Latest Key Consumer Credit Insights

In the August 2024 Market Pulse Webinar, we discussed current data points around fintech and alternative data to ensure you're well positioned to focus on forward and build resilience for your organization - even during uncertain times.

Equifax Risk Advisor, David Sojka, deciphered current consumer credit trends and insights as we head into the end of 2024. While this overview is meant to be a snapshot of the larger discussion, you can receive full access to the standard charts and graphs by reaching out to the Equifax Risk Advisory team: RiskAdvisors@Equifax.com.

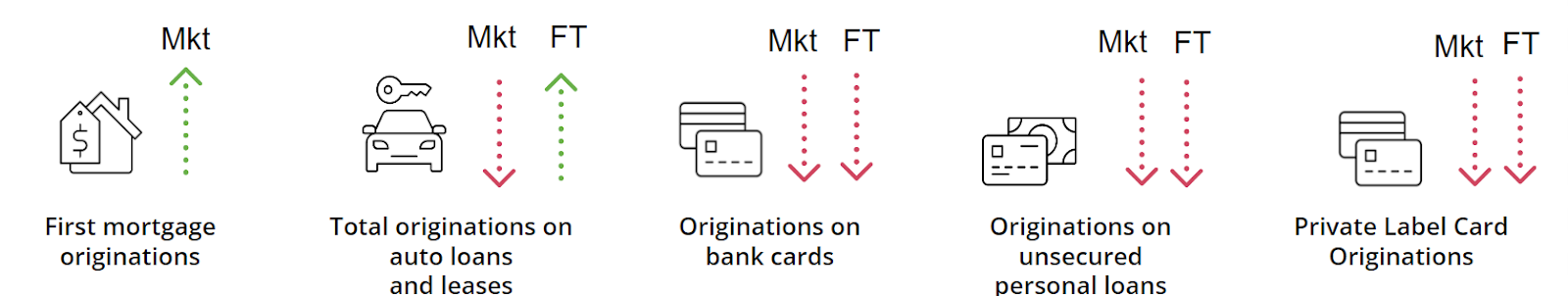

Originations

Out of five products, we compared the results between the market and fintech¹:

-

Mortgage

-

Auto

-

Bankcard

-

Personal loan

-

Private label card

We found that, as of April 2024, consumer originations have slowed across bankcards, personal loans, and private label cards:

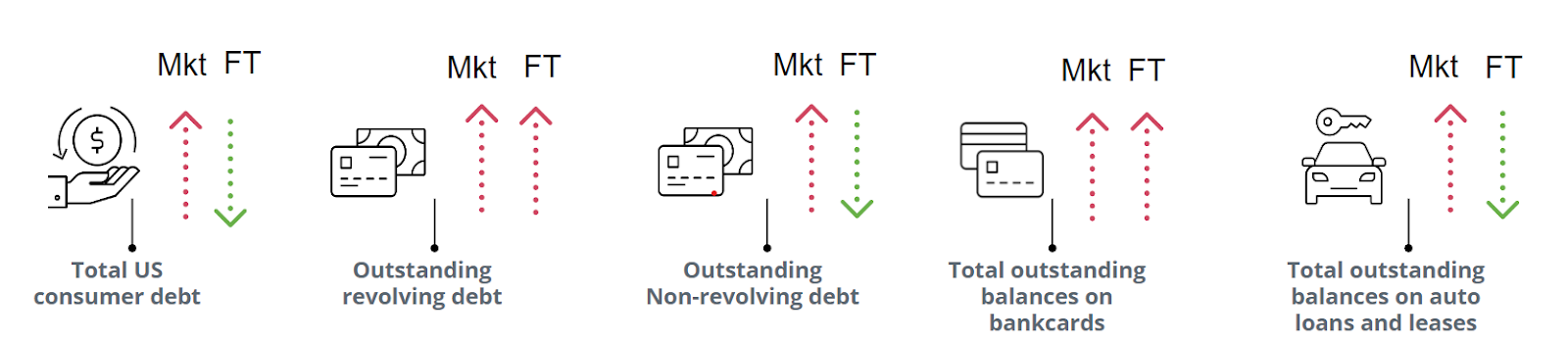

Debt

As of June 2024, year-over-year consumer debt outstanding has increased for all categories in the overall market, but decreased with fintech lenders for total consumer debt, non-revolving debt and auto debt²:

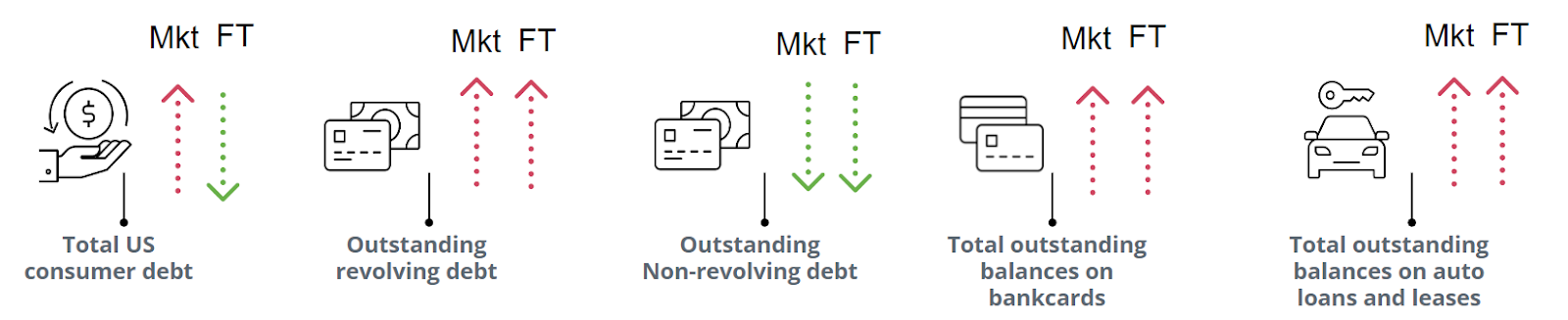

Month-over-month data,

however, shows fintech consumer debt and non-revolving debt

improving. The non-revolving debt was the only improvement for the

overall market:

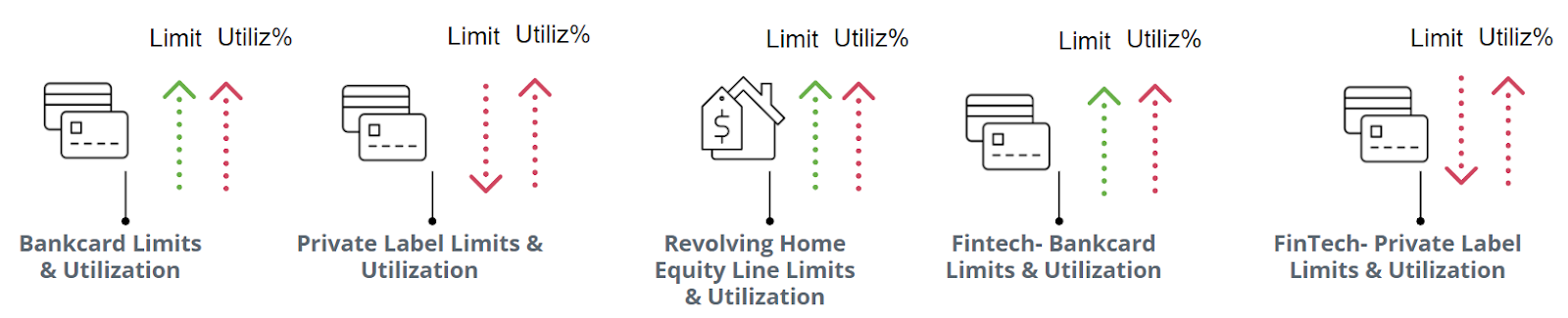

Utilization

June utilization increased across all products, and credit limits have risen for the bankcard as well as for home equity²:

Delinquencies

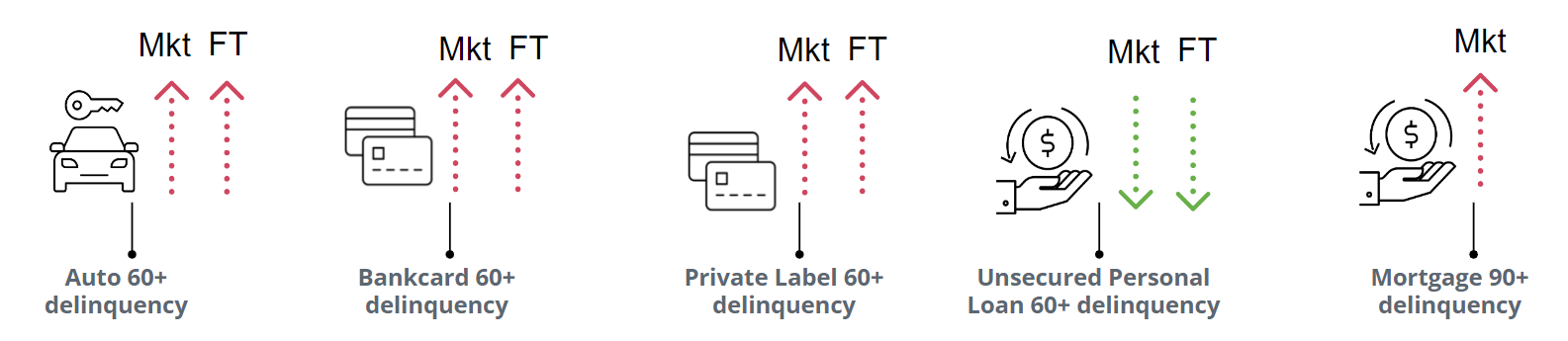

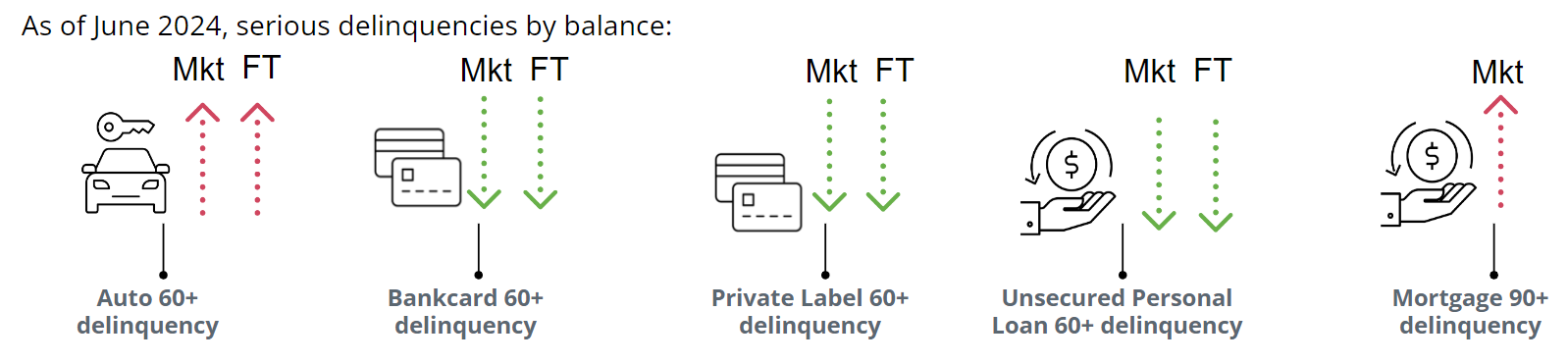

June delinquencies on all of the products shown below increased year over year except for personal loan, which improved²:

June delinquencies on all of the

products shown below decreased month over month except for auto and mortgage:

Vintages

Over the last several months, we have been telling the story that the 2022 and 2020 vintages are worse than earlier vintages, and that is likely caused by loosening credit standards coming out of the pandemic as well as some school loan inflation.³

So, rate cuts are coming.⁴ Inflation is lessening, and consumers are still shopping based on the recent retail sales announcement. We would offer cautious optimism about the U.S. consumer and consumer finance as a whole.

Stay up-to-date

Read an overview of the full August 2024 Market Pulse webinar.

You can find our monthly Small Business Insights, National Consumer Credit Trends reports, the Market Pulse podcast, and more at our Market Pulse hub.

Finally, connect with us on YouTube and LinkedIn for even more content to help you focus on forward.

Sources:

-

Equifax National Consumer Credit Trends Originations Report - published August 2024 - originations through April 2024

-

Equifax US National Consumer Credit Trends Portfolio Report - Published August 2024 - Data as of June 2024

-

Equifax Credit Trends; Data through June 2024; Not Seasonally Adjusted

-

Equifax August 2024 Market Pulse webinar, David Sojka

(c) Equifax Inc. 2024. The statistics provided in this blog are for informational and illustrative purposes only and are not intended to be used for any other purpose.

*The opinions, estimates, and forecasts presented herein are for general information use only. This material is based upon information that we consider to be reliable, but we do not represent that it is accurate or complete. No person should consider distribution of this material as making any representation or warranty with respect to such material and should not rely upon it as such. Equifax does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice. The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

Recommended for you