Equifax Reimagines U.S. Consumer Credit Report Design

EQUIFAX IS COMMITTED TO EMPOWERING PEOPLE IN THEIR FINANCIAL LIVES and our redesigned U.S. consumer credit report was created to make it even easier for consumers to monitor their financial health and view their current VantageScore 3.0 credit score. The redesigned consumer credit report is available now to all U.S. consumers who contact Equifax by phone or mail for a hard copy of their Equifax credit report. The hard copy of the report now more closely matches the experience that a consumer has when viewing via their MyEquifax account.

“We play an important role in the financial lives of consumers and are continuously working to make their experience as friendly and helpful as possible. We strive for the highest quality and effectiveness in our interactions with consumers at every touchpoint and our reimagined consumer credit report is another way that we’re supporting people as they make financial decisions,” said Tina Shell, Senior Vice President of Direct-to-Consumer Operations.

Equifax encourages people to regularly review their credit history. Knowing what’s on your credit report is important, whether you’re just starting to build credit or planning a big purchase like a house or a car. Taking consumer feedback into account, the reimagined hard copy credit report aligns more closely with the visual, digital experience that we already provide. Our goal is to make it easy for people to understand their current and past credit activity with helpful color-coding and easy-to-understand graphics.

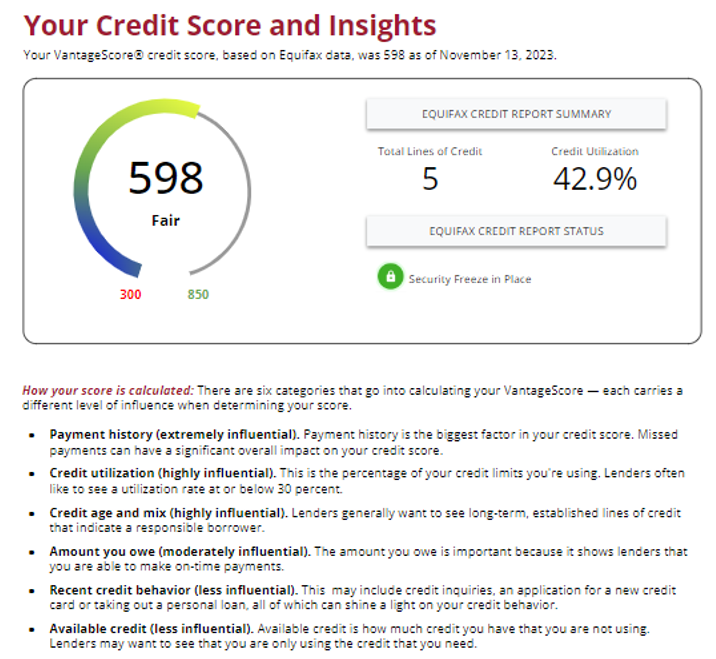

Understanding that many consumers would like to see their credit report information alongside a credit score, Equifax has put the VantageScore 3.0 credit score front and center. While there are many types of credit scores and models used by lenders (and credit scores may vary depending on the credit scoring model used), a “how your score is calculated” section is also at the beginning of the report, providing context around the categories that determine a person’s VantageScore credit score.

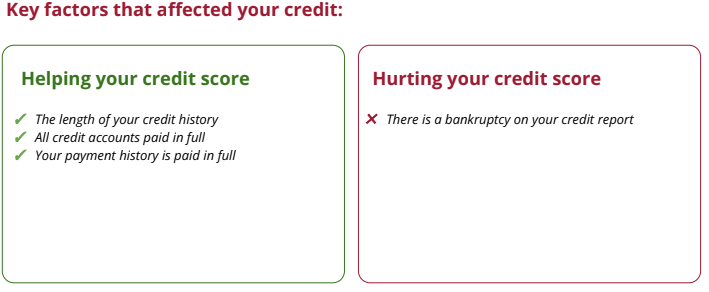

And, a “key factors that affected your credit” section makes it more clear as to what may be helping and/or hurting a person’s respective credit score.

It’s important to make sure that your credit report accurately reflects the credit accounts that you have opened. To make it even simpler to verify this information, we have made account numbers, balance amounts, and the date that each account was opened clearly visible.

Details on the lenders or other authorized organizations who made credit inquiries – and the dates when these inquiries were conducted – are also better organized and easier to understand. Soft and hard inquiry definitions are provided, with distinctive text around which inquiries may impact your credit score. If a consumer sees any information that looks inaccurate or incorrect, they should file a credit dispute.

More information about how your financial behavior impacts your credit, along with what is included on your credit reports and why, can be found on our Equifax Knowledge Center.

Consumers can review their Equifax credit report online free of charge via myEquifax or request their credit report through AnnualCreditReport.com. Consumers can also order credit reports by phone at (877) 322-8228 or by mail at the address below.

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Your Equifax credit report will be mailed to you within 15 days.