With 2022 almost in the books, the US economy is still experiencing pandemic whiplash and general economic uncertainty. We’ve been challenged by the sharpest increase in the Federal Funds Rate in U.S. history in order to combat 40-year high inflation. This means higher interest rates on revolving debt for consumers that carry a balance and in the acquisition costs of Auto and Mortgage loans for consumers. Not to mention the challenges facing the United States given global economic stress, as well as supply chain, and manufacturing disruptions...the list goes on.

So what now? How can you focus on forward and be ready to adapt to dynamic realities in our economy despite a potential recession on the horizon? First, remember that recessions, while painful, are a normal occurrence in business. Take a moment to digest the economic and consumer credit trends presented in our December Market Pulse webinar so you are well-prepared to take advantage of opportunities for smart growth through data, insights, and analytics.

Looking back over the year

Robert Wescott, President of Keybridge LLC and former special Assistant to the President for Economic Policy at the National Economic Council, opened the webinar with a self-assessment: how did his firm’s 2022 predictions shake out? What did Keybridge get right? And where did unprecedented disruptions cause forecasts to fall short?

- Rob predicted in December 2021 that the U.S. economy will grow about 4% with consumers leading the way. In actuality, the US economy grew 2% in 2022, with the shortfall caused by Russia’s invasion of Ukraine. Consumers did lead the way.

- Rob predicted in December 2021 that CPI will be at least 6.5% in 2022 and inflation will not be transitory. In actuality, CPI sat at 7.7% year-on-year in October, and it, indeed, has not been transitory.

- Rob predicted in December 2021 that the Federal Funds Rate of 0% in Dec. 2021 was far too low and would increase sharply in 2022. In reality, we experienced the sharpest increase in Federal Funds Rate in U.S. history – up 4.5% in 2022.

- Rob predicted in December 2021 that China’s economy would slow sharply in 2022 due to a housing slowdown. In reality, Chinese growth was pulled down by a 40% decline in the housing sector.

Wescott observed the biggest economic disruption in 2022 was Russia’s invasion of Ukraine in February. This event drove up global energy prices and slowed world economic growth.

Bringing his assessment to where we are today, Wescott shared that three pillars have sustained the U.S. economy throughout 2022: the resilient labor market, consistent consumer spending, and domestic manufacturing. However, these three pillars are starting to show signs of softening. The labor market continues to add jobs, but the pace of job growth has slowed. The number of job postings on Indeed has declined as 2022 has progressed. Consumer spending has been resilient this year, but financial strains are growing. The saving rate is at a 17-year low and credit card debt is jumping as households attempt to maintain spending. The manufacturing sector is also showing signs of slowing. After signaling an expansion for 29 consecutive months, the manufacturing PMI recently dropped below the 50 breakpoint.

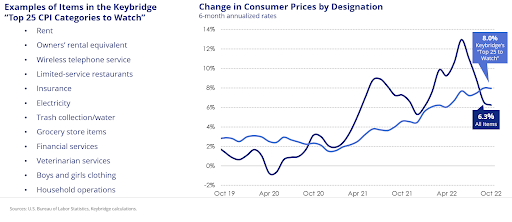

Keybridge’s “Top 25 CPI Categories to Watch” suggests that headline inflation has probably peaked. But underlying inflation remains a challenge, even if energy, food, and car prices soften, shown in Figure 1.

Figure 1

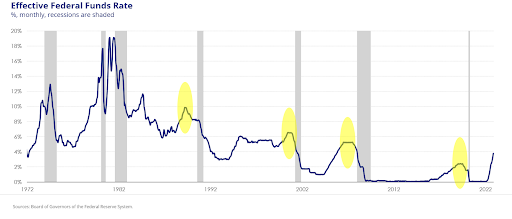

After the Federal Reserve raised rates by 75 basis points again last month, Chair Powell has signaled that the pace of hikes may soon slow. Markets expect rates to hit 5.0% by March.

Wescott went on to observe that key economic factors to watch in 2023 include: the Fed’s battle against inflation, the spreading global economic slowdown, rising consumer financial stress, and recession risks. The Fed’s interest rate increases are starting to show some effects on the U.S. economy.

Housing in particular is showing signs of slowing. He mentioned that construction employment trends are something to watch. He also noted that it’s worth remembering: during the past 4 recessions, the Fed has started to cut rates before recessions actually started. The Fed could raise rates in the first half of 2023, but cut later in 2023, shown in Figure 2.

Figure 2

Concerning the global economy, China’s “Zero-COVID” policy and recent protests against it are bringing more uncertainty to the global economy. Furthermore, high energy prices are slowing economic activity in Europe. And China’s slowdown is hurting manufacturing in Asia. PMIs around the world are signaling a slowdown in manufacturing.

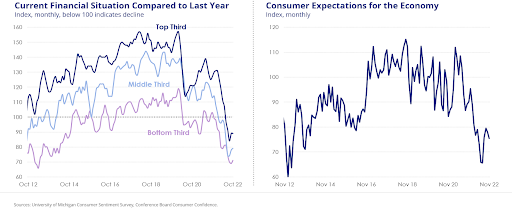

In the US, evidence of financial stress is spreading among U.S. households, including for middle and even some higher-income households, shown in Figure 3.

Figure 3

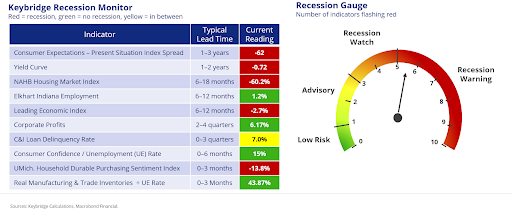

Looking to the future, the Keybridge Recession Monitor is now red for indicators with the longest lead time before a recession starts. Labor market components are still green, shown in Figure 4.

Figure 4

Wescott reminded us that recessions typically last about 11 months and bring about a 2% drop in GDP. Housing and autos typically decline the most. If a U.S. recession were to occur, construction, durable goods, metals, and heavy machinery are generally more sensitive to an economic downturn than services and non-durable goods. Meanwhile many services, such as educational and healthcare services, electricity, and wireless cell service, are viewed as necessities and tend to fare well in recessions. Food also holds up well.

Wescott concluded with general optimism. Even if the U.S. suffered a recession in 2023, there are reasons for optimism for 2024, as long as central banks don’t overdo it with rate increases and a global slowdown is not too deep.

- The U.S. is competitive with relatively cheap, domestically produced energy

- Manufacturing could shift to the U.S. from Europe, especially for energy-intensive activities

- U.S. policies are heavily favoring domestic manufacturing of semiconductors, EVs, batteries, and green energy

And the following ten U.S. business sections, shown in Figure 5, have potential for fast growth over the next 5 years.

Figure 5

Small and medium-sized businesses are also likely to do well after an economic slowdown.

Consumer credit trends and insights

Dave Sojka, Equifax Risk Advisor, shared U.S. August 2022 YTD credit trends and insights. He began with mortgage originations which have come off the YTD boom in 2021 and have fallen below 2019 levels. Auto YTD originations continue, and subprime share has dropped from 2018-2020 levels. Bankcard limit originations continue to grow YOY. Subprime share has decreased since its high in 2021, and the number of new cards originated August YTD is above all prior year levels. Private Label limit originations are below 2021. The subprime share continues to drop, and the number of new cards originated is also below 2021.

Unsecured Personal Loan originations balances are at all-time high levels. Subprime share has been relatively flat since 2018, and the number of new loans originated is also a new high. Home Equity revolving limit and unit originations continue to be higher than they have been since 2011. Mortgage Debt at $12T. Non-Mortgage Debt has been keeping pace with an increasing trend aligned to pre-recession. Revolving Debt in October 2022 is seasonally above 2019 levels. Non-Revolving Debt is also continuing to rise. Utilization has continued to increase for Bankcard, Private Label Card and Home Equity Lines. Credit Limits have decreased for Card products but continue to rise for Home Equity.

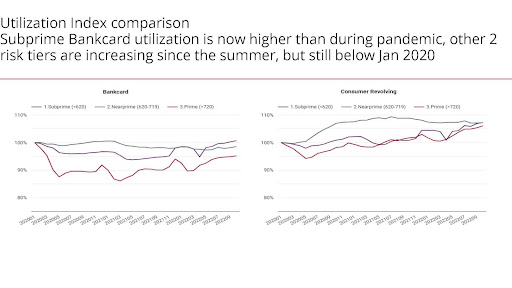

Sharing a Utilization Index comparison, Sojka said that Subprime Bankcard utilization is now higher than during the pandemic. Near Prime and Prime risk tiers are increasing since the summer, but they are still below Jan 2020, shown in Figure 6.

Figure 6

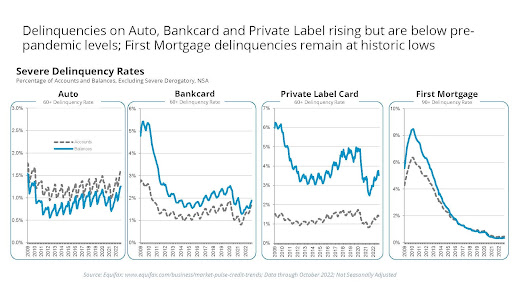

Wrapping up consumer credit trends, Sojka shared delinquencies on Auto, Bankcard and Private Label rising but are below pre-pandemic levels. First Mortgage delinquencies remain at historic lows, shown in Figure 7.

Figure 7

For the complete experience, download the webinar deck and watch our full recording here.

And to learn how to navigate this market and stay resilient right alongside your customers despite global and domestic pressures, check out these recommendations.

* The opinions, estimates and forecasts presented herein are

for general information use only. This material is based upon

information that we consider to be reliable, but we do not represent

that it is accurate or complete. No person should consider

distribution of this material as making any representation or

warranty with respect to such material and should not rely upon it

as such. Equifax does not assume any liability for any loss that may

result from the reliance by any person upon any such information or

opinions. Such information and opinions are subject to change

without notice. The opinions, estimates, forecasts, and other views

published herein represent the views of the presenters as of the

date indicated and do not necessarily represent the views of Equifax

or its management.

Recommended for you