The Student Loan Debt’s Impact on the U.S. Economy

During our July 2022 Market Pulse webinar, presenter Robert Wescott, Founder of Keybridge went over the recent economic trends currently happening with a macro-economic update and how student loan debt is impacting these trends. Below is a recap highlighting the key economic updates Wescott presented. For more, watch our full webinar recording here.

Recession Risks

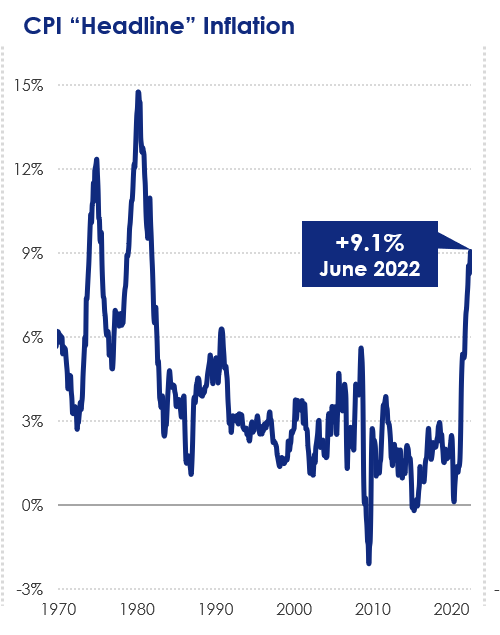

To start off our Market Pulse webinar on July 28, Robert Wescott began by reviewing the recent U.S. economic update. Starting on a positive note, Americans are returning to offices, restaurants, and travel. COVID may not be finished, but the majority of Americans are finished with it and the precautions that have come with it. People are starting to return to normal activities pre-COVID. However, even with a 3.6% unemployment rate which shows economic strength, persistent inflation is substantially hampering the economy’s growth, which is shown in Figure 1 below. With these tight labor conditions, wages have risen leading to higher inflation.

Figure 1

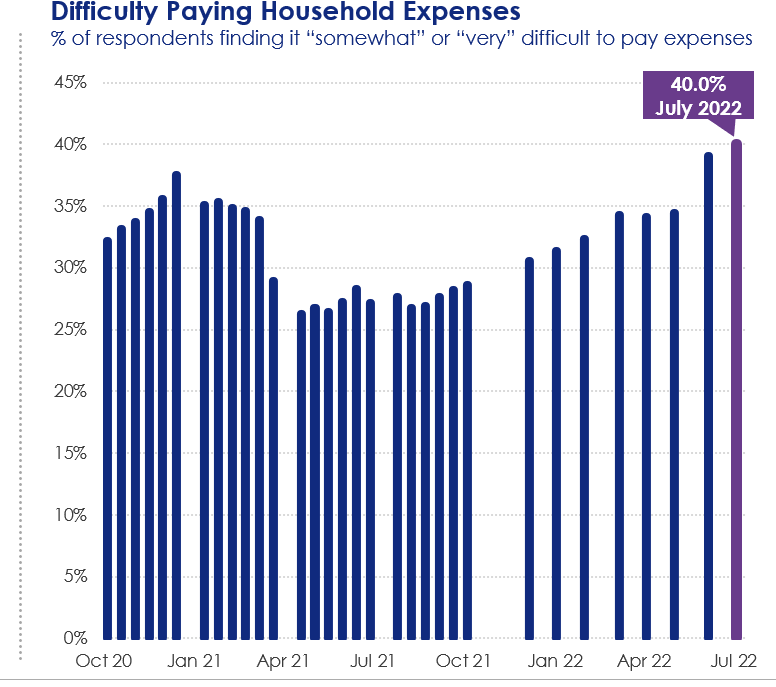

That being said, the Federal Reserve is now raising interest rates to try to combat inflation. However, after the -0.9% Q2 GDP report, market expectations for the end of year rate dropped by 25 bp. Inflation and rising interest rates are making consumers budget conscious. Consumers are becoming more financially stressed as well. 40% of households now report it is “difficult” to pay expenses, which is shown below in Figure 2.

Figure 2

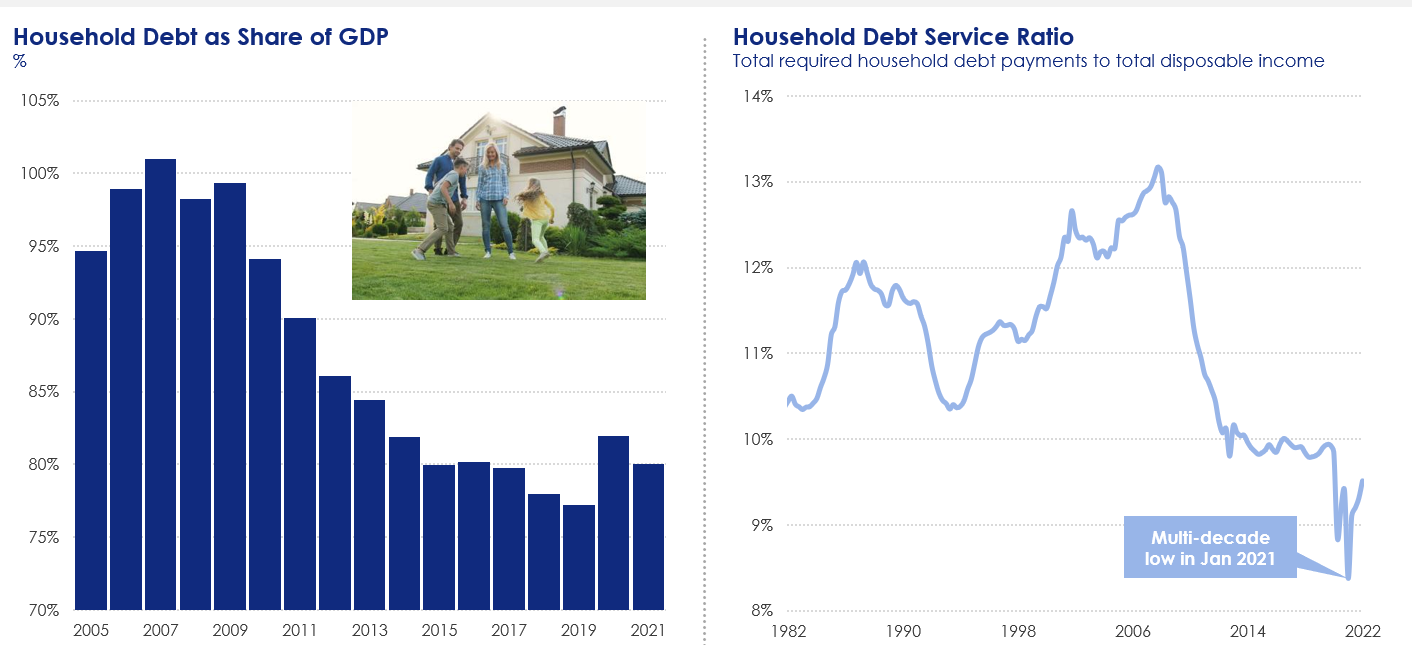

When it comes to households, if there were a recession, they would be in relatively good shape, with substantially lower debt than in the past two decades. According to Wescott, this should help protect households in a downturn.

Figure 3

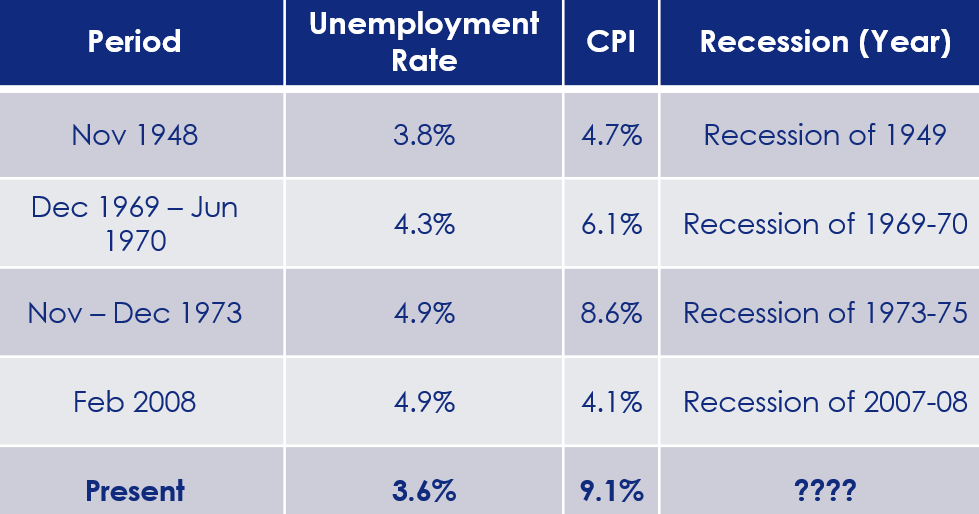

All that being said, are we really in a recession? That can be left up to each individual to decide. However, in Figure 4 below, we show the following chart with columns including past recession periods and where the unemployment rate and CPI were at during that time.

Figure 4

Effects of Student Loan Debt

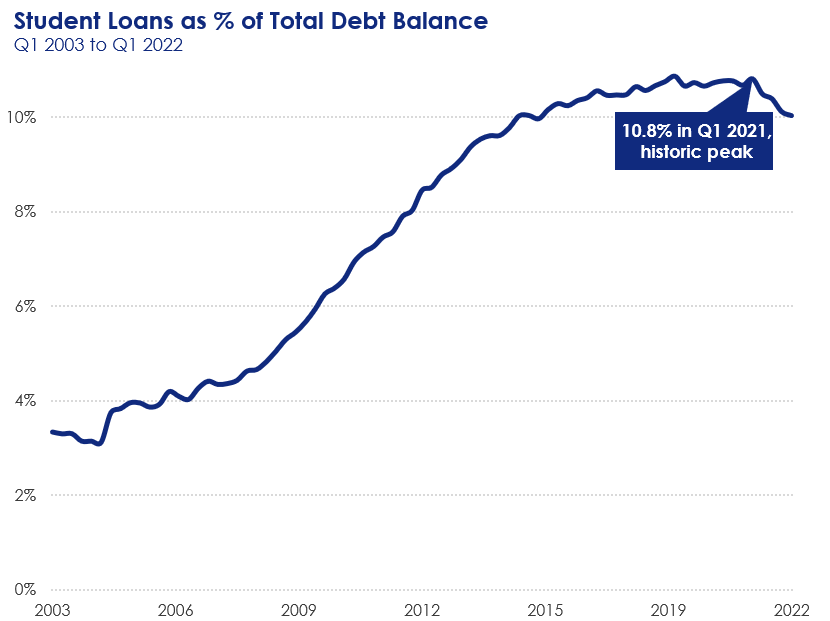

Student loans comprise the second largest debt category after mortgage and before auto loans. After rising over the last two decades, this debt now accounts for more than 1/10th of total household debt, according to Wescott. In Figure 5, you can see the student loan as a percent of the total debt balance and how in Q1 in 2021 there was a historic peak. When COVID-19 hit the department of education and stated that former students can stop paying back their student loans - repayments went up zero and forbearance was up sharply. Consumer spending in 2021 was boosted by 3.6% apparently due to people receiving student debt forbearance that they did not have to pay to student loan creditors.

Figure 5

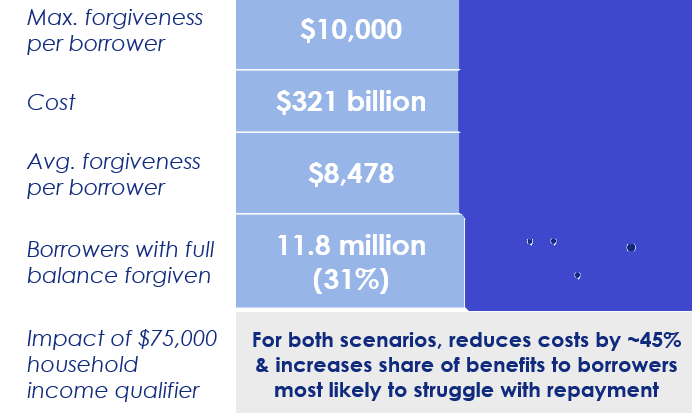

Recently, President Biden started considering an executive order to do loan forgiveness of student debt under 10,000 dollars. Examining Figure 6, we can see how this will affect our current economy. Overall, it will cost the government $321 billion dollars. If we were to have a 10,000 debt forgiveness of student debt, it would mean more spending for consumers, and there would be a boost of entrepreneurship. Also, more people would be likely to get married or have children. GDP would most likely be boosted to $17 - 21 billion dollars, as well as boost jobs and the unemployment rate. However, this will make the inflation rate a little more of a challenge.

Figure 6

For more information and insights on the U.S. economy and the latest consumer credit trends, download our presentation deck or watch our July webinar recording.

* The opinions, estimates and forecasts presented herein are

for general information use only. This material is based upon

information that we consider to be reliable, but we do not represent

that it is accurate or complete. No person should consider

distribution of this material as making any representation or

warranty with respect to such material and should not rely upon it

as such. Equifax does not assume any liability for any loss that may

result from the reliance by any person upon any such information or

opinions. Such information and opinions are subject to change

without notice. The opinions, estimates, forecasts, and other views

published herein represent the views of the presenters as of the

date indicated and do not necessarily represent the views of Equifax

or its management.