Help Borrowers Move Through the Mortgage Process

Buying a home can be stressful and confusing — especially if a consumer is trying to learn about credit and how their credit score can impact their chances at home ownership. The following insights can help lenders like you provide a better experience to potential borrowers and support them in navigating the mortgage lending process with greater confidence.

Why is a credit score important?

Ranging from 300 to 850, the credit score is a numerical estimate of how likely a person is to repay a loan. Simply put, a credit score influences a consumer's ability to get a mortgage loan. To help lenders make more informed decisions, and help consumers get the credit they need, there are multiple versions of the credit score. Industry specific scores are optimized for different types of credit products — like a mortgage — and are adjusted to focus on specific risk behaviors.1

What makes up a credit score?

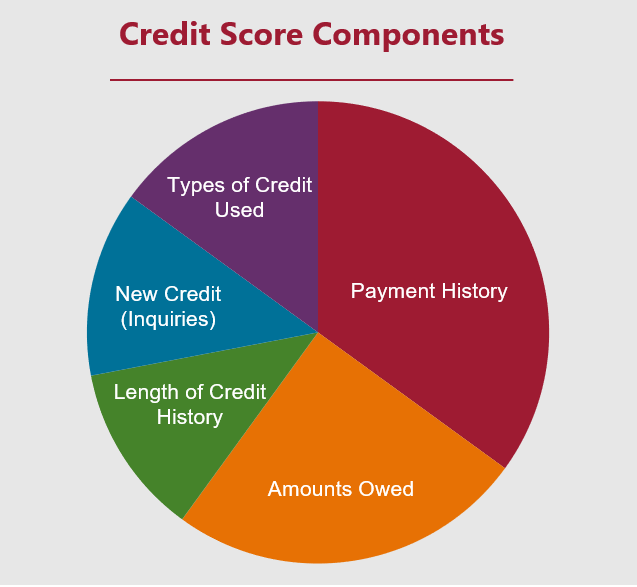

There are five different categories in a credit score:

There are five different categories in a credit score:

- Payment history: 35%

- Used credit vs. available credit: 30%

- Type of credit used: 15%

- New credit: 10-13%

- Length of credit history: 5-7%

These are general guidelines and can impact a consumer's score differently. For mortgage lenders, a consumer's past payment history and the amount currently owed are most important when determining risk (and whether a potential borrower will be able to make payments).

How can borrowers improve their credit score?

Before applying for a mortgage, there are things potential borrowers can ask themselves. Consider a few best practices to better their chances of getting approved for a mortgage loan. Borrowers should check whether they’re paying their bills on time and whether they have any missed payments.

Payment history and paying on time every month will help improve a credit score over time. It’s also recommended that potential borrowers keep a 30% (or less) utilization on existing credit card/charge accounts. This shows lenders that they can pay off debts. Paying the entire balance (or more than the minimum payment) on credit cards for several months will help demonstrate smart financial management — and can even improve their score. A good general rule is for borrowers to avoid applying for other forms of “new” credit (debt) for several months before and during the mortgage application and loan process.

For lenders, educating your customers can help keep the underwriting and closing process on time and on track. Plus, gain visibility into a borrower's credit file through undisclosed debt monitoring tools. These tools continuously monitor all credit types and provide alerts in near real time if changes occur. By doing so, you can help resolve issues as they arise to keep borrowers on track for their mortgage loan.

The tri-merge report — and what it means to you and your borrowers

In the mortgage industry, a tri-merge credit report is used. This report contains a consumer’s credit information from the “big three” credit bureaus: Equifax®, Experian®, and TransUnion®. Because a mortgage represents the largest loan most people ever apply for, this single credit report merges data from all three credit reports into a single document. Having one report makes it more comprehensive for mortgage lenders.

Equifax Mortgage Solutions utilizes merge logic to combine the information from the three national credit reporting agencies to create the merged tri-merge credit report. Reducing duplicate credit tradelines can help lenders have a true picture of the consumer's debt to income ratio. It can also make the report easier to read and understand. There are instances where duplicate accounts may show up on a tri-merge report; this can happen for a variety of reasons and is often related to the merge logic itself. The duplicates can be verified and removed as part of the credit supplement process.

The Equifax Mortgage Solutions Trended Credit Hi*Lite report includes trended data. Trended data provides historical insight (24 months) of a consumer’s balances, scheduled payments, and actual payments for each tradeline when available. This view provides additional insight into a borrower’s credit management behaviors.

What are the different types of inquiries?

Soft inquiry — An inquiry only visible to the consumer. Generally, soft inquiries are posted to the credit report for:

- Insurance

- Marketing

- Pre-approved offers of credit

- Account management

- Quality control of portfolios

- Prequalification (consumer written consent)

These inquiries will stay on the credit report for one year and will not impact the consumer’s credit scores. For example, a potential borrower may consent to a prequalification to find out how much house they could potentially afford. A hard inquiry will not be posted to the consumer’s credit file unless/until the consumer decides to move forward with a mortgage loan application. Then a credit report is pulled as part of that process.

Hard Inquiry — An inquiry that is initiated by the consumer and is visible to the consumer. Companies that have requested their credit file can see these inquiries too. Hard inquiries impact credit scores and serve as a timeline of when a consumer applies for new credit. They may also stay on the credit report for two years. Recent hard inquiries can tell a lender that the consumer is shopping for new credit. This may be meaningful when assessing creditworthiness.

Do multiple mortgage inquiries impact a credit score?

Because a mortgage is a major commitment, a consumer may want to shop and compare to get the best rate. The impact of multiple inquiries on the credit score is the same as if only one lender pulled credit, as long as the inquiries are all within a 45-day period.

What is a mortgage prequalification vs. a pre-approval?

Prequalification — A prequalification generally means that a lender collects some basic financial information from a potential borrower to estimate how much house they can afford. It’s typically a first step in the homebuying process and a ballpark estimate. Mortgage lenders use prequalified offers to reach shoppers looking for a mortgage loan. By presenting relevant offers that fit their needs at the right time can provide a better experience.

Pre-approval — Pre approval requires the consumer to complete an application and supply required information to the lender. The lender will then use that information to evaluate creditworthiness of the potential borrower. The pre-approval process involves the lender checking the consumer's credit and score, but also includes reviewing bank statements, verifying employment, income , and other documents. When putting in an offer, pre-approval can be used to a borrower's advantage. It shows mortgage lenders that the consumer meets the requirements. It can also prevent fallout of pending approval.

Help your borrowers be informed homebuyers

At Equifax, we believe being informed is the first step in making a sound home buying decision. Fortunately, you can help educate potential borrowers about credit and the homebuying process using this blog post and the following resources:

Provide a better mortgage experience

To learn more about using the tri-merge report with trended data, undisclosed debt monitoring, prequalification, or other Equifax mortgage solutions, visit equifax.com/business/mortgage

[sources]

1https://www.ficoscore.com/about#:~:text=FICO%20%C2%AE%20Scores%20are%20the,lenders%20use%20FICO%20%C2%AE%20Scores.

Recommended for you