The Young Affluent Can Drive Deposit Growth - If You Can Find Them!

Spoiler alert! Wealth amongst Gen Z consumers is highly concentrated. In fact, just under 30% of Gen Z households hold over 90% of Gen Z assets. So if you are targeting Gen Z, you need to make absolutely sure that you are reaching the right Gen Z consumers!

Let’s dig in and learn about Gen Z

Gen Z consumers with significant assets are a highly valuable segment for banks and credit unions to have as customers. Not only does their wealth provide the opportunity to manage attractive balances today, but also, their youth presents the opportunity to manage these assets as they grow to even higher levels over the decades to come. Simply put, these wealthy young consumers can drive KPIs today and high customer lifetime values over the duration of their relationship with you.

However, there is a significant challenge in trying to efficiently identify and target these consumers. Let’s walk through an exercise of trying to find them. We’ll use IXI asset insights, which are built on nearly $31 trillion in actual bank deposit and investment position data, to drive our analysis. We’ll start with first defining the Young Affluent segment as consisting of Gen Z households that have at least $1 million in deposits and investments.

Because the Young Affluent segment might end up being very small, let’s also define a second segment, the Young Emerging Affluent. These Young Emerging Affluent Gen Zers have at least $100,000 in assets (and includes the Young Affluent as a subset). So while many of the Young Emerging Affluent might not reach the $1 million mark today, they still have an attractive financial base to fuel growth through their expected next 30+ years of earning income.

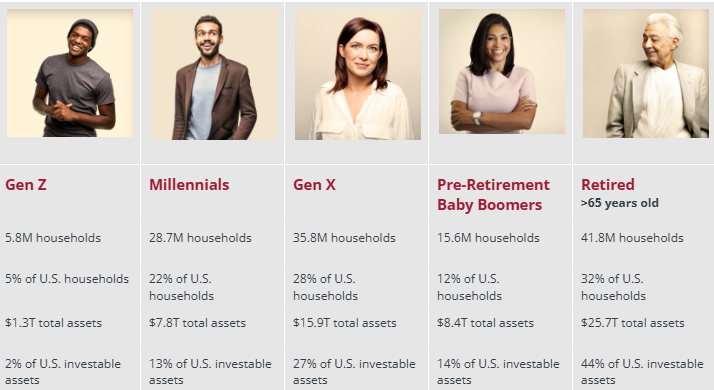

With our definitions in place, let’s now look at the Gen Z segment as a whole. As per the chart below, there are approximately 5.8 million Gen Z households in the U.S.

As a cohort, Gen Z holds $1.3 trillion in deposits and investments. This is a small market size compared to other life stages, but it is still an attractive amount. For instance, it’s more money than is held by consumers in 4 states.

Honing in on the young affluent

Next, let’s see how that $1.3 trillion is distributed across Gen Z households. How many Gen Zers meet our goals of having at least $100,000 (the Young Emerging Affluent) or $1 million (the Young Affluent) in assets?

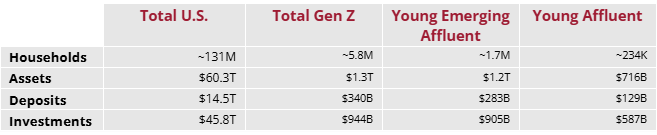

As you might guess, only a portion of Young Emerging Affluent Gen Z households have the $100,000 minimum asset level to be included in our exercise. According to IXI estimates, just under 30% of Gen Z households have at least $100,000 in assets. That’s approximately 1.7 million households for you - and your competitors - to find.

It’s even harder to find Young Affluent Gen Z consumers, those that have at least $1 million in assets. In fact, across the U.S. there are only 234,000 households that meet this criteria. That’s less than 4% of Gen Z households and only 0.2% of all U.S. households! These consumers are the golden needles in the haystack - they are really hard to find because there just aren’t a lot of them. And this is true not only for you but also for your competitors. Finding these wealthy young households is tricky - it requires deep insights on consumer wealth and where these consumers live.

Just 30% of Gen Z households hold over 90% of Gen Z assets!

Circling back to our spoiler alert… yes, you read that

headline correctly. Just under 30% of Gen Z households hold almost

all of Gen Z assets. Specifically, those 1.7 million Young Emerging

Affluent Gen Zers account for over 90% of this generation’s assets.

Meanwhile, the 234,000 Young Affluent Gen Zers hold over 55% of all

Gen Z assets. As you can see, wealth is extremely concentrated in

this segment. So if you are targeting Gen Z, it’s critical to know

exactly which Gen Z households to go after.

Once you’ve identified who falls into the Young Emerging Affluent and Young Affluent Gen Z segments, there’s a lot of challenging work that has to be done to secure them as long-term customers. For instance, you have to engage them with attractive offers and compelling advertising content. Plus you need to understand their financial behaviors and preferences so you can reach them with messages that will catch their attention.

But all of your work and investment in targeting these consumers will be wasted if you first don’t accurately identify who they are, especially because they are such a concentrated market segment. Also, don’t miss out on your existing customers and members that currently fall into these segments. These are your easily accessible customers that you can market and cross-sell to in order to capture more of their deposits and investments.

So do the hard work upfront! Be smart and use the most accurate insights you can to find these wealthy young consumers. Then, once you’ve created well-formed audiences, intelligently engage them to meet your deposit growth goals today and for the future.

Discover tips to identify and market to the young affluent, learn more about the IXI Network, and explore additional Wealth Trends. Get even more in-depth insights around growing deposits in our eBook.

(c) Equifax Inc. 2024. All Rights Reserved. The statistics provided herein are provided for information and illustrative purposes only.

Recommended for you