Lending FAQS: Keep Pace with the Mortgage Market

The mortgage industry is constantly changing. But these lending FAQs can help you keep up with the latest trends and gain a competitive edge — while also expanding access to credit and improving the mortgage experience for homebuyers.

Why should I use a tri-merge credit report with trended data?

The tri-merge credit report combines reports from all three bureaus into a single document. This provides a more comprehensive picture of an applicant’s credit history. Equifax provides tri-merge credit reports with trended data. This incorporates up to 24 months of scheduled payments, actual payments, and past balances, so lenders can see historical payment and credit behaviors. This can also be predictive of future behavior.

For example, standard credit reports don’t differentiate between homebuyers who consistently pay only the minimum balance due on cards (known as revolvers), as opposed to those who pay in full or more than minimum (known as transactors). With trended credit data, lenders can gain more insight into a potential borrower's credit management skills and payment patterns. Armed with that information can help lenders make stronger, more confident lending decisions.

How can supplemental reports help me and my customers?

A lot can happen between loan application and closing. Supplemental reports can help provide verified updates to a homebuyer’s file during the underwriting process. Supplements are typically requested when information within the credit report requires additional information or updates in order to meet the lender’s and/or Government Sponsored Enterprises (GSE) underwriting requirements, such as:

- Confirming Derogatory items

- Update to payment history

- Updated balances since the loan application was initiated

- And more

You can identify opportunities to help an applicant improve their chances of qualifying or getting a better rate, while taking a consultative approach to improving the lending experience. Here are just a few solutions available through Equifax:

Edited Credit Hi Lite (ECHL) Supplemental report — Let’s say a consumer notices that the balance on their credit card reporting on the tri-merge credit file is higher than it is today as they just paid down their credit card a couple of days prior. Our ECHL process allows the lender to obtain the updated balance. The lender can then include it in the consumer debt to income ratio evaluation instead of waiting for the creditor to update the credit bureaus. This service can also add rental history that can be used in underwriting as well.

Accelerated Rescore — In the case of disputed or incorrect credit information, this service can update tradelines with the credit reporting agencies in less then 48-72 hours.

Credit Xpert® What If Simulator™ — The “what if” simulator estimates how a change in behavior can impact a client’s credit. This can lead to improved credit scores, better terms, increased sales volume, and better customer experiences.

Credit Xpert® Wayfinder™ — When a low-scoring customer has the potential to improve, Wayfinder helps generate a personalized plan that provides specific steps they can take to attain the score they need.

Credit Xpert® Credit Assure™ — This report includes not only the credit score, but also the applicant’s score potential, so you can judge their potential to qualify for a loan or a better loan program. When used with an Accelerated Rescore, it can help them obtain the best rates possible, based on their credit.

Why should I care about undisclosed debt monitoring?

Undisclosed debt is any liability that exists at the time of closing that the borrower doesn’t disclose during origination. This can include auto leases, loans, mortgages, revolving credit, or installment loans.

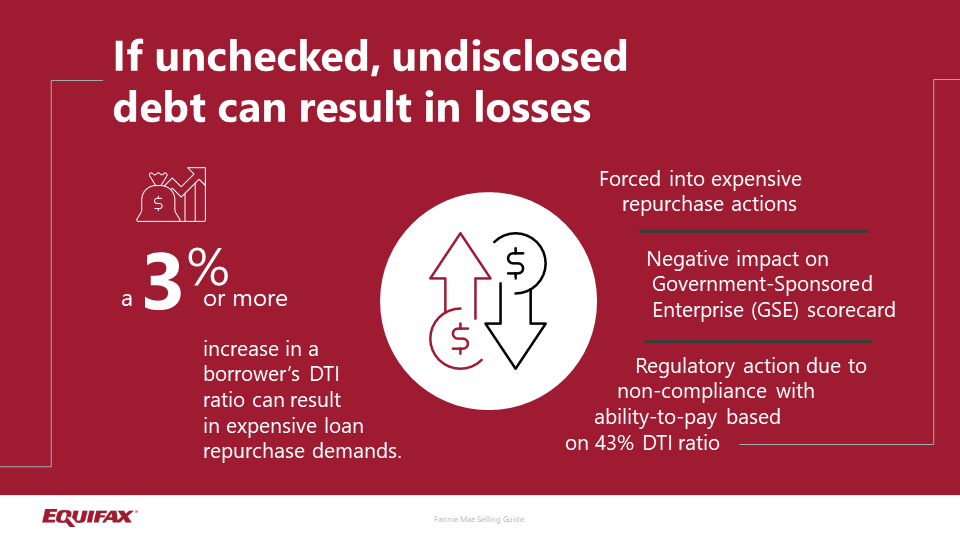

The GSE guidelines require lenders to look into undisclosed debt as part of its underwriting requirements. This can be difficult, as many homebuyers incur new debt after the initial mortgage application before closing. This can result in an increase in potential risk. In fact, 36% of borrowers who opened a single new tradeline before closing increased their debt-to-income ratio by at least 3%.1

How can undisclosed debt impact a mortgage loan?

Undisclosed debt can disrupt mortgage closings, overload underwriting resources, and ruin the customer experience. When a borrower doesn’t disclose all obligations — both new and existing — the calculated debt to-income (DTI) ratio is inaccurate. That means the mortgage lender can’t accurately evaluate a borrower’s ability to repay. It can also keep borrowers from qualifying for favorable rates, and potentially lead to a rejected application.

By stressing the importance of avoiding new debt, you can help borrowers close more easily. Also, borrowers can secure the best possible terms based on their records, and enjoy a more positive experience. More visibility into borrower activity may reveal misrepresentation or undisclosed debt. By using a debt monitoring solution, lenders can better mitigate risk and streamline underwriting efforts.

How can I better inform my customers about mortgages, loans, and credit scores?

Equifax has the technology mortgage lenders need to make smarter decisions and help homebuyers achieve the dream of homeownership. Read "Help Borrowers Move Through the Mortgage Process" for more insights and how you can help your potential borrowers. For more information, visit Equifax.com/business/mortgage

[sources]

1From Equifax analysis based on an anonymous sample of 105,000 mortgage applicants

Recommended for you