How will Recent Ecommerce Growth Impact Fraud Levels?

In this recap of our May 6 webinar, “Market Pulse: Growth Amid Rising Fraud,” Amy Crews Cutts, President and Chief Economist at AC Cutts & Associates; Rich Stuppy, Vice President & Senior Customer Experience Leader at Kount, an Equifax Company; Hrishi Talwar, US Identity, Fraud, and Compliance Leader at Equifax; and Tom Aliff, Senior Vice President of Data Analytics and a Consulting Leader at Equifax provide the latest consumer credit, employment, and fraud prevention insights. Looking for answers to questions submitted during this webinar? Read our blog post, 5/6 Market Pulse, Your Questions Answered .

Return to Growth

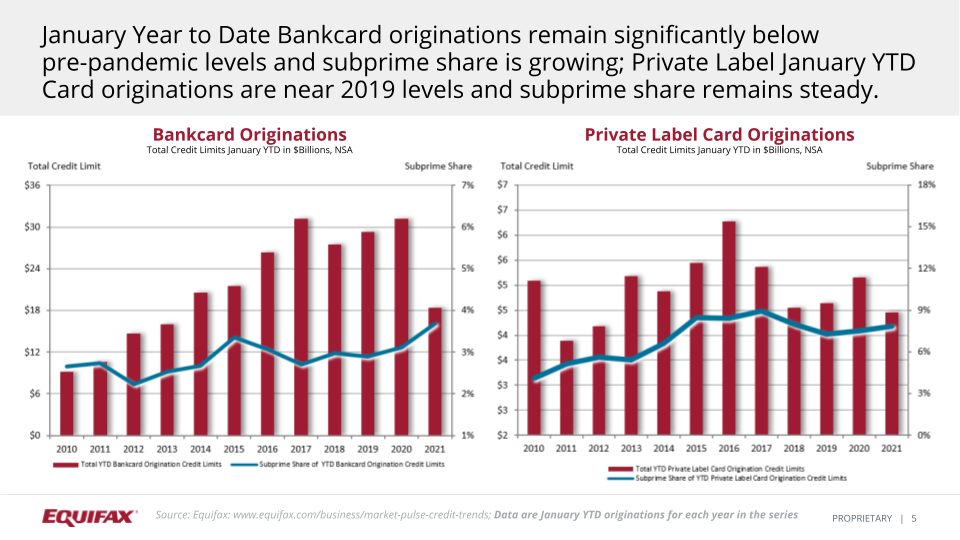

Stimulus and the widespread increase in vaccinations has led to a surge in consumer demand for credit. Looking at the 2021 numbers, there is an uptick in the market compared to the 2019 demand for credit. Tom Aliff reported that as of March 2021, credit inquiry activity was more than 20% above 2019 levels. Compared to 2020 levels, there was a 30% increase. Looking at the January year-to-date data (chart below) illustrating how originations are trending over time, bankcard and private label cards are still low for the month of January 2021. But, both expect to rise as data is reporting into Equifax.

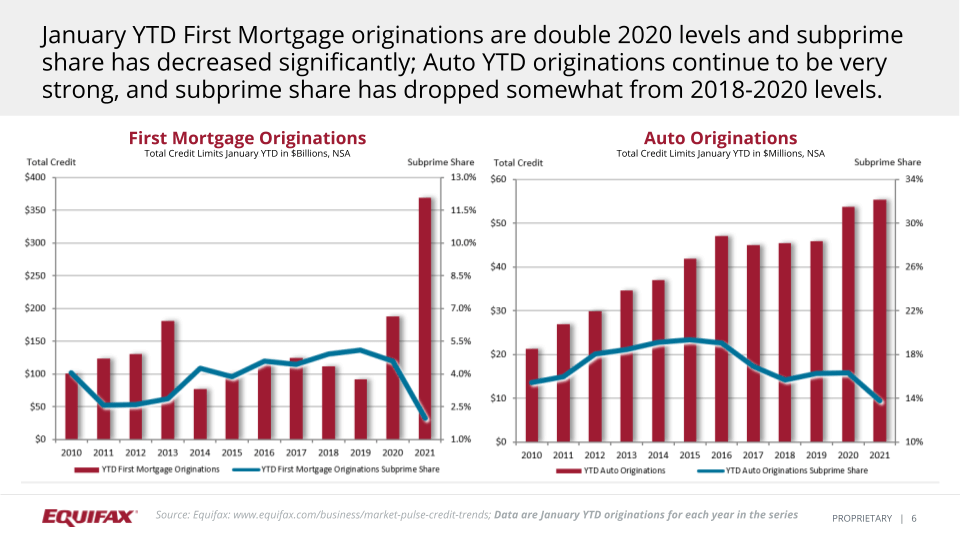

Additionally, first mortgage originations, as of the January year-to-date, are double 2020 levels, but subprime share is significantly lower.

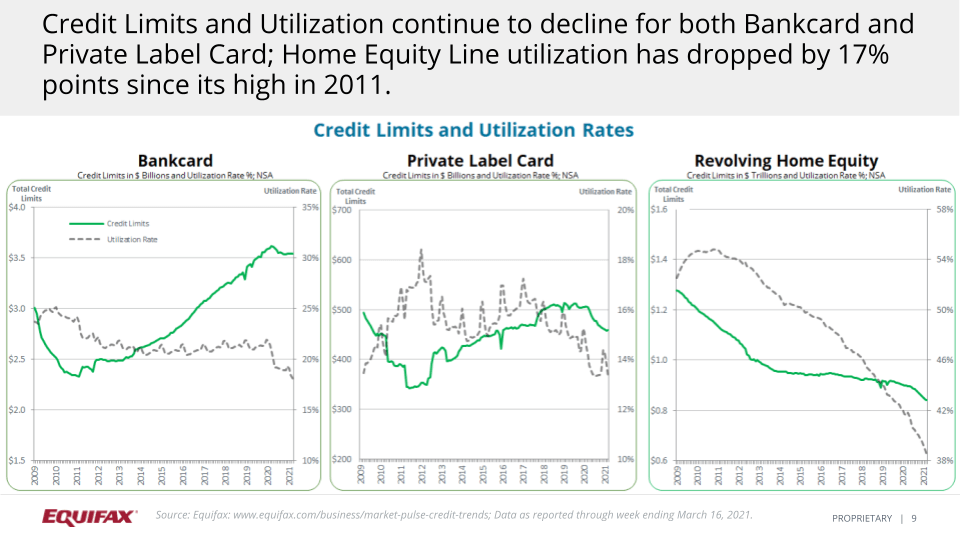

Looking from a revolving credit standpoint, utilization on bankcard and private label card are the lowest they have been since 2009. HELOC balances and utilization are the lowest levels they have been since we have been tracking the data back to 2006 (not shown on chart). This is due to a combination of decreased card spending, balance payoffs from government stimulus payments and refinance of mortgages that pay off home equity lines of credit as part of the refinance process.

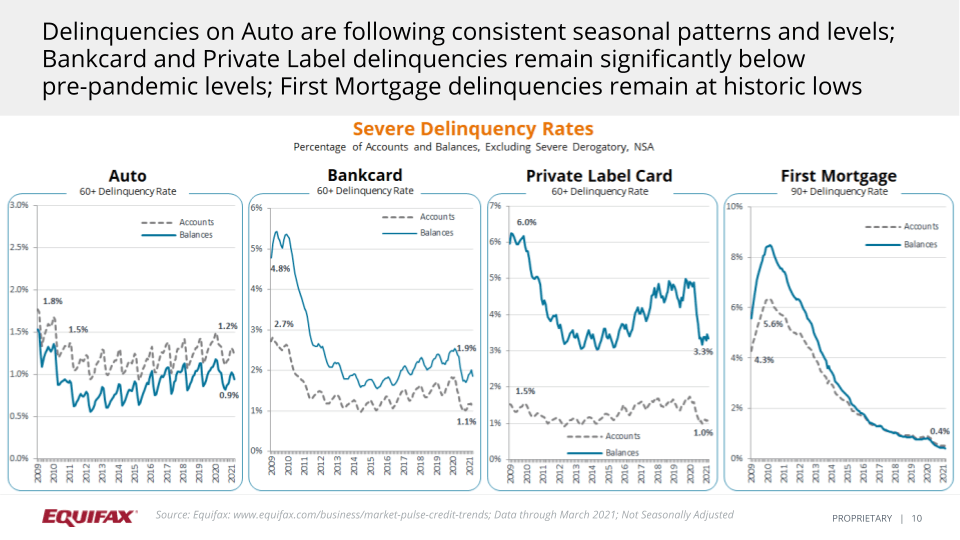

The chart below shows delinquency trends. Auto delinquencies are following a seasonal pattern, but bankcard, private label card, and first mortgage have all decreased. Aliff mentioned that, due to the reduction in delinquencies and utilization, there has been a shift in consumer score distributions to higher levels.

New Claims Data

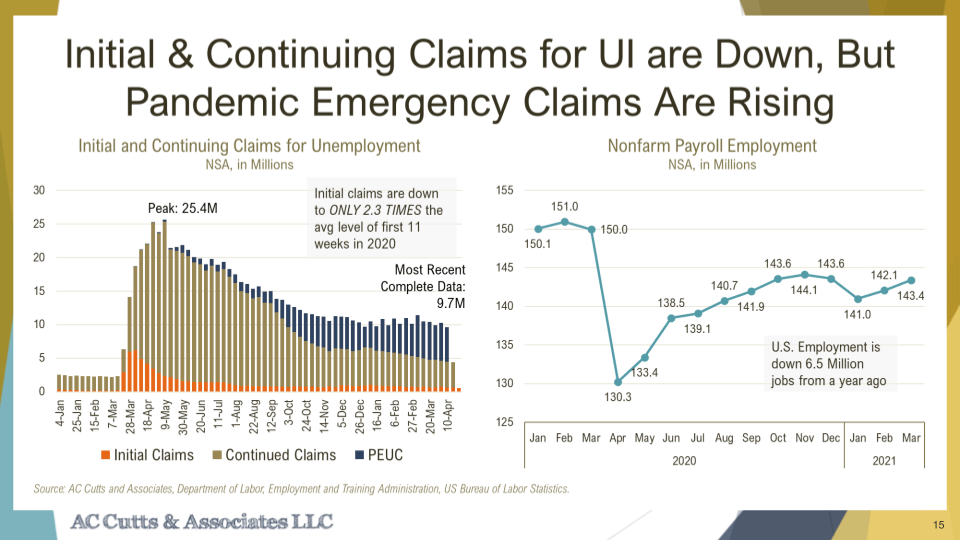

Next, Amy Crews Cutts reported the new continuing, initial, and pandemic emergency claims for unemployment data. Since the start of the pandemic, we set a new record low, coming with initial claims around 498,000 applications. With the good news of initial claims decreasing, comes bad news. The bad news is that the number is still high compared to the past few years. Initial claims, according to the chart below, are down 2.3 times the average level of the first 11 weeks in 2020.

However, the pandemic emergency claims have been rising. Also, Cutts mentioned from the Department of Labor report the continuing claims data, which is only down 1.7 million from this time last year and is still very high when compared to the past. These are people who are in the unemployment system and are receiving benefits. As for nonfarm payroll employment, US. employment is down 6.5 million jobs from a year ago. However, Cutts explained that there are expectations of one million more people employed compared to the month of March 2021.

Fraud Opportunity

With federal pandemic-related support from households comes a huge opportunity for fraud. Cutts reported that $424 billion was put into households from federal programs in March. This is a large influx of capital and money into households' pockets. Unfortunately, Cutts mentioned this leads to an incline for individuals to steal money. Cutts cited that the Pandemic Unemployment Assistance program makes every American and their identity a target. The Department of Labor estimates that 10% of new federal unemployment benefits will end up in the hands of fraudsters. This is $89 billion expected fraud.

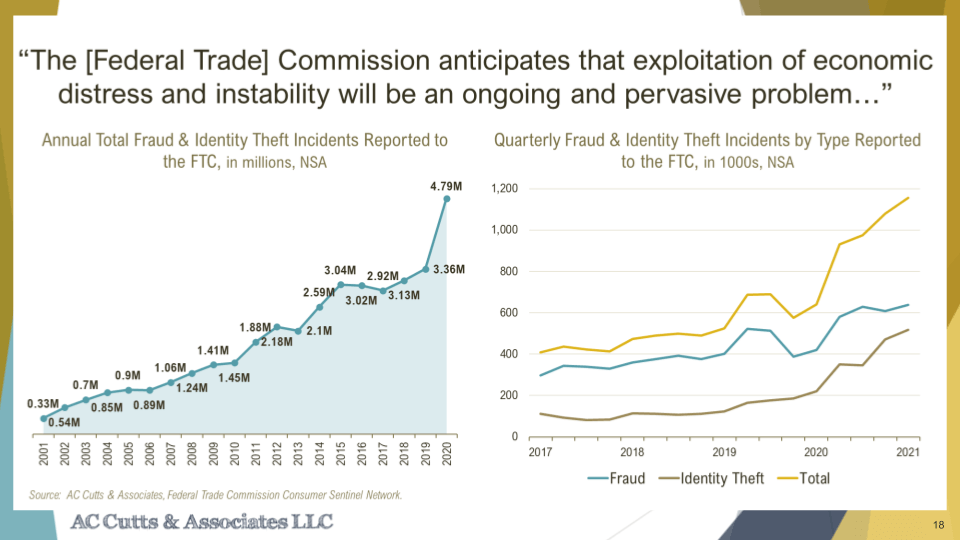

This organized crime could top $300 billion by end-of-year. Cutts reported that the Federal Trade Commission anticipates that exploitation of economic distress and instability will be an ongoing and pervasive problem. According to the (left) chart, there has been an increase in reported fraud and identity theft incidents. The chart (right) shows that fraud incidents take the lead for most reported incidents. So far in 2021, there has been 1.2 million incidents of fraud and theft reported.

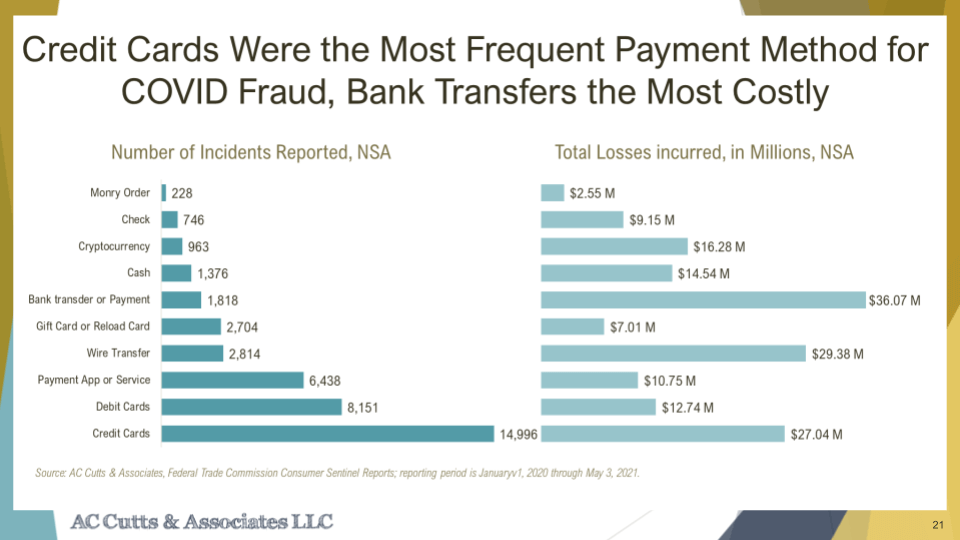

Cutts stated that the biggest increase in identity theft was government benefits fraud. Next, Cutts went over the two biggest states for identity theft. These states were Rhode Island and Kansas. The chart (below) shows which biggest payment method was being affected by fraud. Credit cards were the most frequent payment method for COVID fraud. However, mortgage fraud is now less than a 30th of what it was leading up to the great recession/’08 financial crisis.

Fraud and the Digital Acceleration

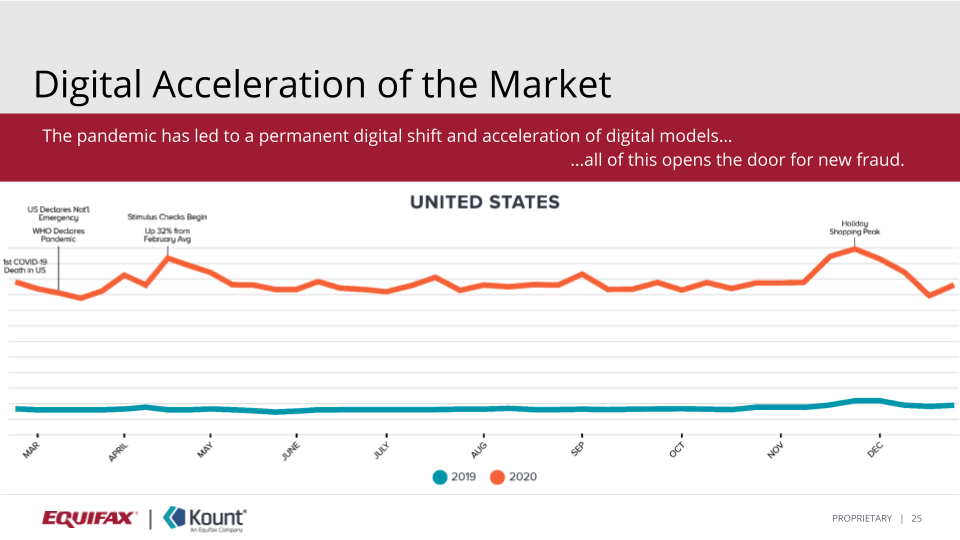

Rich Stuppy, Vice President & Senior Customer Experience Leader at Kount, explained there has been a large increase in fraud due to digital acceleration. As digital accelerates, companies use that to create better and more interesting brand experiences. Each step in that brand experience or customer journey is another place for fraudsters to attack. The graph below depicts the large increase from the beginning of 2020 in overall digital transactions that are in the Kount, an Equifax company, fraud control business. However, reports from the leading digital platforms of five years, four years, three years of digital acceleration were being pressed into a narrow window of the first couple of months of 2020. And according to Stuppy, that will continue throughout the coming year.

The Fast Growing Fraud

Next, Hrishi Talwar, US Identity, Fraud, and Compliance Leader at Equifax, cited that between 2019 and 2020 there was a 42% increase in identity theft. This is because fraudsters are following exposed programs with only a single-layered approach of verifying someone's identity. Fraudsters get access to the funds and then siphon the funds into domestic accounts or overseas. Talwar expanded on Cutts’ insights by noting there's an expectation that post-2021 identity theft rates will decline. This is due to expecting that some of these government relief funds are going to end their programs.

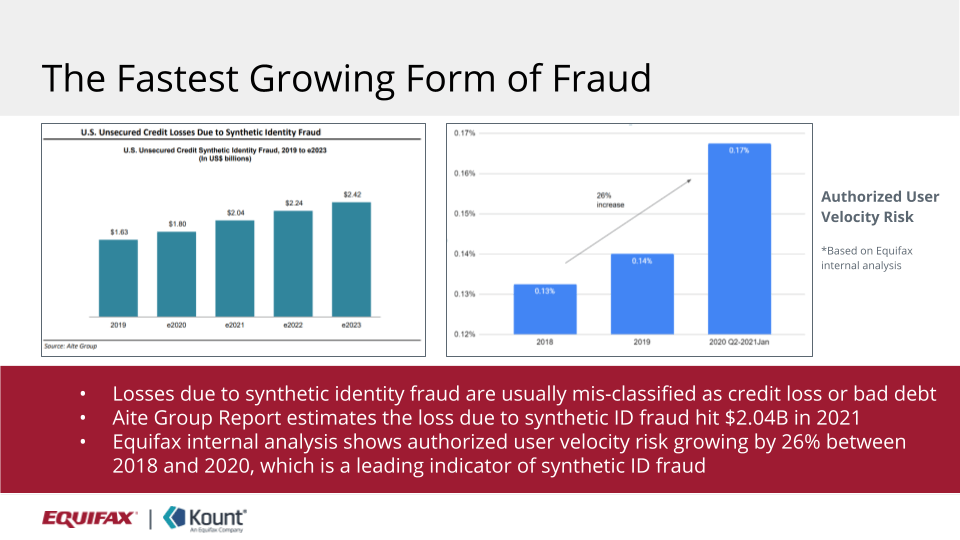

According to Talwar, it's important to pay attention to what is the fastest-growing form of fraud. The chart (left) shows synthetic identity fraud as the fastest growing form of fraud with expectations of a continuous increase in years to come. Data reported to Equifax explains how new authorized users were getting added to new accounts. The data showed a 26% increase in sheer volume over the last two years. Adding authorized users is a common mechanism for synthetic identities to get introduced into the system, leading to fraud.

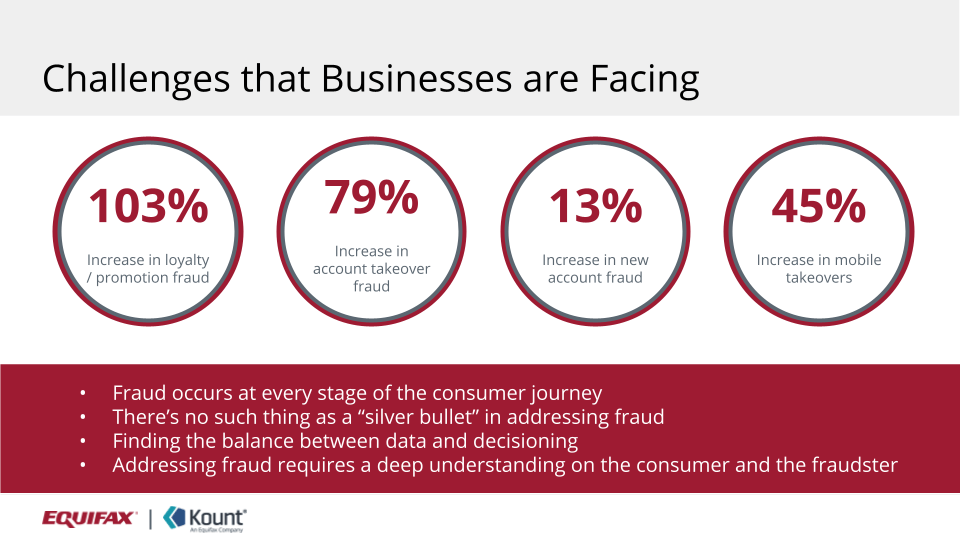

Stuppy reported a 100% + increase in loyalty and promotion fraud. The largest increase was in account takeover, much of which automation powered. However, the increase in actual account takeover fraud is nothing in comparison to the increase of the velocity of attacks. Again, the automation on account takeover is tremendously effective. The thing to remember is there's no silver bullet in addressing fraud. Stuppy stated fraud requires a layered approach. It requires balancing between the data you have, the sensors you can install, and the decisions and platform capabilities you have to make real-time decisions. It requires a deep understanding of your customer's journey that you've designed for them, but also the fraudster.

Best Practices

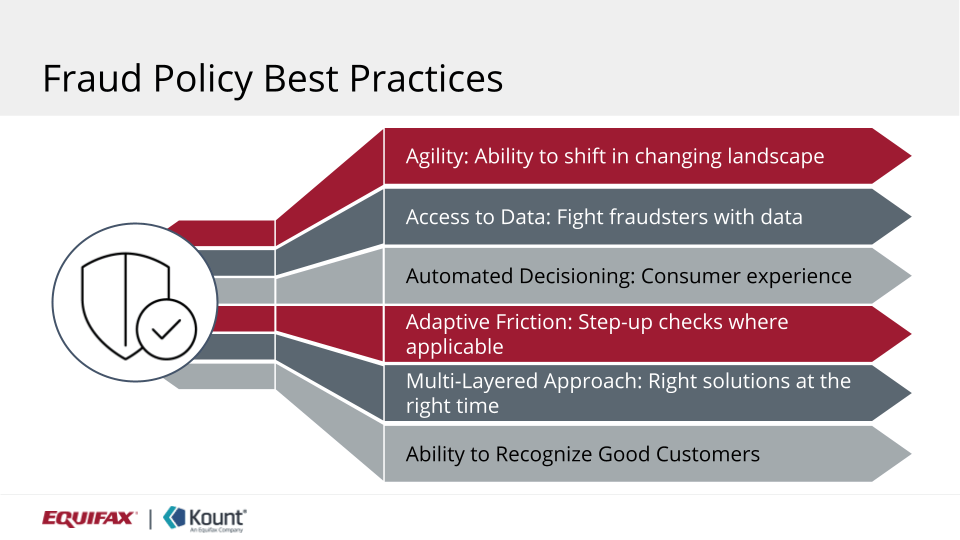

The slide below shows the best practices Equifax recommends. Stuppy mentioned when in a digital environment, you're going to have the ability to have automated and real-time decision-making capabilities based on that data. One of the components that you'll use to help make those decisions is the ability to apply adaptive friction.

That could be providing an altered customer journey or customer opportunity based on the perceived risk at that moment, or doing things like step-up authentication, or adding the appropriate approach at the appropriate layer. Then it boils down to the ability to recognize your good customers, give them the best possible experience, and at the same time recognize who is a high-risk customer. Then, you can give your high-risk customers the experience that they require.

Equifax + Kount

Lastly, Stuppy and Talwar concluded with the new partnership between Equifax and Kount. With the two companies working together, we’re able to offer a tremendous set of capabilities to shared customers. Equifax has a massive set of data around fraud events. Kount has heartbeat, real-time, daily events, with many of those layers talked about previously in the webinar. Together Equifax and Kount will continue to bring all of those capabilities in a combined asset to all customers.

Access the full webinar recording by visiting Market Pulse: Growth Amid Rising Fraud.

Download a copy of the presentation slides here .

And, if you would like to speak to an Equifax representative about any of the data or solutions mentioned in this blog, please contact us today .

Recommended for you