Market Pulse: Year-End Holiday Spending Trends, Economic Insights

This is a recap of the December 10 webinar, Market Pulse: Consumer Spending Trends and Expectations. We’re sharing key insights offered from Amy Crews Cutts, President and Chief Economist at AC Cutts & Associates; Nick Mangiapane, CMO of CommerseSingals, a Verisk Financial business; Jennifer Cox, Risk Solutions and Consulting Leader; and Thomas Aliff, SVP of Data and Analytics at Equifax. Looking for answers to questions submitted during this webinar? Read our blog post, Holiday 2020 Consumer Spending: Your Questions Answered.

The Recession or “She-cession” Continues

Two weeks into December, the U.S. reached 1.4 million initial unemployment claims. That number is likely to rise again in January 2021, according to Amy Crews Cutts.

The primary unemployment reason given has shifted from temporary in the early stages of the pandemic, to currently people citing their layoffs as permanent.

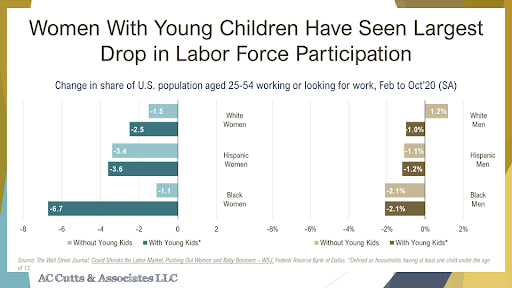

Crews Cutts notably explained that the U.S. has now lost 2% of its workforce and that some have dubbed this the “She-cession” because it has hit women --particularly those with children -- the hardest. The impacts of further job loss loom as many have used up the benefits provided earlier this year, like those provided through the CARES Act. Because of this, economists are calling for further fiscal support packages to help those still struggling and prevent an even more prolonged, deepening recession.

Bankcard and Private Label Card Origination on the Rise

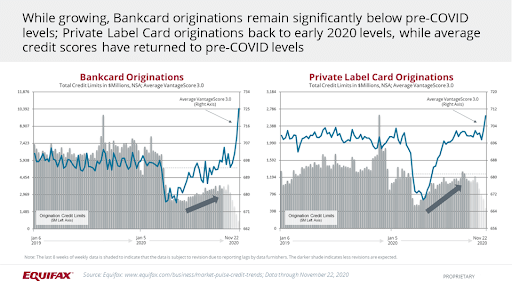

Jennifer Cox reported that bankcard and private label card origination continues to rise since June and April respectively. Private label origination numbers are back to nearly their early 2020 levels. Bankcard has seen slower growth and is still just halfway back to where it was earlier this year.

Furthermore, Cox explains that while card originations numbers are rising, credit limits for bankcard remain relatively flat and utilization overall has leveled off. This is primarily due to the influence of the 700+ VantageScore group who makes up the vast majority of cardholders. The under 700 VantageScore populations have experienced credit limit declines, which contribute to their credit utilization numbers increasing. A similar trend can be seen in private label, with some credit line reduction, which is felt primarily by those in the under 700 VantageScore group.

As Mortgage Interest Rates Decline, First Mortgages Continue to Grow

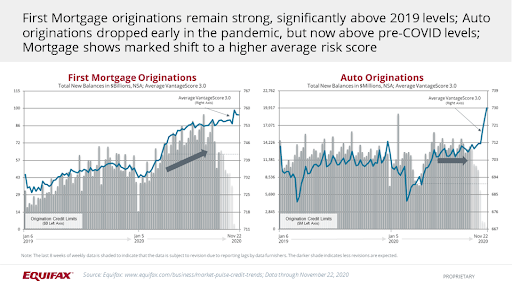

First mortgage originations driven by the low interest rates have already outperformed 2019 numbers and continue to grow. This year is projected to close at around 15% higher in originations than the last record-breaking high in 2003, according to Cox. Crews Cutts elaborated that in 2003 the record was broken for the first time when interest rates fell below 6%, as reported by Freddie Mac’s survey of mortgage rates dipping. Today’s mortgage interest rates are as low as 2.7- 2.75%. Cox, also noted that auto originations continue to be on the rise and are also above pre-pandemic levels.

Rises and Drops in Debt Levels

The booming increase in first mortgage origination has led to an increase of $240 billion since the start of March. Primarily driven by the auto industry, non-revolving debt has also grown by $70 billion since March. And while this growth is typically across most credit score bands over time, it has been mainly limited to the Prime or Near Prime tiers during the pandemic. Revolving debt has dropped $114 billion as of March, and the steep debt declines occurred over all credit score tiers. Debt level decline was most severe at the start of the pandemic when shelter-in-place and business closures drove large reductions in consumer spending. Since then debt levels have started to flatten out, according to Cox.

Rate of Delinquency Rising

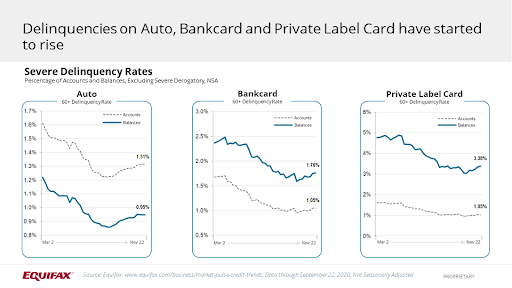

Overall, delinquencies have started to rise for auto, bankcard, and private label cards.

These increases line up with the end of government benefits and accommodations, according to Cox.

She also explained that current delinquency rates are still at significantly lower levels than at the start of the pandemic. Delinquency rates are another area to watch as the U.S. government deliberates on further fiscal relief for those impacted by the pandemic-led recession, particularly as benefits and accommodations expire.

Loans and Outstanding Balances in Accommodations

Tom Aliff cited that with 2.4% under possible accommodations compared to 1.5% on March 3, there has not been much change in loans that are in a possible accommodation status month-over-month in the last few months. First mortgages and home equity loans are currently at the top, followed by auto, credit card and consumer finance. The total outstanding balances that are in a possible accommodation status are at 6.4%. This is up from the 2.8% reported as of March 3.

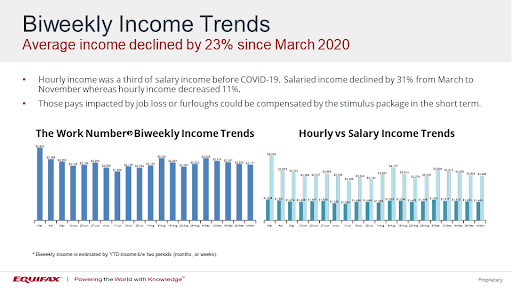

Average Income Down 23%

The total income for hourly and salaried employees has declined by 23% since March 2020, as tracked by the The Work NumberⓇ database from Equifax. This decrease doesn’t necessarily reflect the number of consumers who have lost their job, but rather shows overall pay decreases. Salaried employees’ income has declined by 31%, while hourly earnings have decreased by 11%.

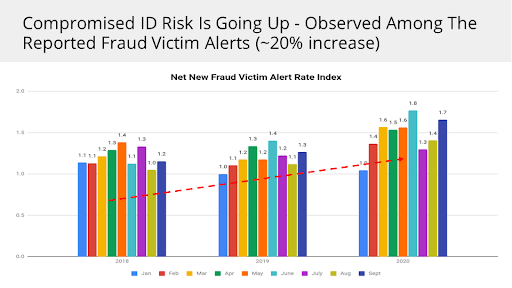

Synthetic ID Fraud is Up as Online Usage Increases

Aliff explained that insights around synthetic identity are showing a shift particularly driven by the accelerated move towards online. This shift poses a higher risk of fraud because of onlines faceless channels. In particular, authorized user abuse has increased by 25% in credit inquiries. Aliff goes on to explain that Equifax captured synthetic identity shows that typically accounts are created with a real or made-up name, social security number, date of birth -- and a postal address, phone number, and email address that the fraudster behind the identity controls.

This synthetic ID fraud is harder to identify. It's likely to increase for lenders because it often does look and feel like a real person.

Aliff explained that there is a 36% increase in authorized users whose identity information is inconsistent with the primary account user. A common credit manipulation technique is know as "piggybacking." Piggybacking uses information from legitimate credit cardholders who are in good standing without their knowledge or permission. It can then manifest into credit boosting schemes tied to credit repair and other fraud still in the grooming process. Finally, Aliff pointed to a 20% increase in consumers who have reported being a victim of fraud. This fraud was flat in 2018 before starting to grow in 2019 and is trending upwards in 2020.

*Source: Based on ID theft fraud reports to Equifax credit files

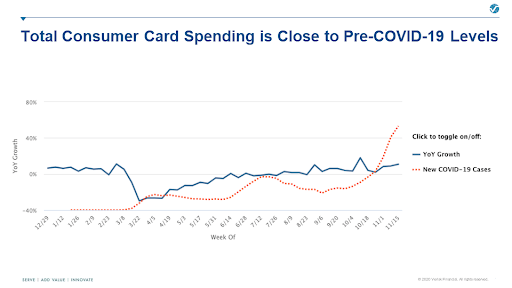

U.S. Credit and Debit Card Spending at Pre-Pandemic Levels

Nick Mangiapane reported that across the U.S., total spending levels on credit and debit cards have almost returned to pre-pandemic levels. He explained that initially, spending saw a significant drop in mid-March. This was a 30% decrease from the same week in 2019. However, since March spending has been on a slow but steady increase back up, despite peaks in covid numbers.

*Source: Data provided by Commerce Signals, a Verisk Financial business

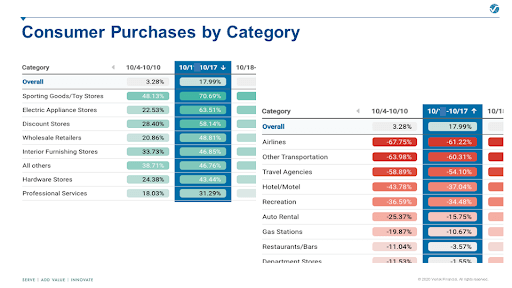

Consumer Spending is Up

In October, the week of Amazon’s Prime Day saw an overall increase of almost 18% of total consumer spending across all categories. Consumers spent the most on sporting goods/toy stores, which had a 70% increase in card spending compared to 2019. The next highest categories included electronic appliance stores and discount stores. While the lowest spending categories included airlines, other transportation and travel agencies -- not too surprising. Mangiapane noted that although airlines are still showing a spending decrease of 61%, it’s improved since March when it was down 90%.

*Source: Data provided by Commerce Signals, a Verisk Financial business

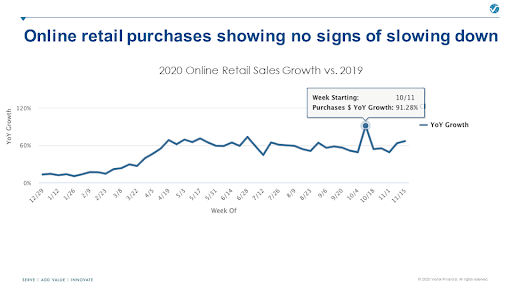

Online Spending Tripled Since March

Consumer online retail spending has continued to increase this year. It has been up 50 - 60% each week since April, with a staggering 91% jump the week of Prime Day. The week of Prime Day also showed increased spending for other big-box retailers. And unlike 2019, online spending did not see a major drop following Prime Day.

*Source: Data provided by Commerce Signals, a Verisk Financial business

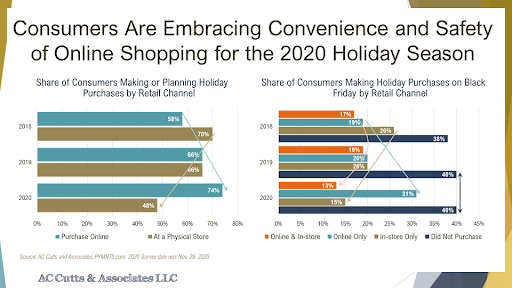

Crews Cutts also referenced spending trends from data compiled by PYMNTS.com that found in-store shopping is down 48%, while online shopping is up 74% this holiday season. During Black Friday, 15% opted to shop in-store only, while 31% shopped only online.

The full webinar recording can be accessed by visiting Market Pulse: Consumer Spending Trends and Expectations, and you can download a copy of the presentation slides here.

Are you interested in joining future Market Pulse webinars? Click here to sign up.

And, if you would like to speak to an Equifax representative about any of the data or solutions mentioned in this blog, please contact us today.

Recommended for you