The Mass Affluent: You Can Bank on One Thing — They're Not All Alike

Today's mass affluent population is as diverse as the banks that serve it, representing a broad spectrum of individuals with varying financial needs, biases and preferences. How you approach them, and the financial products you offer them, will be as different as night and day. In the second and final part of this series, we explore the diverse demographics that make up mass affluents and their wealth, banking behaviors and preferred delivery channels. Currently, the mass affluent can be divided into four basic submarkets:

1. Young professionals: self-directed and tech savvy

Young mass affluents are tech savvy and need to be courted through online and mobile media. They're used to taking charge of their own finances and investments and consider banks to be vehicles that house their savings, track their checking accounts and offer credit and debit card services. They're eager to simplify their lives and must be sold on more venturesome financial products and strategies. These millennial prospects must be shown the value of planning for upcoming purchases as well as the value of aggressive retirement strategies. Many believe that Social Security benefits will be severely curtailed by the time they reach retirement.

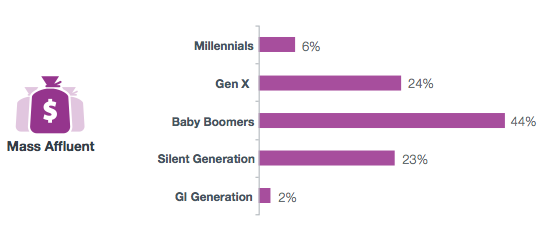

Estimated percentage of mass affluent assets held by each US generation (Source: WealthComplete and Income360)

2. Established professionals: big spending ahead

These mass affluents of the generation X population are taking on increased financial responsibilities by buying homes, purchasing or leasing high-end cars, going on vacations, raising families and saving for their children's college. They need to be cross-sold from basic banking services to products that may require professional financial planning such as sophisticated investments and mortgages. It can also be helpful to sell them on financial planning strategies that single out debt reduction and aggressive retirement vehicles. Like millennials, this cohort has some serious reservations about the value of Social Security when they retire.

3. Early or soon-to-retire: adding wealth with minimal risk

Mass affluents in their late 50s and early 60s are planning for retirement and have already established a substantial nest egg. They are receptive to financial planning advice from institutions they have grown to trust over the years, which provides banks with a good opening to promote financial opportunities that add wealth without too much risk. It may be beneficial to court them on the value of paying off debt and on a mixed portfolio of financial products that protect what they have with the added potential for growth. This generation understands the three-legged approach to retirement planning: Social Security, an employer's retirement plan, and personal savings — the last leg being where they may need guidance. Those in their 50s will have some concerns about Social Security, but this is less so for those in their 60s.

4. Retirees: protecting nest eggs

More so than early retirees, these mass affluents have amassed a considerable nest egg and seek to protect it from inflation and the poor returns offered by standard savings vehicles. These late baby boomers will value personal guidance from a single reliable financial adviser at a trusted financial institution who can protect their nest egg and provide asset allocation strategies that guard against market and governmental uncertainty. It is obvious that the mass affluent are a diverse body of individuals whose banking needs and preferences vary widely. Opportunities exist in every cohort and can be taken on through the use of customer insight tools like those offered by Equifax.

Recommended for you