How Effective is Your Approach to Assessing Identity Trust?

Businesses and Fraudsters Are Adapting

The global pandemic of COVID-19 is pushing both businesses and fraudsters to adapt. While the demand for digital onboarding solutions has grown (due to social distancing measures), so have opportunities for tech-savvy fraudsters.

I’ve seen how the scope and complexity of identity and fraud risk often shifts. Our customers rely on us for the most accurate identity and fraud insights. They want to not only make their customers' experience seamless and effective, but to help them battle emerging fraud tactics every day.

It is critical to center these insights around the concept of identity trust, which is at the core of any interaction. It is more significant than ever as we see an increase in online and digital interactions. During these unprecedented times, we’re writing this blog series to delve into how the next generation of identity and fraud data science can maximize trust. We’ll share candid insights from our data science experts to empower you with the latest trends, information and data-driven intelligence. As a result, we'll help you make the right identity trust decision in every customer interaction.

When Traditional Methods Don’t Work Anymore

Let’s start by taking a look at a regional bank that’s a customer of ours. Traditional fraud analytics just weren’t working anymore. The bank's fraud incidents were rising among online account applications, as were costly fraud-related losses. This put an unnecessary burden on the bank’s good customers to prove they were in good standing. Alternatively, it caused the bank to spend additional time, money and resources on the problem. Yet, if the bank’s risk team knew then what they know today about next-gen fraud data and analytics, they could have proactively identified 92 percent of the bank's fraud.

Compared to today’s on-demand and real-time standards, traditional data and analytics can be a slow-moving process. That's because it's frequently driven by domain expertise and human intuition. While it usually involves automation and modeling, models are sometimes updated annually, if that. The data fueling the models isn’t typically diverse or dynamic, nor is it routinely reviewed for relevance and accuracy over time. The broader analysis often is comprised of disparate processes and data sources that are independently analyzed and manually pieced together.

The end result? A partial view — or worse, an inaccurate view — of the identity and related fraud risk that is rarely streamlined across an organization. Real consumers are impacted, while fraudsters get through easily. Pivoting back to the problems the regional bank encountered, the issues begin to make sense in this type of environment.

Poor Data Management Extends Onboarding Time

As new account fraud continues to soar, additional research from Fenergo indicates that poor data management increases the time taken to onboard clients. As a result, it negatively affects customer experience. Additionally, it has a significant impact on the lifetime value of the client.

It is estimated that poor customer experience is costing banks $10 billion in revenue per year. However, like the regional bank mentioned above, many financial institutions are still using outdated strategies to battle high-tech fraud and to improve customer experience.

A Closer Look at the Science Behind Identity Trust

Traditional credit risk models assume that an individual’s identity is accurate. They focus on predicting if the person can and will “pay as agreed.” However, the data and analytics used to determine identity trust is different. These models are designed to reconcile identities and intent. Ultimately, the goal is to answer two basic questions: 1) are the individuals who they say they are; and 2) are their intentions what they say they are.

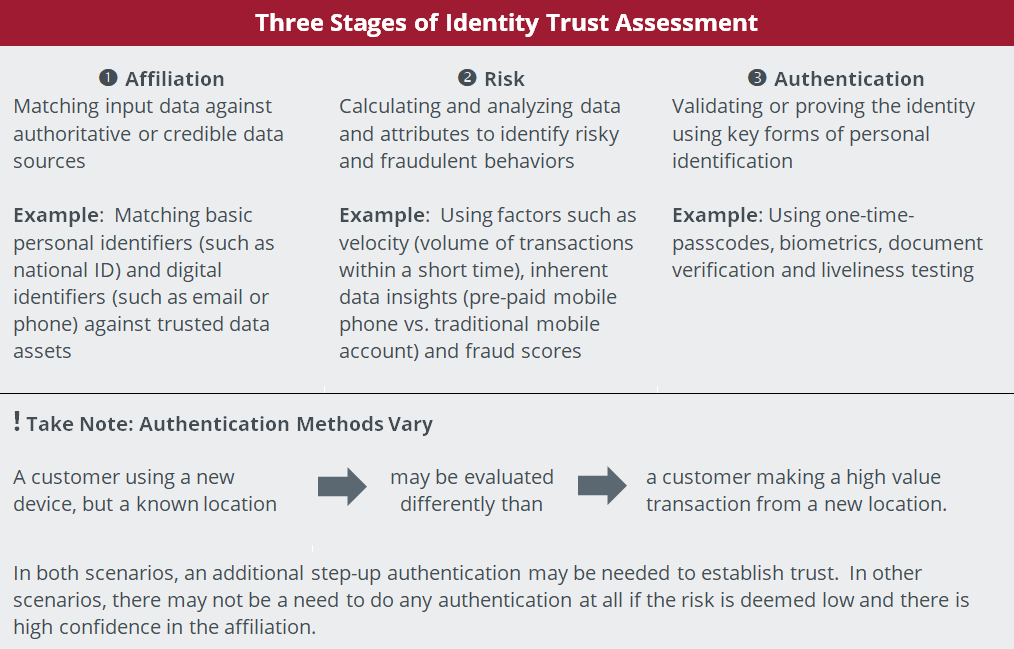

Trust is a very contextual assessment, and it varies by use cases. In general, the data and analytics approach is used to evaluate three stages of an identity trust assessment — affiliation, risk and authentication.

As you can see, the trust decision is a multi-faceted process. A multitude of intelligent data, behavior patterns and signals are combined to make the best identity trust decision for every transaction. That decision balances “real costs” with “opportunity costs.” The time and effort required to validate information counts as real costs. And customer friction, due to false positives or extra authentication steps during sign up, drives opportunity costs.

A More Sophisticated Evaluation of Identity and Fraud

Today’s fraudsters are always adapting. Just think about the large scale bot attacks driven by automated software, skyrocketing account takeover fraud (ATO). They racked up $9 billion in losses in 2019 and hard-to-detect synthetic identity fraud, where the stolen identity information of real people is used to open new accounts. Even first-party fraud, where an individual simply provides false information or intentionally defaults on an account, can be difficult to flag or recognize without the right tools. What if businesses could build trusted identities, while protecting the customer experience across all transactions and interactions... in seconds?

To keep these and other emerging fraud tactics at bay, the next generation of identity and fraud data analytics has proven to be intelligent, adaptive and cohesive.

It offers inclusive, dynamic views that connect the dots and better represent identities and risk from every possible angle.

Where traditional approaches are fueled by siloed data and technologies, next-gen identity and fraud solutions are powered by data, attributes advanced modeling techniques and even platforms — all across a single enterprise. The approach is fast, flexible and sophisticated. Financial institutions can clearly visualize trusted identities and fraud risk across their organization — in seconds. They can do this no matter how or where it attempts to enter. As a result, they can avoid it, cut their losses and better focus on business growth. Meanwhile, consumers have fewer headaches associated with false positives. Additionally, businesses experience a smarter, sleeker process that keeps them engaged through account opening and beyond.

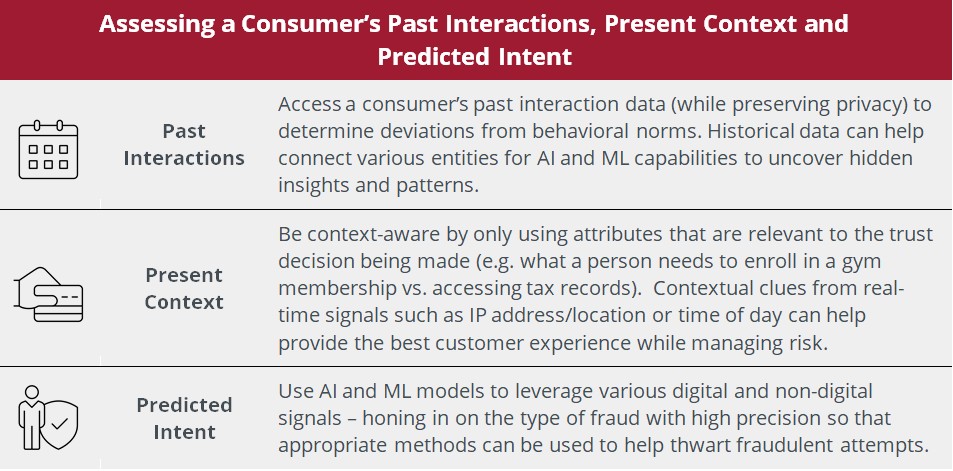

Instead of using a "one-size fits all" approach or segmentation based on predefined risk categories, next-gen solutions help you make the best decision for every individual customer every time they interact with you by considering their past interactions, present context and predicted intent.

Next-Gen Identity and Fraud Solutions are in Use

The good news is these next-gen identity and fraud solutions are available today — and in use by many businesses. You can integrate and manage multiple data sources and differentiated data to orchestrate unique, 360-degree views of identity and risk. Artificial intelligence and machine learning capabilities can be layered over the data to accelerate fraud detection and increase accuracy, in real time.

Channeling data, attributes and technologies through a single API can help streamline, simplify and optimize decision making. The bottom line is static data and siloed processes just won’t cut it anymore. I encourage you to explore the possibilities of a more advanced approach to building identity trust. In my next blog, we’ll explore the immense power of data. To sharpen identity trust and accelerate risk detection across the customer lifecycle, you need to capture and activate rich data. Stay tuned for a deeper look.

Recommended for you