Impact of Global Economic Headwinds on the US Economy

The IMF is predicting global growth may slow to 3.2% in 2022 and 2.7% in 2023, down from 6% in 2021. How will the domestic economy fare given these global headwinds? And what can US companies do to build resilience into their 2023 plans?

Factors weighing on economies around the world

Sharing his assessment of global macroeconomics, Robert Wescott, President of Keybridge LLC and former special Assistant to the President for Economic Policy at the National Economic Council, said there several factors weighing on economies around the world and slowing global growth: high energy prices, rising inflation, central banks raising rates, and geopolitical tensions.

Surging energy prices have hit Europe the hardest. Many European industrial plants have shuttered due to high natural gas prices, pushing several countries to the brink of recession. For context, concerns about high-cost Western manufacturing have been growing for years. But Covid and new geopolitical tensions introduce new complications. The global economy is struggling with stark realities like that of how autocrats like Russian President Vladimir Putin can put military goals ahead of the economic wellbeing of their people.

Stresses on the globalization model mean the world environment for business is changing. More companies are diversifying their supply chains. This might mean the “globalization business model” is under threat.

China is still a major source of imported goods, but “China +1” countries are gaining ground. The share of goods coming to the U.S. from Vietnam and India have grown rapidly since 2019.

Accordingly, production costs will rise. ISM values for manufacturing are now under 50 in most major European and Asian countries, signaling strong chances for contraction.

Bringing his assessment to the national level, Wescott shared that slowing global growth and changes to the globalization business model will shape the U.S. economy in the near-term and long-term. It's true the labor market remains a bright spot for the U.S. economy. The unemployment rate is back to its pre-Covid level – 3.7%. Most sectors are posting organic job growth. And consumer spending has been another bright spot. However, it has been sustained by households dipping into their savings. The personal savings rate is at its lowest since Apr 2008.

Keybridge’s “Top 25 CPI Categories to Watch” measure of underlying inflation (including items like rent, grocery, clothing, and household operations) suggests a persistent problem, even if energy prices and prices of new cars recede. The Federal Reserve raised rates by another 75 basis points in November, bringing the fed funds rate to 4.0%. The pace of increases may soon slow, but rates are expected to hit 5.0% by March. We continue to see evidence that the Fed’s rate hikes are hitting the economy. Job posting data from Indeed suggests that the labor market is starting to cool.

The Keybridge Recession Monitor is now red for the indicators with the longest lead time before a recession starts, shown in Figure 1.

How the economy is impacting global and US consumer credit

Swarnima Pandey, Equifax Analytics Insight Expert, broke down global consumer credit trends across cost of living, mortgage demand, and arrears. Inflationary pressure is visible across countries with cost of living rising around the globe. In the UK, Equifax transaction data shows that ~60% more people have become reliant on high-cost, short-term credit in Q2 compared to Q1 of this year. In Canada, credit card spending is reaching historically high levels with average spend per card consumer up by 17.3% in Q3 2022 when compared to Q3 2021 and 21.8% up from pre pandemic (Q3 2019) period. Non-mortgage debt has been increasing across countries driven by demand and inflation.

Rising rates are deterring new mortgage volume while bringing some price correction in many regions. The UK has seen the Bank of England's base rate increase from 0.1% at the end of 2021 to 3% as of November 2022. In-line with this steady increase, the cost of secured lending continues to rise in an attempt to control inflation rates. Prime interest rates in Canada went from 0.25% to 3.75% since March 2022.

Arrears are beginning to rise. Delinquency rates are rising for non-mortgage products in most regions with varying levels of severity. In Canada, credit card and other non-mortgage products are starting to rise. Auto and installment loan delinquencies are fast approaching pre-pandemic levels. In Australia and New Zealand, personal loan early delinquency (30+ days past due) hit the highest level since the pandemic at 3.13%.

Zooming in from global to national, Tom Aliff, Equifax Risk Consulting Leader, shared U.S. July 2022 YTD credit trends and insights. He began with mortgage originations which have come off the YTD boom in 2021 but are above 2019 levels. Auto YTD originations continue, and subprime share has dropped from 2018-2020 levels. Bankcard limit originations are now above pre-pandemic levels. Subprime share has decreased from 2021, and the number of new cards originated July YTD is above all prior year levels.

Unsecured Personal Loan originations balances at all time high levels. Subprime share has been flat, and the number of new loans originated July YTD is also a new high. Home Equity revolving limit and unit originations are now higher than they have been since 2008. Mortgage Debt at $11.9T. Non-Mortgage Debt has returned to keeping pace with an increasing trend aligned to pre-recession. Revolving Debt in September 2022 is above 2019 levels. Non-Revolving Debt is also continuing to rise. Credit limits and utilization have started to slowly increase for both Bankcard and Private Label Card. Home Equity line utilization continues to increase.

Delinquencies are beginning to rise

Aliff said Bankcard and Private Label delinquencies are

below pre-pandemic levels. First Mortgage delinquencies remain at

historic lows. But delinquencies on Auto are rising.

30+ DPD:

- Most significant in Personal Loans

- Card and Auto are rising yet are not quite where they were in 2019

- Mortgage near the 2006 all-time low.

60+ DPD:

- Increases in dollars are most significant in Personal Loans

- Auto dollar delinquency is at all-time high

- Mortgage near the 2006 all-time low

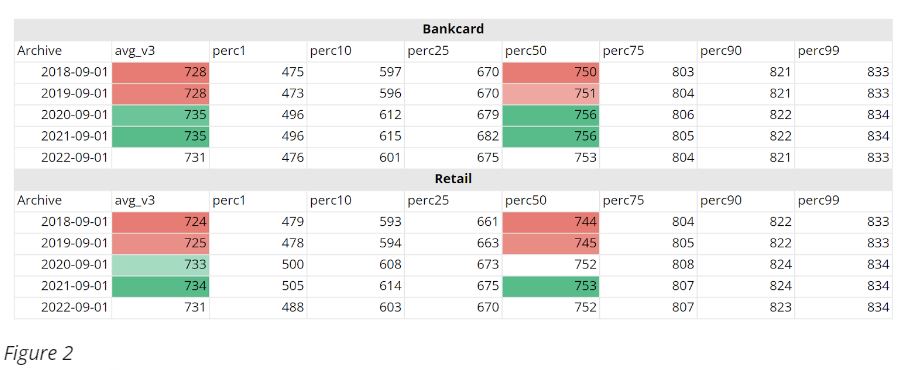

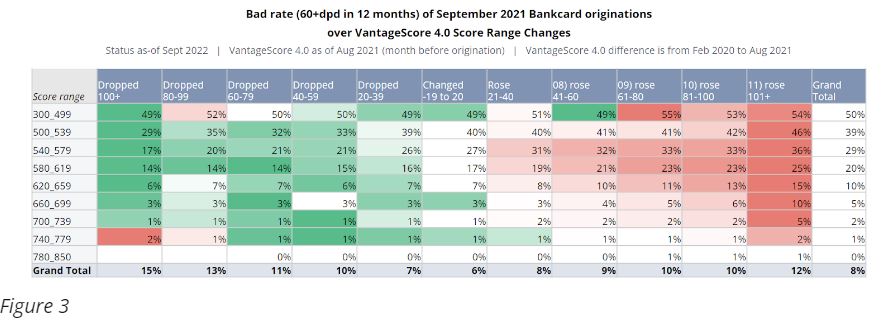

In order to provide an analysis of how consumers have performed after score increases due to the pandemic (Figure 2), Aliff provided the Bad Rate of September 2021 Bankcard originations over VantageScore range changes. (Figure 3).

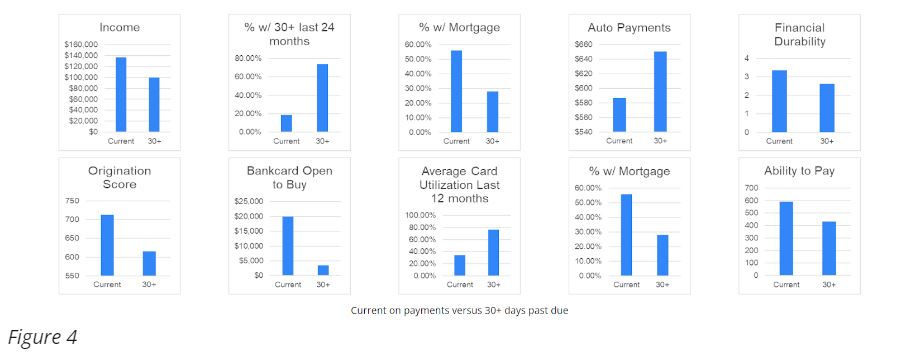

Aliff wrapped up consumer insights with the September 2022 Auto repayment status among consumers who were current on their Auto payments in June 2022 — broken down by financial profiles, shown in

In order to stay resilient right alongside your customers despite global and domestic pressures, check out these recommendations.

For more information, download the webinar deck and watch the full recording.

* The opinions, estimates and forecasts presented herein are for general information use only. This material is based upon information that we consider to be reliable, but we do not represent that it is accurate or complete. No person should consider distribution of this material as making any representation or warranty with respect to such material and should not rely upon it as such. Equifax does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice. The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

Recommended for you