The Impact of Synthetic Identity Fraud... By the Numbers

What is synthetic identity fraud?

Synthetic identity fraud occurs when fraudsters create new, fictitious identities by using different components of real identities – such as a name from one person, an address from another place, or the Social Security number (SSN) of a minor or deceased individual. Fraudsters attempt to gain credit with the fictitious identity in order to monetize it, use it for short-term gain and then abandon the identity.

This fictitious identity leaves the lender out of pocket to collect funds and, because there isn’t a victim, our customers have a difficult time classifying the loss. What's even more troubling is synthetic ID fraud is still on the rise.

The Effect on Various Industries

A recent Aite Survey estimates synthetic identity fraud as a $700 million problem in 2016 and is expected to grow 17% a year1. One of the reasons is that synthetic identities may be introduced in to the credit system and nurtured over long periods of time. When a financial institution brings on a new customer that looks like a good customer, they may face losses later on that they write off as bad debt, rather than as fraud.

During the US Government Accountability Office (GAO) 2017 Synthetic Identity Fraud Forum2, one panelist described a bust-out scheme in 2013 that involved a syndicate of 19 perpetrators managing 7,000 identities and more than 25,000 credit cards with losses that exceeded $200 million.

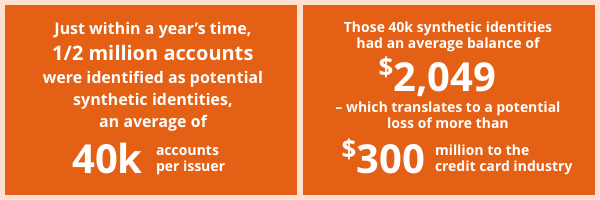

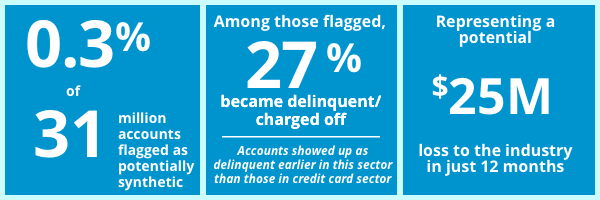

An Equifax study3 of its top credit card issuers showed that just within a year’s time, 1/2 million accounts were identified as potential synthetic identities – an average of 40,000 accounts per issuer. And those 40,000 synthetic identities had an average balance of $2,049 – representing a potential $300 million loss to the credit card industry. A similar Equifax study4 was applied to telecommunications and utilities providers, and 0.3% accounts were flagged as potentially synthetic. Among those flagged, 27% became delinquent. With an average charge-off of $886 per account, this represents a potential $25 million loss to the industry in just 12 months.

How Equifax Can Help

FraudIQ® Synthetic ID Alerts are based on patent-pending algorithms that analyze attributes, such as authorized user velocity and identity discrepancies, to help determine if the identity presented is potentially synthetic.

When you submit a batch file or real-time inquiry and suspicious information is found, the synthetic ID alert will be returned, providing you with the information your business needs to assess in order to detect this type of fraud. Successfully protecting your business against fraud requires a multi-layered approach.

FraudIQ Synthetic ID Alerts are part of an integrated suite of identity verification, authentication and fraud detection solutions that leverage Equifax’s proprietary and differentiated data. This data helps you assess modeling behavior, rather than just data checking – which can provide a better output for prevention.

1 Aite Group Study, October 2017

2 GAO “Highlights of a Forum: Combating Synthetic Identity Fraud,” July 2017

3 Equifax Data Analysis, June 2016 – June 2017 4 Equifax Data Analysis, May 2016 – April 2017

Recommended for you