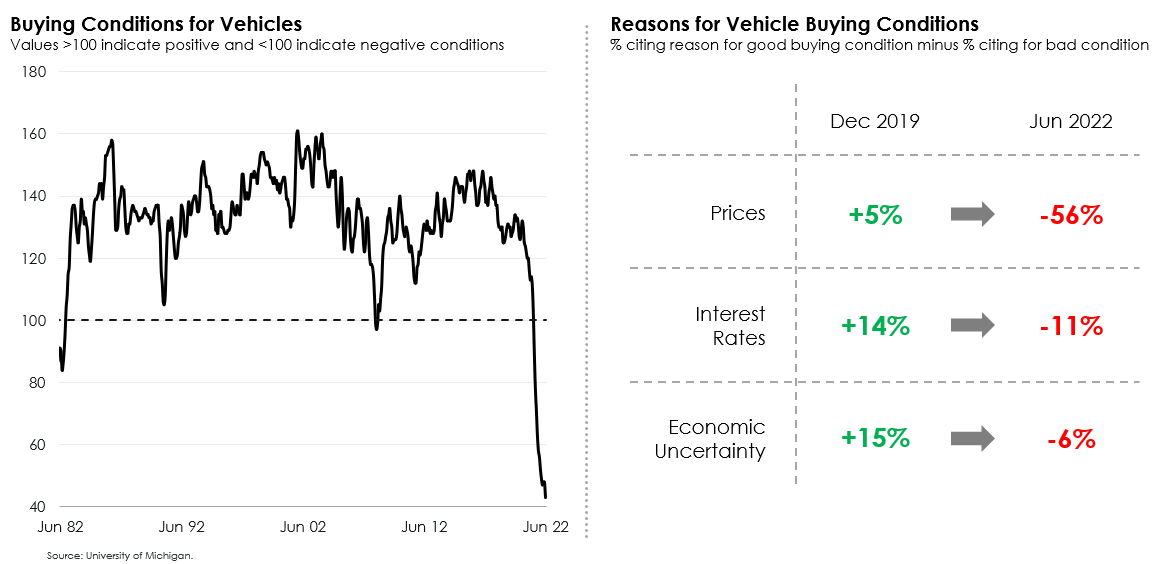

In Figure 2, we can compare the data to pre-pandemic levels. The chart on the left shows buying conditions. It shows whether it is a good time or not to buy a car. Based on the chart, you can see it is a poor time to buy a car. The chart on the right shows right before the pandemic what the prices were and how interest rates and economic uncertainty are huge factors on whether it is time to buy a car or not. These were all reasons why people were buying cars before the pandemic. There was low economic uncertainty, interest rates, and prices were reasonable. Since the pandemic all of these have flipped. Now these three reasons are why people are not buying a car at this time. This has led to consumer financial stress in the automotive industry as car payments continue to rise.

Figure 2

Last, Jensen looked at what normally happens to auto sales during a recession. He explained that we usually see auto sales in the 16 million per year range. And, during a recession that tends to fall down into 12 million, or even 10 million and below. During the great recession we saw a decline bounce back just like how we saw during the pandemic recession. Jensen concluded by stating that it is important to remember the auto sector does get hit harder during a recession than other sectors.

* The opinions, estimates and forecasts presented herein are for general information use only. This material is based upon information that we consider to be reliable, but we do not represent that it is accurate or complete. No person should consider distribution of this material as making any representation or warranty with respect to such material and should not rely upon it as such. Equifax does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice. The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

.JPG)