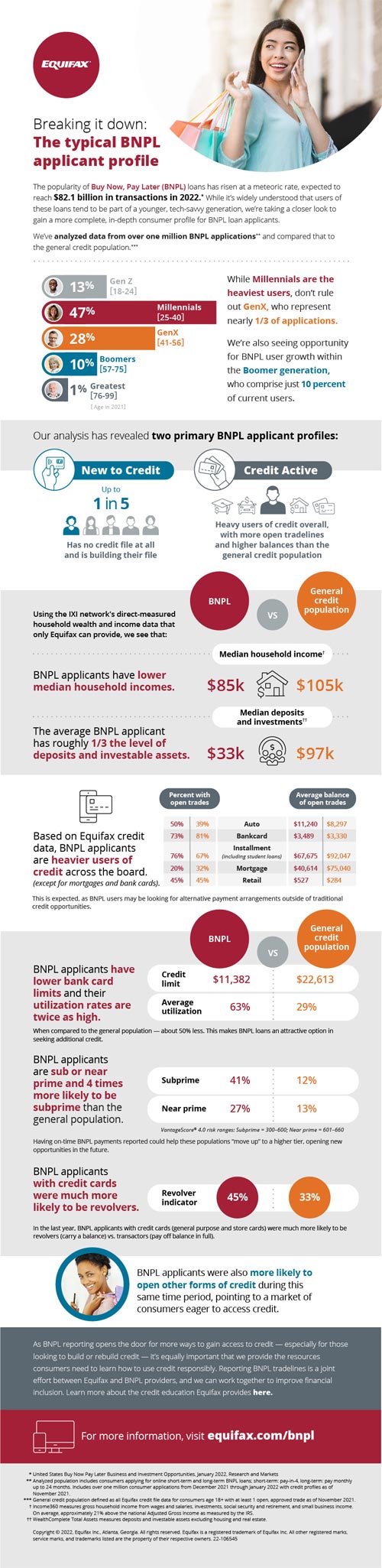

Infographic: The Typical ‘Buy Now, Pay Later’ Consumer Profile

BETTER DATA DRIVES SMARTER DECISIONS and can help open the door to new financial opportunities for consumers. That’s why, earlier this year, Equifax became the first consumer reporting agency to formalize a process for the acceptance of ‘Buy Now, Pay Later’ (BNPL) payment information in traditional U.S. consumer credit reports. Equifax believes BNPL reporting can benefit consumers who pay their BNPL loans on time, providing a new opportunity for thin- or no-file consumers to gain access to credit.

Equifax is encouraging BNPL providers to report into Equifax as a powerful source of data. While some higher value BNPL loans were already being reported into the company, the new standards for acceptance are designed to enable the reporting of increasingly popular “pay-in-four” loans. The company will continue to conduct and analyze data on BNPL consumers, how BNPL might impact consumer credit scores as it increases in popularity, and more. Most recently, Equifax has analyzed data from over one million BNPL applications and compared that to the general credit population to learn more about the typical BNPL user.

As the company works together with BNPL providers to improve financial inclusion with our joint efforts toward BNPL reporting, it’s equally important that Equifax continues to provide financial education. Learn more about the financial education Equifax provides at the link here and check out the full BNPL consumer profile infographic below.