The Shifting Fintech Landscape

The economy is recovering and the outlook for small businesses is continuing to remain strong. Fintechs have started to step away from traditional credit data and have started relying on alternative data to drive their customer experiences. This has led to a rise in non-traditional players providing leveraging payment services like buy now, pay later (BNPL). For our September 2 Market Pulse webinar we discuss what these trends mean for traditional financial service providers and small businesses seeking access to capital post-pandemic.

This month’s Market Pulse webinar presenters included Dr. Robert Wescott, Founder and President at Keybridge; Sarah Briscoe, Lead Commercial Statistical Analyst at Equifax; and Tom Aliff, Risk Consulting Leader at Equifax. Bill Phelan, Senior Vice President and General Manager of Commercial at Equifax, had a one-on-one chat with Sharla Godbehere, Leader of Fintech and Alternative Finance at Equifax, where they discussed the shift in consumer behavior and lending behavior that is driving the transformation of the eCommerce economy.

Current economic update

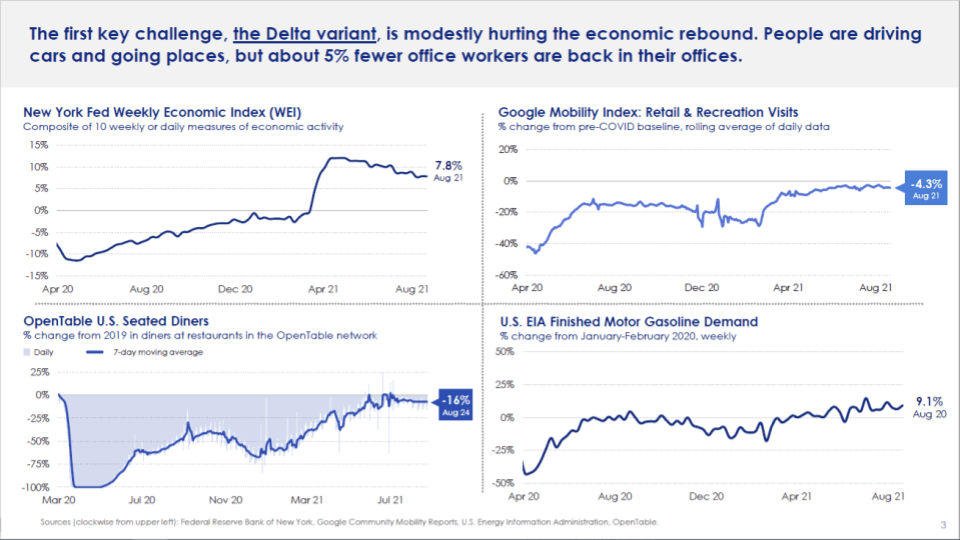

First, Robert Wescott started by discussing the current U.S. economy. Wescott stated that even though the economy is strong, there are a few caveats that need to be solved. According to Wescott, COVID-19 right now is moderately affecting the economy. However, we as an economy are getting tougher and are getting vaccinated.

As of recently, (shown below) gasoline demand is up compared to pre-COVID times. Opentable seated diners have been down 16% for the last few weeks. Places where we have had the biggest increase of COVID-19 cases have seen drifted down activity like Florida and Alabama, however, Texas is still growing. When states like New York see a rise in COVID-19 cases in other states, they tend to spend less out of fear of the headlines and more COVID-19 cases coming to their state.

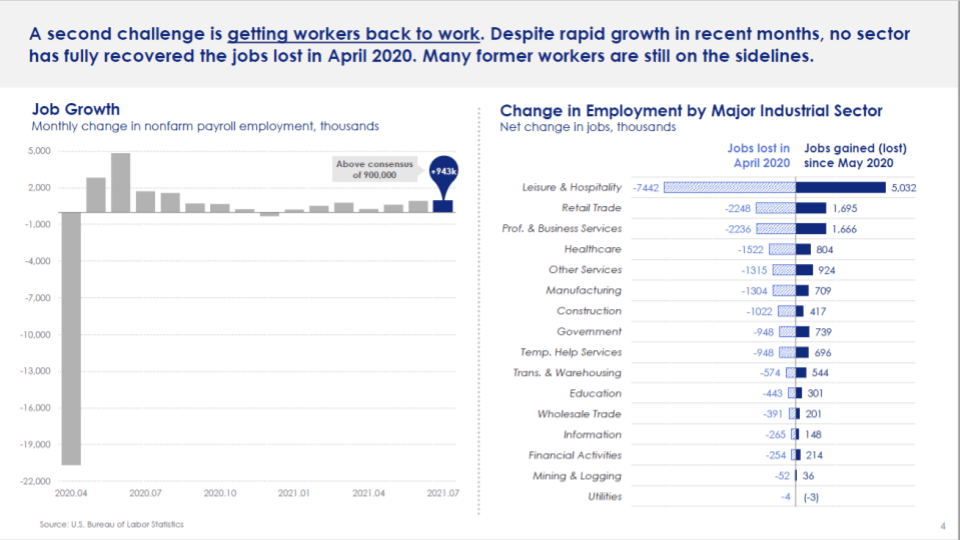

When it comes to employment, about a million people a month have been going back to work. However, the chart below shows how many people lost their jobs in April 2020 when COVID-19 hit last year. This is one of the challenges that the economy is still facing. We are nibbling away at gaining the amount of jobs we have lost since then but we are not there yet. People are still questioning and are concerned for their safety and health when it comes to determining whether they should be going back to school or work. According to our studies, women of color have had the largest decline in labor force participation since COVID-19 hit.

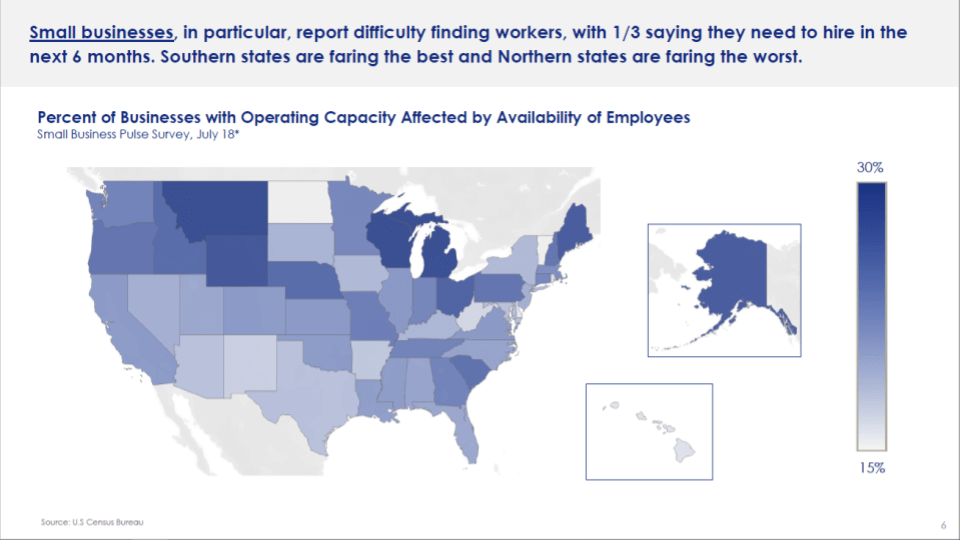

When it comes to small businesses, many are still having trouble finding employees to hire. A third of small businesses said they need to hire workers in the next 12 months. When it comes to location, the south of the United States is doing better at finding workers than the north.

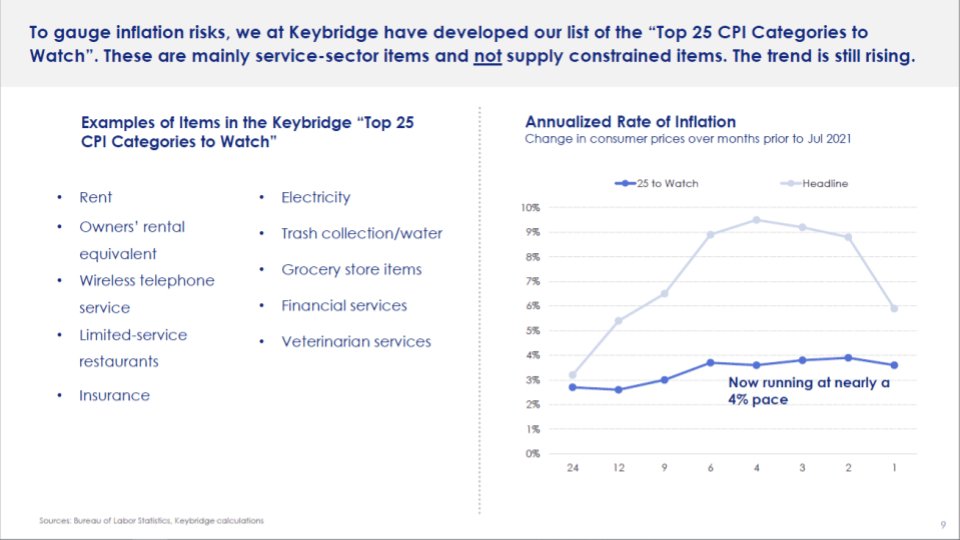

Wescott continued by noting the rise in inflation. CPI inflation is 5.4%, which drifted up and even though many believe it will come down quickly, Wescott thinks otherwise. Wescott further explained by stating the four concerns that are currently taking place. One concern is the stimulus in the system or as Wescott called it “dry powder.” There is two trillion dollars in consumer spending “dry powder.” That being said, a lot of money is still in people’s pockets ready to be spent.

The second concern is the end of dis-inflation from China. For 30 years China was taking one percent out of inflation for the world and lately prices in China are up nine percent resulting in more inflation than dis-inflation. The third concern is the rapid rising wages. The last average hourly earnings for the last five years has doubled compared to 2010-2019. And the fourth concern is the supply chain problems that are currently happening. Washing machines, gas and more types of supply have continued to rise over the last year due to COVID-19.

To gauge inflation risk Keybridge has developed a list of the “Top 25% CPI Categories to watch” (shown below). However, these are mostly service-sector items and not supply constrained items. But where will inflation rates go? Wescott believes that the Federal Government will try to withhold tapering until after Chairman Powell’s desire for re-appointment in 2022, but this will raise inflation risk.

Small business and equitable access to data

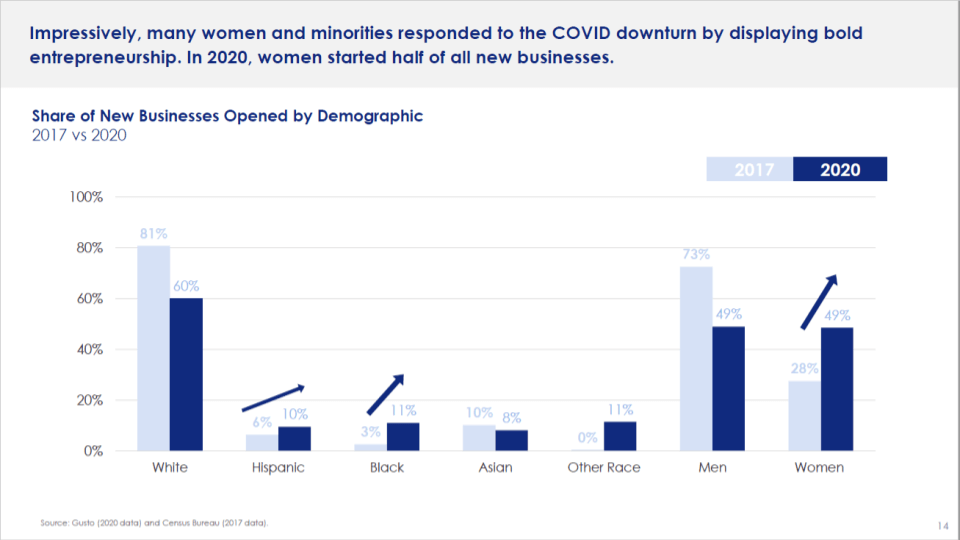

Small businesses employ about 47% of workers in America and account for 44% of the gross domestic profit (GDP). The current COVID-19 recession was painful but shorter than the 2008 crisis. One of the factors as to why it was shorter was because of the PPP loans which were greater in 2020. This helped a lot of small businesses. The chart below breaks down the share of new businesses based on demographic when comparing the years 2017 to 2020. Keybridge has been analyzing how minority small businesses are doing.

In 2017, men were dominating the entrepreneurial world, however, in 2020 the amount of men and women entrepreneurs was equal. Women started half of all new businesses. Since COVID-19 in 2020, Blacks and Hispanics starting new businesses have also increased. However, many minority owned and women owned businesses have struggled to get access to credit.

Looking at the credit risk by demographic (shown below), the lower credit risk category includes Whites and Asians, while Hispanics and Blacks are in the high risk category, which has been an issue. Keybridge concluded that fintech, financial education, technical assistance, and targeted and publicly-backed lending can help for an equitable distribution of access to credit for different demographic groups.

Small Business Indices

Next, Sarah Briscoe, Lead Commercial Statistical Analyst at Equifax, reviewed the latest Equifax Small Business Indices data. The Small Business Lending Index increased for four of the last six months and continues to show strong summer results following the pandemic lows. The rolling three month index is up 12% compared to a year ago, but down three percent from last month. By state, improvements in lending can be seen across the country and only a few states saw decreases throughout the year.

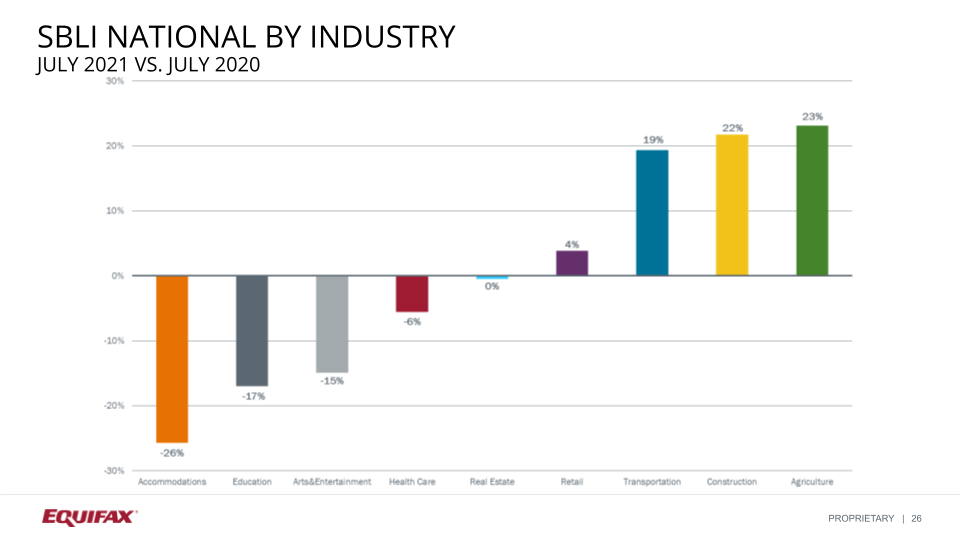

Briscoe continued by displaying the year-over-year lending change across different industries (shown below). There is strong growth in the agriculture, construction, and transportation industries, which account for about 25% of all U.S. businesses. However, the other industries on the left side, accommodations, education, arts and entertainment, and healthcare are seeing lending decrease.

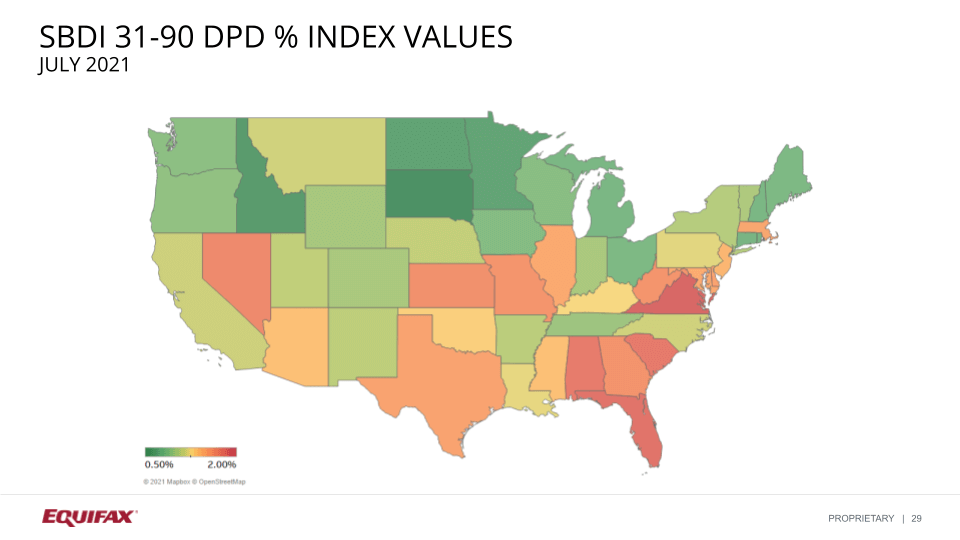

The Small Business Delinquency Index 31-90 days past due rate decreased two basis points from June to July 2021. The index has decreased for eight consecutive months and the index is just 10% above the all time low. Compared to a year ago, delinquency decreased 82 basis points and the index has decreased year-over-year for the past five consecutive months due to the pandemic. By state the highest 31-90 delinquency rates are present in Florida, Georgia, Alabama, and South Carolina. The lowest delinquency rates are in northern states (shown below).

Briscoe continued by looking at the different industries. A few highlights included healthcare having a small uptick in July of two basis points, construction remaining flat month-over-month, and all the other industries seeing a decrease, with transportation at the lowest delinquency level since 2015.

Next, Briscoe looked at the 91-180 national past due Small Business Delinquency Index, which decreased 2 basis points from .46 in June to .44 in July. By state the highest 91-180 delinquency rates are in Nevada, New Mexico, Florida, and Alabama. The lowest delinquency rates are present in northern states like Montana, Idaho, and Nebraska. When looking at industry segments, all segments excluding agriculture have seen decreases month-over-month. Retail has seen improvement over the past several months, but remains at levels far above the pre-pandemic levels in 2019.

Consumer credit trends

After Briscoe, Tom Aliff, Risk Consulting Leader at Equifax, shared the recent consumer credit trends. For the first half of the year for first mortgage and auto originations we have seen a 47% increase higher than what it was in 2020. And, auto originations are at a record high.

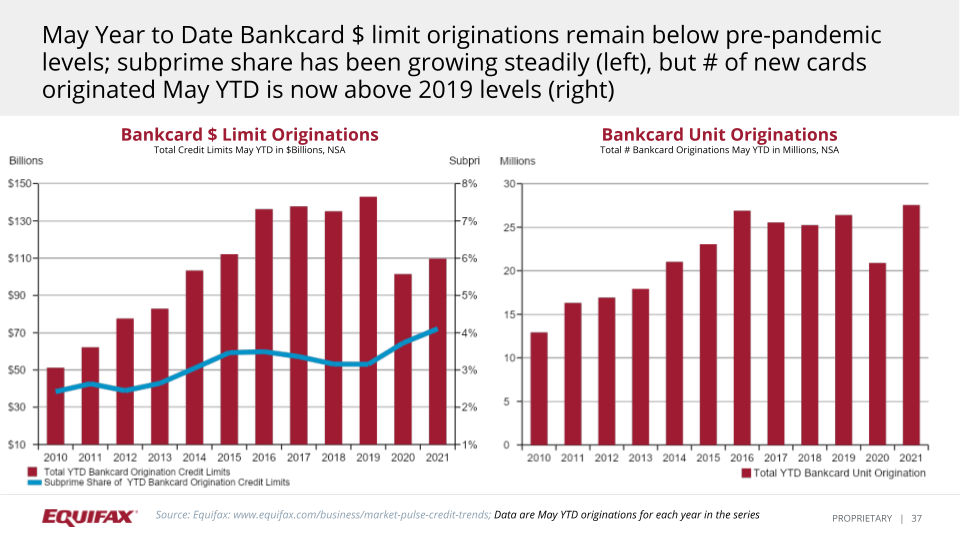

In terms of bank cards, (right side chart, shown below) there was an increase in total unit originations. The left side chart shows the highest that it has been. While unit originations are up, the total limit and credit lines are still down. This is due to lenders managing risk exposures and trying to limit the total amount that is being lent out by each of the unit originations.

When Aliff examined Private labels, he mentioned they have seen some increase through the year. The beginning of the year was slightly slower, but there has been a month-to-month pick up when compared to 2020 levels, even though we are not at the limitations standpoint we were at in 2018 and 2019. But according to Aliff, private labels will increase with the holiday shopping season within the next few months.

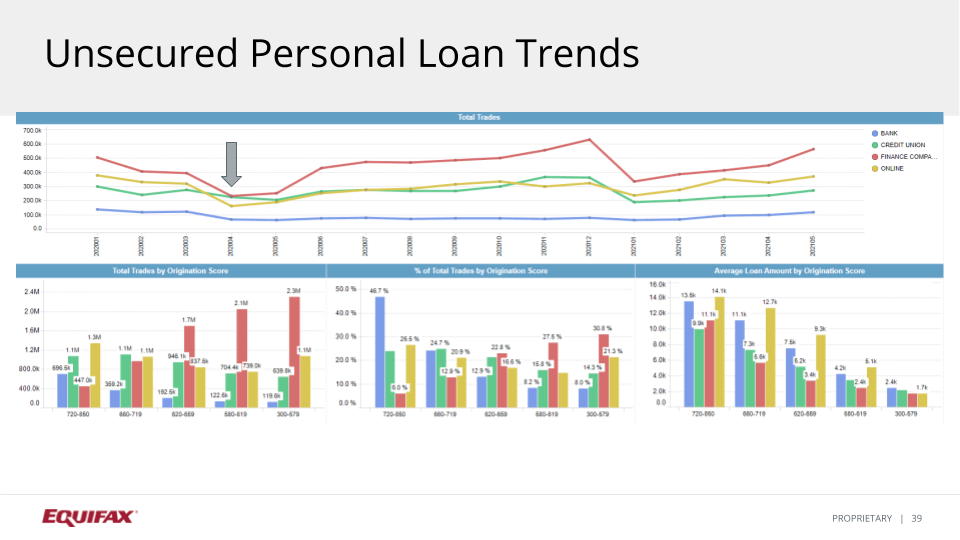

Looking at unsecured personal loan trends, total market, finance companies, and online are creating the majority of the total tradeline (pictured in the top graph below). In the lower graphs you can see total trades by origination score and the lower risk on each of the charts on the left hand side. When examining each of the lending institution types (blue is bank, online is yellow, etc.), we see distribution where it relates to finance companies from total trade origination by score, which is skewed more towards subprime credits while online is skewed more towards prime perspective.

Also, when looking at new originations, there is a large amount of growth in the online space, which is increasing faster than the rest of the market. Another takeaway according to Aliff is that the online financing is skewed towards lower risk.

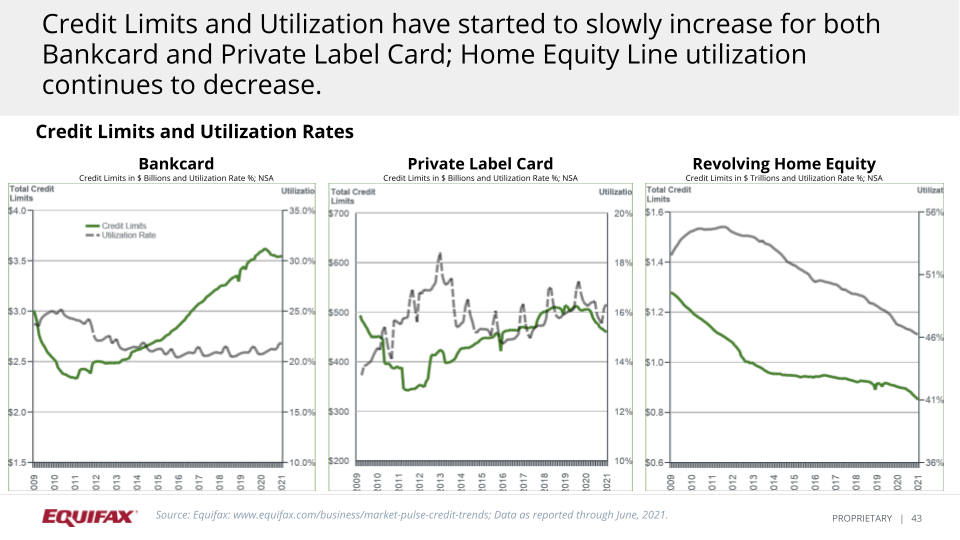

As it relates to credit limits and utilization rates, we have seen bank cards’ credit limits (green line in left chart) dip down while its utilization rate had a little bit of an increase, but most of it has been fairly flat for the last six years. However, as of recently credit limits and utilization for both private label and bankcard have slowly increased with home equity utilization continuing to decrease (shown below).

A discussion on buy now, pay later

The webinar concluded with a one-on-one fireside chat with Bill Phelan and Sharla Godbehere, where they discussed the finance installment payment system, buy now, pay later (BNPL), and its impact on small businesses and consumers. Phelan started off the conversation by defining BNPL, in which consumers can buy a product now, but pay for the product over a period of time through installments. As of recently, statistics showed that around two percent of all online shopping in the U.S. is using buy now, pay later. Sharla Godbehere continued the conversation by sharing with the audience that BNPL started in Australia, which has around seven percent of online shopping using BNPL there as of today. There is a huge opportunity for these companies to have their consumers leverage BNPL.

Godbehere further explained that the reason it is growing is because BNPL is really easy to use and does not need your credit card number at the time of purchase. It only needs your name, phone number, address, and date of birth. BNPL also helps consumers plan their finances better. Consumers can manage their payments much easier with BNPL. BNPL opens the environment for consumers who do not have credit cards, as now they are able to shop online without a credit card.

Next, Phelan asked Godbehere what innovations she has seen since helping companies with their BNPL installment plans. Godebehere shared a few key areas that BNPLs need to take into consideration. The first is ID verification. The second and third areas are fraud and credit risk verification. ID verification, fraud, and credit risk verification can all be done in one simple transaction. These companies need to look at fraudulent and credit risk transactions and examine them within seconds, since consumers will not want to wait while trying to buy something on the BNPL company’s site. Godebehere continued to share how BNPLcompanies can grow by expanding their merchant network broader than in the past.

Another interesting fact Godbehere mentioned is that consumers spend 30-80% more if they have a BNPL option available. When it comes to what niches Godbehere has seen BNPL in, there are not many industries she has not seen that use BNPL programs, as the majority of industries have some type of BNPL installment. Phelan closed the webinar by addressing the importance of BNPL. He believes it is gaining a lot of attraction and is here to stay. For more information, contact your Equifax advisor.

Watch a replay of our webinar, “Market Pulse: The Shifting Fintech Landscape” or download a copy of the presentation. Read our Q&A blog here.

* The opinions, estimates and forecasts presented herein are for general information use only. This material is based upon information that we consider to be reliable, but we do not represent that it is accurate or complete. No person should consider distribution of this material as making any representation or warranty with respect to such material and should not rely upon it as such. Equifax does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice. The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

Recommended for you