Market Conditions Ripe for More Consumer Lending

An improving economy means more people feel confident in their ability to pay back a personal loan. From debt consolidation to major purchases, consumers are increasingly choosing more flexible, easy-access loans over credit cards. As a result, everyone wants a piece of the action -- and that includes loans originated by alternative lenders.

Alternative lenders have entered the scene disrupting norms by targeting demographics previously ignored by traditional lenders and relying on high-tech solutions for customer acquisition and servicing. This expands the pool of potential applicants and provides quick and easy access to capital. However, alternative lenders still face many challenges as they seek to qualify more applicants and create lasting relationships with new customers.

In this blog, we will explore those challenges more deeply and propose technology and data solutions to help alternative lenders succeed in this market.

Growth in Lending at All-Time High

Americans are borrowing more and doing so with varied loan products such as mortgages, auto loans, credit cards, personal loans, etc. “Total household debt increased by $82 billion (0.6%) to $13.29 trillion in the second quarter of 2018. It was the 16th consecutive quarter with an increase, and the total is now $618 billion higher than the previous peak of $12.68 trillion, from the third quarter of 2008. Further, overall household debt is now 19.2% above the post-financial-crisis trough reached during the second quarter of 2013,”according to the Quarterly Report on Household Debt and Credit Q2 2018, Federal Reserve Bank of NY

Personal Loan Markets Follow Suit

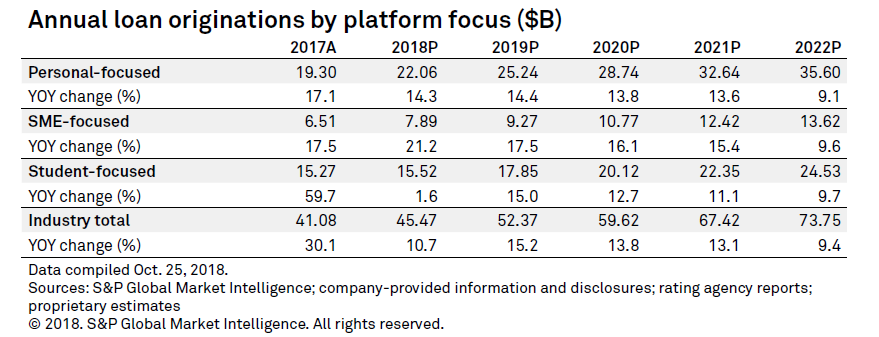

Personal loan balances are at around $120 billion, according to Forbes. In the matrix above, it is worth noting that it is estimated that the personal loan market will exceed $35B in 2022, reflecting an almost 40% increase from 2018. Several factors are influencing the growth in popularity, including:

- An improving economy

- Lower interest rates offer alternative to high-interest credit cards

- The rise of Fintech and other alternative lenders

- Debt consolidation

- Desire to pay off a loan in a fixed period

- Ability to borrow more than on a credit card

- Ease of application process and speed of decisions offered by Fintech providers

- Rise in number of data aggregators and lead generation providers that give consumers ample choices to comparison shop

FinTech Leads the Way

A Fintech lender is an online lender that bases its underwriting, risk assessment, funding and marketing on financial technology. Most lenders, including traditional banks and credit unions, now fit this description. But the term is generally used for startups and relatively new firms that operate exclusively online and use alternative data sources and new credit models.

Technology has played a key role in the accelerated growth of unsecured personal loans. Lenders now have access to vast amounts of financial data and credit scoring tools to help them make better lending decisions. They are increasingly making decisions on applied statistics instead of relying entirely on human judgment. This makes underwriting unsecured personal loans faster, cheaper and financially viable.

However Tech Savvy, Lenders Still Struggle with Servicing Customers

FinTech lenders have low conversion rates due to stiff competition, which coupled with smaller size loans means customer acquisition costs are generally very high. To succeed, FinTech lenders will need deeper segmentation of applicant population. To achieve this, they need a full-spectrum score that includes thin-file, no-file combined with general prime and near-prime consumers enabling them to say “yes” to more customers.

Challenges Growing a Personal Loans Portfolio

- Cost of Acquisition and Retention:

Various factors drive up the cost of acquiring

customers.

- More investment in technology and analytics to refine underwriting precision

- In some instances, per customer account profitability is difficult since repeat business tends to go down once the customers have availed credit, develop a credit history and become eligible for loans from conventional lenders at lower rates

- Competition keeps conversion rates low. This is a highly competitive market with lenders playing an interest rate game to win customers.

- Data Validation - Traditionally banks could review the savings account/credit bureau records. But to score the underbanked with more confidence, alternate data is essential.

- Credit Valuation – Most FinTech organizations rely on innovative technology solutions to facilitate the application and servicing process. However, they are still bound by more traditional banking norms when it comes to credit scoring and loan processing.

- Cost to Brand Reputation: Targeting thin-file or previously unscorable customers means rejection rates are high. This results in negative customer feedback which can impact a positive brand perception with their core customers.

Measuring Consumer Behavior with Advanced Modeling

Machine Learning

While modelers have traditionally used logistic regression to calculate credit scores, we are now applying advanced analytics. Technology and new data science such as explainable AI, offer a vast new realm of data, behaviors and financial stats that can be factored into a new borrower's risk analysis. The Equifax proprietary NeuroDecision® Technology (NDT) is the first machine learning credit scoring system reviewed by regulators and credit scoring experts. In the past, the fundamental challenge in using neural networks has been the ability to explain the basis for an outcome, which is a regulatory requirement. Through NDT, these models yield increased performance and are explainable.

Trended Data

Traditional credit scoring results in a snapshot of one’s credit profile at a given point in time. However, trending and analyzing data over a period of time reveals patterns that can predict a consumer’s future behavior, providing a new dimension of insight into the consumer’s financial profile. The predictive nature of trended data helps strengthen analytics and model development, so lenders may refine business strategies to more profitably grow their portfolio and better assess risk.

Score More Personal Loan Applicants with Alternative Data

In addition to advanced modeling techniques, lenders are making more offers to more qualified applicants. Consequently, they're turning to alternative data sources to augment their risk scoring. Alternative data solutions reveal how people pay their everyday bills— like utilities, pay TV and cell phones. Since the vast majority of U.S. consumers have these basic services, the data coverage is comprehensive. It's highly predictive of future account performance within the utility, pay TV and communications industry.

However, many options in the marketplace today present issues like:

- More swap out opportunities than swap in

- Requiring financial account credentials, which can cause friction during the application process

Saying ‘Yes’ To More -- with Confidence

Introducing Insight Score for Personal Loans (ISPL), an innovative FCRA risk score optimized for unsecured personal loans. ISPL combines Equifax unique data assets and technology, such as communications, pay TV and utility payment history, trended data and NeuroDecision ® Technology (NDT). It enables lenders to more confidently approve a broad spectrum of consumers for personal loans. With ISPL, no consumer-contributed data is required.

To learn more, visit the Insight Score for Personal Loans webpage.

Recommended for you