How will D.C. Power Shift Impact Economic and Regulatory Change?

In this recap of the January 14 webinar, Market Pulse: DC Power Shift, What's Next?, we share key insights from Amy Crews Cutts, President and Chief Economist at AC Cutts & Associates; Stephanie Gunselman, Senior Policy Counsel at Equifax; Jennifer Cox, Risk Solutions and Consulting Leader at Equifax; and Thomas Aliff, SVP of Data and Analytics at Equifax.

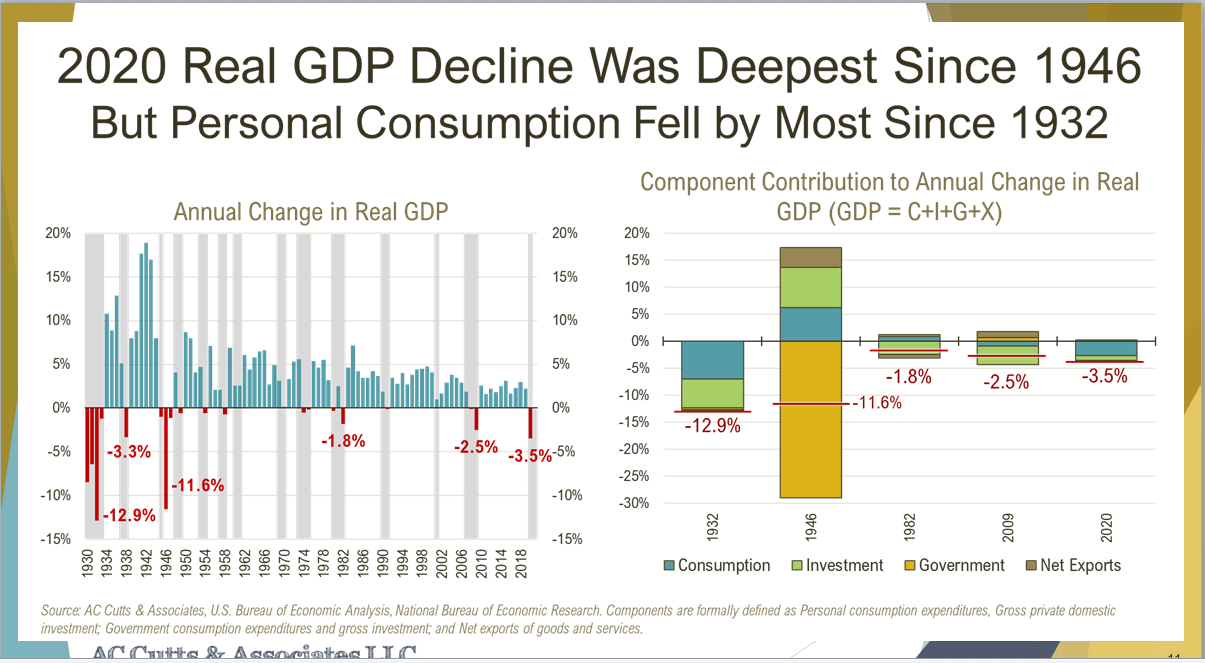

Why is 2020 GDP Lowest Since 1946?

Last year closed with the lowest Gross Domestic Product (GDP) measure since 1946. GDP is made up of government and consumer spending, business investment and net exports. Looking at individual sectors, consumer spending shrank even further with the largest decline since 1932, Amy Crews Cutts explained. This is this first time in recent history that the decline in consumer spending has lasted so long. Cutts further noted that this is why the focus in Washington centers around managing the recession through additional stimulus funds. The recession impacts have economists calling for further stimulus not to grow the economy, but to keep businesses and households afloat and from total financial ruin. Currently, the Biden administration is proposing a plan that would infuse another $5.68 trillion in fiscal support into the economy if passed today.

Unemployment Continues To Show Racial and Gender Disparity

Reports show new initial unemployment claims are down. There were only 770,000 new applicants reported at the time of the February 4 webinar. However, Cutts clarified that this is still four times the number of new claims filed than this time last year. Additionally, she said the total number of unemployed claims is nine times what it was last year. Black and Hispanic populations have experienced the highest levels of labor force changes and job losses. Women continue to be the main group that makes up those who have dropped out to the labor force, particularly those with children. The driving factor for this increase is the continued need to care for young children or elderly parents, as schools and social services aren’t able to provide assistance.

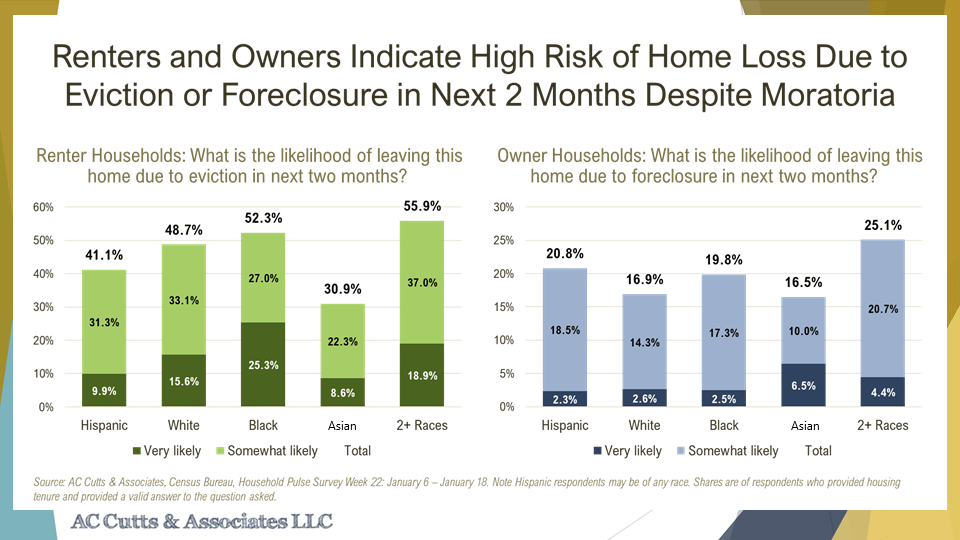

Is an Eviction Crisis Looming on the Horizon?

Unfortunately, the labor market racial disparities are also mirrored in mortgage financial distress, according to Cutts. Black, Asian and Hispanic households reported very high levels of missed mortgage payments. Additionally, their confidence in being able to make future payments is very low. Despite the extended eviction moratorium both renters and homeowners believe they have a high likelihood of having to move because of either eviction or foreclosure. Cutts cautioned that looking at renter numbers recently released in a study by economist Mark Zandi of Moody’s Analytics, there is a looming eviction crisis.

Future Recession Racial Disparity Impacts

In closing comments, Cutts further cautioned the labor market disparities and financial distress that is disproportionately impacting communities of color will have lasting impacts on the credit standing of those households. These impacts will include instability in income that would lead to demonstrated ability to repay due to uncertain income streams and damage to credit that even with the CARES Act provisions could have lasting impacts on abilities to gain credit in post-recession times.

Review of Early Presidential Actions

President Biden's administration moved swiftly to extend the 0% interest rate forbearance of federal student loans through the end of September. Biden also extended the eviction and foreclosure moratorium through March, implemented a mask mandate on federal grounds, and launched a national COVID-19 response, explained Stephanie Gunselman. Additionally, Biden directed executive branch agencies to review their policies for impacts on the economy and how they can address the economic crisis themselves.

Biden’s Chief of Staff, Ronald A. Klain, issued a memo instituting a regulatory freeze pending review. It requires department and agency heads to review all new and pending rules passed in the last days of the Trump presidency. Any rules that were sent to the federal register but not published were immediately withdrawn. Rules that had been published are subject to additional review. The memo is also likely to impact the operations of the Consumer Financial Protection Bureau (CFPB), Office of the Comptroller of the Currency (OCC) and other independent agencies as they take heed from it, as well. Included in the review list at the CFPB is the Qualified Mortgage Rules, at the OCC is the Fair Access Rules and supervisory guidance issued by the banking regulators.

Finally, Gunselman noted the Biden administration will focus on building racial equity and social justice. This was highlighted by a series of executive orders and memos that Biden issued. They direct federal agencies to address systemic barriers and improve racial equity, including the wealth gap and access to financial products. This is crucial as the recession is hitting racial minorities hardest, as Cutts reported earlier in the webinar.

Regulators Hone in on Consumer Protection

A new administration brings many new appointments, departures and even reappearances, explained Gunselman. In the CFPB Dave Uejio is serving as the Acting Director while Rohit Chopra awaits Senate confirmation. While Uejio holds the position he will move forward adopting priorities laid out by the Biden administration, including financial inclusion, equity and fair lending. Assuming that Chopra is confirmed, Gunselman thinks we will see robust enforcement of the CFPB’s current statutory authority. This could include enforcement of the Unfair, Deceptive, and Abusive Acts and Practices Act (UDAAP), bringing a strong focus on the abusive aspects of that statute.

Furthermore, Chopra supports monetary damages for consumers. He believes the private sector should compensate consumers for law violations. Gunselman predicted he may be harsher on repeat offenders and larger industry players. Another area of focus that Gunselman highlighted for Chopra could be student loans. Chopra previously served as the student loan ombudsperson for the CFPB. He believes more protection is needed for student loan borrowers, both for debt collection practices and student debt cancellation.

Lastly, Gunselman explained the CFPB may review payday lending regulations. That's an area Uejio indicated was relaxed under the Trump administration. Another shift in the Federal Trade Commission (FTC) moved Commissioner Slaughter into the Acting Chair. Similar to the CFPB, the FTC will likely use its rule and penalty authority more broadly. This includes the potential for more enforcement of antitrust and other enforcement, according to Gunselman.

Michael Barr Likely Nominee for Treasury Department

At the OCC, Blake Paulson is currently serving in the acting capacity. It is believed that Michael Barr, who was previously a Treasury Department official, is the likely nominee. Barr has called for strong consumer protections. It’s thought the OCC will likely overhaul the Community Reinvestment Act rules and focus on fair access and equity issues. The OCC may also continue to review the role of fintech and cryptocurrency. In the Department of Housing and Urban Development, there will likely be a renewed focus on investing in underserved communities and homeownership expansion policies. Gunselman summarized the top priority for regulators as consumer protection and explained that this will be reflected in their examination, regulatory and enforcement efforts. The enforcement is likely to include areas of disparate impact, fair lending and the CFPB may look at new areas such as pricing, underwriting or use of alternative data.

In Congress, the areas to watch are potential reform to the Fair Credit Reporting Act (FCRA) and scrutiny of credit reporting and banking industry practices. FCRA reform could include restrictions on the use of credit information, limits on what can be included in a consumer credit report, and new duties for users and furnishers of consumer reports.

Equifax continues to work with peers and industry groups to more broadly identity and discuss the potential unintended consequences of the proposed reform. Ultimately, Gunselman noted the two main elements could include higher-cost loans and more restrictive lending criteria.

Congress and COVID-19 Pandemic Response

President Biden has taken some unilateral actions in response to the pandemic. Before taking office, he announced a $1.9 trillion stimulus called the “American Rescue Plan.” His plan would provide households with another $1,400, and combined with the $600 from the December stimulus from the Appropriations Act, would total $2,000 for most people. The plan further proposes to boost unemployment insurance up another $100 to a total of $400 in weekly federal enhancements. That protection would extend into September. Additionally, the plan would include further assistance for renters, particularly in low and moderate-income households, and some utility bill cover as well. The plan also includes reform ideas such as increasing the child tax credit, the earned income tax credit and increasing the federal minimum wage to $15 per hour.

Ultimately, Gunselman explained the expectation is that a response bill will be passed in mid-March, despite calls for more immediate actions. Amidst all of this are continued discussions to pause reporting of any negative credit information. Gunselman believes this would be difficult to include in the reconciliation process and is an area of concern as it could lead to unintended consequences to consumers. Limiting information on consumer reports can lead to gaps that could cause more conservative lending practices and the inability to accurately assess risk, explained Gunselman.

Consumer Loan Origination Remains Strong

Jennifer Cox provided updates of the consumer credit trends and insights with a review of year-over-year origination volumes:

- Mortgage origination remains strong, largely due to low-interest rates, and is about two times 2019 levels.

- Year-over-year the mortgage origination growth rate is the highest in 10 years.

- Auto closed the year relatively flat compared to 2019 volumes, but that is consistent with seasonal trends and still shows rebound since the initial plummet early in the pandemic.

- Card origination continues to grow. Bank card originations have continued to grow since June, but are still significantly below pre-pandemic levels, down about 40% from 2019.

- Private label origination is seeing growth, which was expected with holiday spending. The numbers are still below 2019 levels and are down about 23%. It has been hit less hard than bank card. That is likely due to consumer behavior as we moved to digital and online.

Consumer Shifts in Score Distribution

- The mortgage superprime population, defined as 780+, moved from about 30% to 49% origination.

- Midprime and subprime, defined as 620 and below, have each decreased 5%.

- Auto saw more significant shifts with superprime growing significantly and subprime decreasing.

- Bank card score distribution since March has been choppy, but there is a shift to a higher FICO score.

- Private label has remained at a more traditional mix following early subprime swell seen in early pandemic days.

Consumer Debt Level Update

- The continued increase in mortgage debt, now up $460 billion since March.

- Non-mortgage debt remains fairly flat, down $40 billion since March.

- Revolving debt: card balances saw an uptick with holiday spend, but still down $94 billion since the start of the pandemic.

- Non-revolving debt: increased by about $51 billion, driven by the auto rebound and student loans.

Consumer Credit Utilization Update

- Increase in utilization for bank card, driven by holiday spending. Credit line saw an uptick in utilization for bank card to 93.3%.

- Private label utilization in December returned to pre-pandemic levels.

- Home equity line and utilization levels continue to decline. They are 2.5% lower than in March of 2020. That is representative of the K-shaped recovery that we detailed in our January recap blog.

- Homeowners and home equity have a bit more financial flexibility than non-homeowners and aren't tapping into home equity lines.

Consumer Account Delinquencies

- Auto delinquencies have been increasing consistently since August 2020 and are now 20 basis points from their August level and just 15 basis points below March 2020 level.

- Bank card delinquencies continue to rise, but still 24 basis points lower than the March 2020 levels.

- Private label card delinquencies have leveled off over the past few months and are hovering about 160 basis points below their March 2020 levels.

- A significant drop in first mortgage delinquency levels has leveled off.

Loans in an Accommodation Analysis

Tom Aliff provided more perspective on loans and accounts in accommodation status:

- As of January 25, 2021, loans under accommodations are still below previous highs.

- Credit card accommodations ticked up slightly at the end of 2020.

- Across all account types, a total of 2.3% are under Possible Accommodations (PA) status compared to 1.5% back on March 3, 2020.

- Similar to loans, balances under accommodations continue to decrease across all product types.

- A total of 5.9% of balances under PA on January 25, 2021, compared to 2.8% on March 3, 2021.

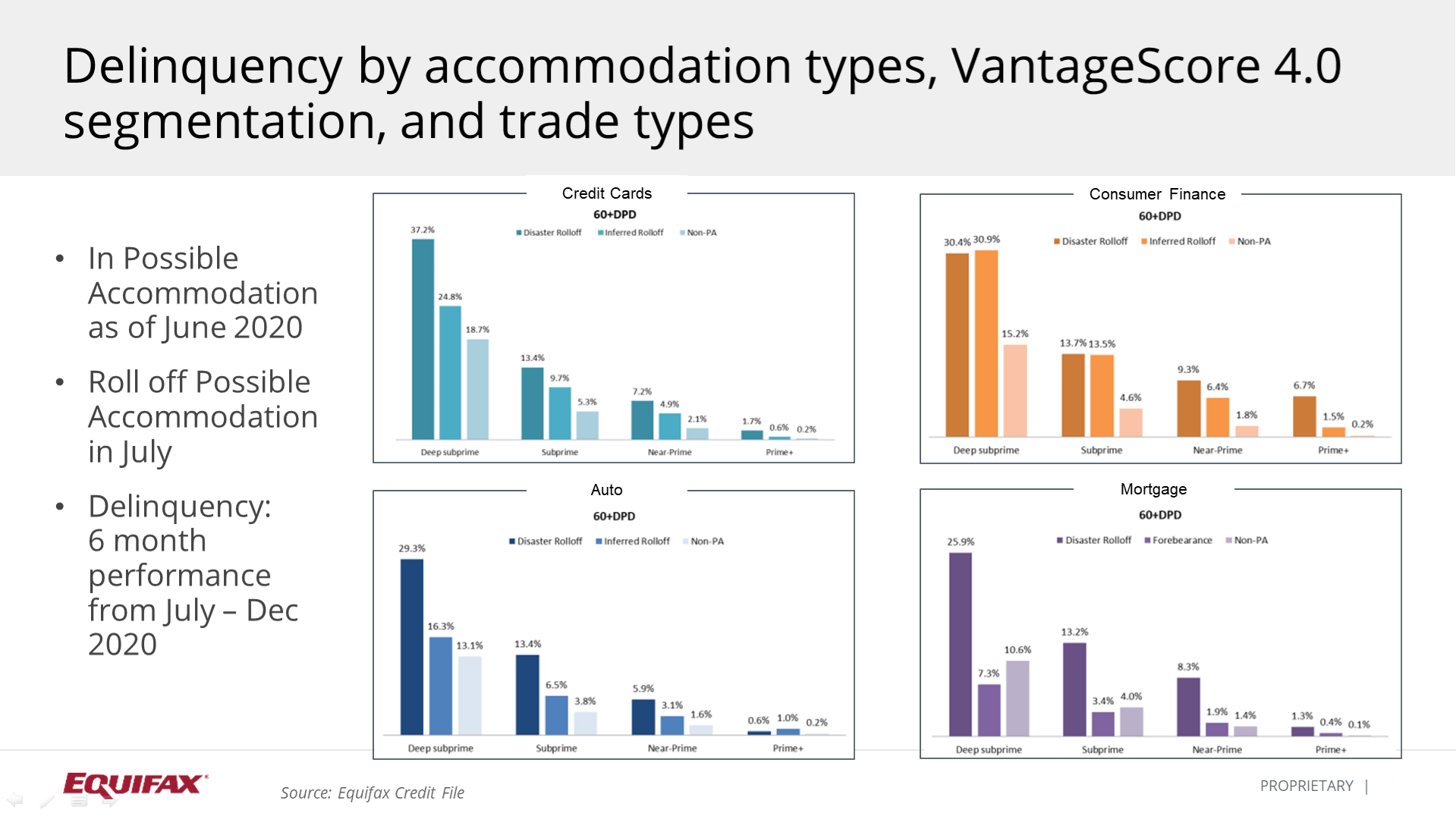

Post Accommodations Delinquency Rates

Aliff described an analysis of delinquency rates for accounts rolling off of PA status (Disaster or Inferred Roll-off). This is compared to loans that never entered into a PA (Non-PA) for credit cards, consumer finance, auto and mortgage accounts. The PA status types included disaster or inferred. Inferred were accounts with an open balance, but no scheduled payment due. As shown in the graph, accounts that had a PA status of disaster and inferred showed higher delinquency rates. That's in comparison to non-PA accounts, particularly in the deep subprime credit groupings.

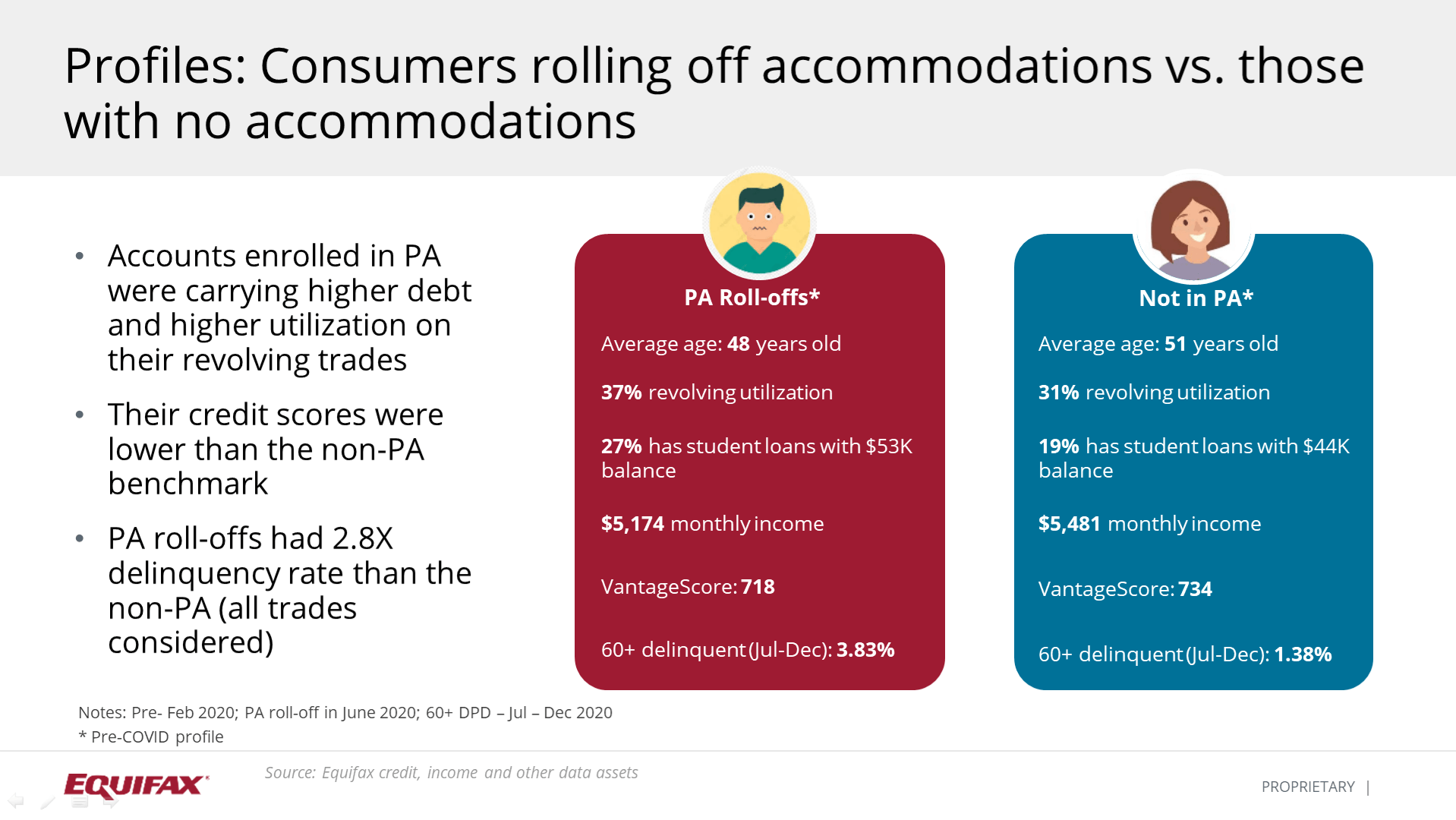

Consumer Profiles Post Accommodations

The image below details two consumer profiles. One is for a consumer with a PA roll-off. The other is for a consumer who never entered into an accommodations status. While both have similar ages and incomes, accounts enrolled in PA had higher debt and higher credit utilization rates on their revolving tradelines than their non-PA counterpart. Additionally, consumers with a PA had lower credit scores and had 2.8 times higher delinquency rates than non-PA consumers.

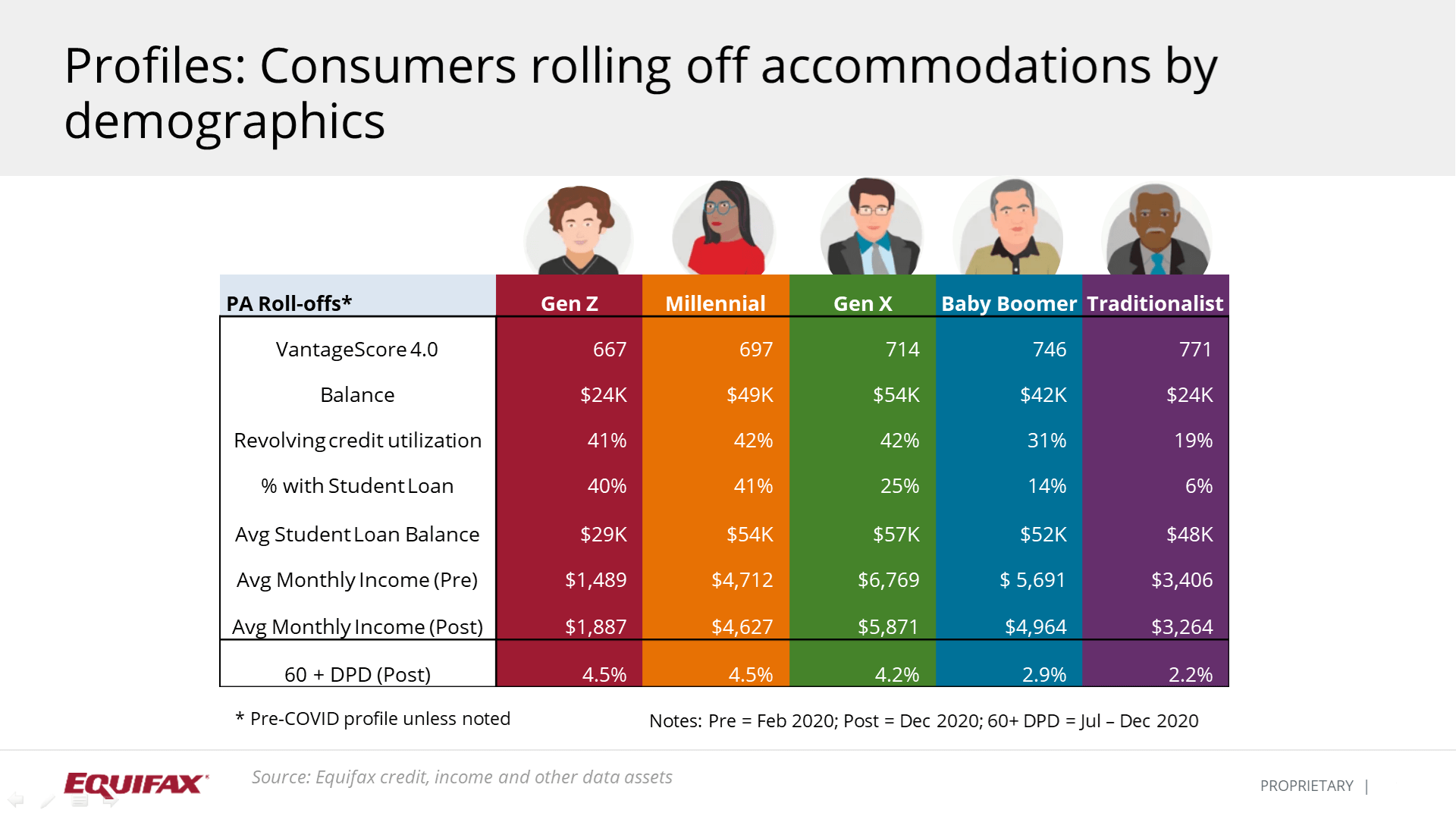

Lastly, the image below breaks down PA accounts by different demographics. The profiles segmented consumers rolling off of accommodations by age groups. And it showed Gen Z and Gen X had a relatively higher risk and lower credit scores. Gen X and Baby Boomers saw a 13% reduction in average pay. Forty percent of Gen Z and Millennials carry student loan debt, the majority of which is still in accommodations. Tom Aliff explained more younger consumers were in accommodations, including Gen Z, Millennials and Gen X. And younger generations are less likely to roll off of accommodations than older generations. He said it will be important for financial institutions to understand their clients' nuanced needs.

The full webinar recording can be accessed by visiting Market Pulse: DC Power Shift, What's Next? and you can download a copy of the presentation slides here.

Are you interested in joining future Market Pulse webinars? Click here to sign up.

And, if you would like to speak to an Equifax representative about any of the data or solutions mentioned in this blog, please contact us today.

Recommended for you