Model efficiency and performance is the key

Any company that leverages credit data from multiple credit bureaus is likely familiar with this problem: how to keep up-to-date and map credit scores and attributes across multiple bureaus. Managing this huge array of data is an ongoing challenge for analysts and modelers. An innovative solution known as multi-bureau attributes can help companies overcome these struggles. We sat down with Orlin Atanassov, Senior Product Manager at Equifax, to discuss what companies need to know about multi-bureau attributes and how they can use them to improve model performance and save time on model analytics.

Let’s start with the problem. What challenges do companies face in regards to managing data from multiple credit bureaus?

Many companies rely on credit scores and attributes from all

three bureaus to fuel their models. But this can be a complicated

and tedious process. Companies need to build, validate, deploy and

maintain separate models and attributes with each bureau. Plus they

need to continuously develop and maintain in-depth CRA-specific

attribute knowledge.

At the same time, companies need to stay

up-to-date with regulatory requirements and maintain compliance for

each model integration. Relying on data and attributes from each

bureau can also present a risk to business continuity; if one bureau

has an interruption in service, then there could be significant

disruption in a client’s services and model development.

Now let’s learn about multi-bureau attributes. What exactly are they and why should companies pay attention to this capability?

With multi-bureau attributes, companies can enhance their bureau strategy and models by relying on attributes and scores leveled across all three bureaus. When we say leveled, we mean that data used for attribute calculations is mapped across all three nationwide consumer reporting agencies. We use the same attribute logic as Equifax’s best-in-class, single-bureau credit data attributes in a custom configuration for the company. There are over 2,700 multi-bureau-capable attributes, which cover the vast majority of attributes that companies use to fuel their models.

With multi-bureau attributes, companies can achieve better consistency and performance for their models. Attribute values remain consistent regardless of the underlying data source. When we analyze leveled attributes, we can see that they yield very similar model KS values across all three bureaus.

Multi-Bureau Attribute Leveling Results (KS)

Leveled attributes across the three bureaus yielded very similar model KS values

How else can clients benefit from multi-bureau attributes?

With multi-bureau attributes, companies can significantly improve their resource allocation and compliance, while supporting business continuity:

-

Only one model needs to be developed and maintained for all three bureaus

-

One seamless integration supports credit attributes across all three bureaus

-

Companies can stay compliant with a single integration regardless of whether Equifax is the primary bureau

-

Equifax services are maintained via “always-on” Google Cloud to help avoid business disruptions

What types of companies are most likely to gain model performance lift and resource efficiencies from multi-bureau attributes?

Large banks, card issuers, and telecommunication/utility companies can all benefit from multi-bureau attributes.

-

A bank or credit card issuer might explore multi-bureau attributes to simplify creation and maintenance of models that are used across the lending lifecycle including targeting, acquisition, prescreen, and account management.

-

A communications or utilities company could use a model fueled by multi-bureau attributes to help it score more applicants for its services and grow its customer base.

Multi-bureau capabilities can be a good fit for many companies, including those that have sophisticated analytical capabilities and in-depth credit bureau expertise as well as those that are looking to outsource analytics and model development.

How much improvement in model predictability could a company expect to achieve with multi-bureau attributes?

Models powered by multi-bureau attributes enable companies to ‘score more’ and ‘score better.’

‘Score more’ refers to the fact that a model powered by multi-bureau attributes will allow a company to score more applicants than if only a single bureau data is used. That’s because consumer data might not be reported to all three credit bureaus; hence, a consumer might be on one credit bureau’s credit file but not on another.

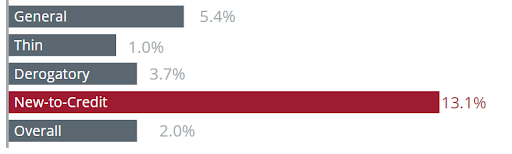

‘Score better’ refers to proven results that show that multi-bureau attributes provide lift in model performance. One company found that a point-of-application risk model fueled by multi-bureau attributes exhibited an over 13% lift in performance in its New-to-Credit segment.

Sample Company Improvement in Model Predictability (KS Lift)

Leveraging multi-bureau attributes and AI/ML enabled significant improvement in model performance

What does a company need to know about getting started with multi-bureau attributes?

Developing models fueled by multi-bureau attributes may take a bit of time, but the effort is worth it. It’s a custom solution that a company can use across business applications. It is much easier to keep models up-to-date and the performance gains can be significant.

Email riskadvisors@equifax.com to learn how multi-bureau attributes can help your team improve analytics efficiency and boost model performance. Or, check out our:

Recommended for you