How Credit Unions Can Address Rising Auto Loan Delinquencies

It’s no secret that auto affordability remains an issue for consumers. High auto prices and high interest rates are an ongoing challenge, both of which are affecting the auto market. Many auto buyers have had to stretch their budgets to afford either new or used vehicles and meet ongoing monthly payments.

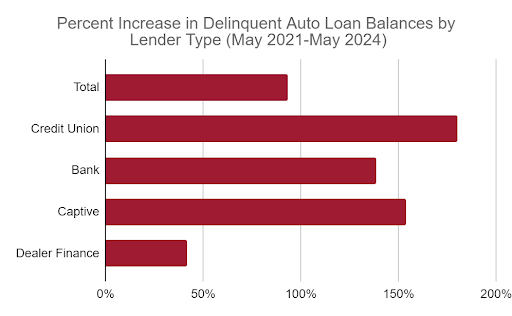

For credit unions that hold auto loan debt on their books, the ramifications of these challenges are showing up loud and clear. How so? Delinquent auto loan balances for credit unions are up 180% over the past three years (May 2021-May 2024).¹

It is true that credit unions have a lower overall percent of delinquent auto loan balances compared to other lender types.

The concern is that the increase in the percentage of delinquent auto loans balances is higher for credit unions than any other lender type. Banks and captives also experienced an increase in the percentage of delinquent auto loan balances (139% and 154% respectively). Meanwhile, the increase at dealer finance organizations was only 42%, while the national average was 93%. To recap: the 180% increase for credit unions is about double the national average - and is higher than any other lender type.¹

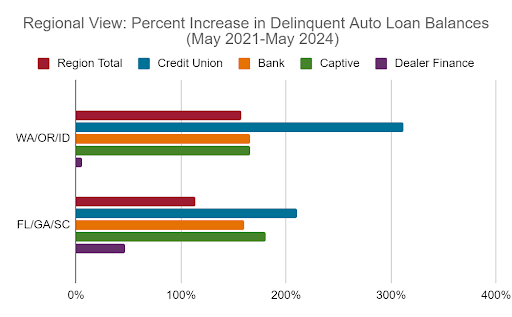

A regional view of auto loan delinquency struggles

Credit unions in some geographies have been hit hard by the rise in auto loan delinquencies, as per recent readouts from Credit Trends. For example, credit unions in Washington/Oregon/Idaho had a 312% increase in delinquent auto loan balances (May 2021-May 2024). That’s about double the average increase in that region at 157%. Plus it far exceeds the increase in delinquent auto loan balances at dealer finance groups of just 6% in that region.¹

Credit unions in Florida/Georgia/South Carolina also had a high increase in delinquent auto loan balances during the same time period at 210%. Again, that’s about double the average increase for that region of 114% and is the highest increase for all lender types.¹

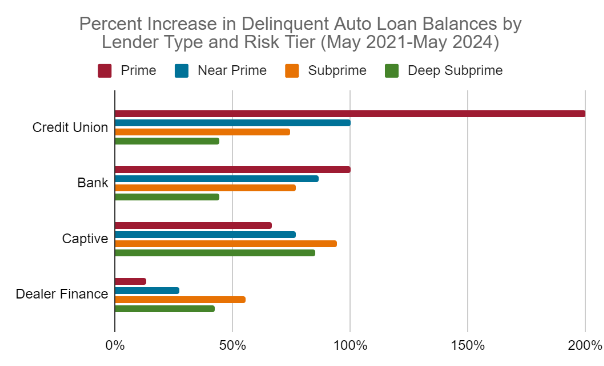

For credit unions, it’s not just the subprime segment

driving increased delinquencies

One might think that the increase in auto loan delinquencies is driven by the credit tiers that are likely under the most financial stress. Namely the subprime and deep subprime segments. But for credit unions, that is not the case! In fact, prime and near prime auto borrowers at credit unions experienced a higher percent increase in delinquent balances (200% and 100%) across the three year study period.¹

This high increase in auto delinquencies across the prime and near prime segments was also experienced by banks (100% and 87%). Captives and dealer finance saw the reverse. The increase in delinquent auto loan balances at these lenders was higher for subprime and deep subprime credit tiers.¹

The auto loan landscape for credit unions - and all auto lenders - might improve in the coming months. Auto prices are finally starting to come down, lenders are focused on shortening loan terms, and interest rates might get cut. Emphasis on “might”.

However, those factors may only have a minimal effect on auto loan borrowers. Especially those that are already experiencing financial stress and having trouble meeting their auto loan commitments.

What can credit unions do to better contend with auto loan delinquencies, assist their members, and mitigate risk?

We know that you are there for your members. You want them to turn to you for their financial needs and trust that you will support them during financial hardships.

Right now, many of your members are faced with financial stress. Some of your members are already delinquent on their auto loans, and some may become delinquent in the near future. Now is the time to be even more proactive in identifying these members. You need to understand their financial situations. You need to offer them options that will help minimize delinquency and default risk for your organization. You need to deepen relationships and ensure your members know that you are there to help. Here are some strategies to get started.

Take a closer look at your account review efforts

Take a look at your auto loan portfolio. Have your members’ credit scores changed since origination? Have their loan balances increased across their other credit accounts? How about utilization? Do your members have new delinquencies for credit accounts held at other firms?

You can answer these questions with a deep-dive account review of your auto loan holders. This can help identify members that may be at risk of delinquency or default. You can also better evaluate members that are already delinquent to understand their current credit situation.

Here are some questions to consider as you assess your account review strategy.

-

How often are you conducting reviews? Quarterly reviews can increase the amount of exposed dollars at risk saved by 3.5 times over annual reviews. Monthly reviews can help you save even more.²

-

Are you using the latest credit scores and attributes? Newer credit data can provide an average 15% lift, and potential increase in performance of up to 94% over legacy attributes.²

-

Would a broader view of your members’ finances change your treatment strategies? If you are relying primarily on credit scores for your account reviews, then it might be time to explore new data. This can help differentiate auto loan borrowers - and all members - that might have a solid credit score, yet present higher risk of delinquency. For example, up-to-date income and employment data can give credit unions a more current view of members’ cash inflows. Alternative data available via OneScore can provide insight on bill pay behaviors for telecom, pay TV and utilities, as well as use of specialty finance. Segmenting accounts with financial durability measures can reveal members’ likely ability to meet financial commitments, even when under financial stress.

-

Are you aware of changes outside your organization? Keep track of whether your members’ are pursuing new credit accounts at other firms. To help, you can receive daily alerts of members that have prequalified or applied for new credit at another firm. Credit unions can also enhance account reviews to gain an early warning of impending risk. One way to do this is to identify changes in members’ credit accounts held at other firms. Changes such as new delinquencies or an increase in utilization. This could reveal hidden, at-risk accounts. Here’s a case in point: super prime consumers (720+) with a new “off-us” 30 days past due trade are 8.9 times more likely to go delinquent in the next 6 months.²

Reach out early and often

Account reviews can yield deep insights into the current and potential risk of your credit union’s auto loan portfolio. By identifying members that present increased risk, you can reach out early to help them address their unique needs.

Increased communications and financial education can be a good investment. In fact, 80% of consumers want their financial institution to help them improve their financial health.³ Credit union marketers can deliver messages explaining how credit scores are calculated. Plus detail how delinquent payments can impact a member’s credit score. This is especially important for members that also hold student loans, as delinquent payments will soon have an impact on credit scores. Credit unions can also offer members access to credit scores and reports, monitoring services, and digital solutions to help them track and improve their credit.

Presenting options to help members’ better manage their auto loans and other debts is also important. For example, credit unions can offer modified repayment plans, refinancing, or debt consolidation. Credit unions can also help limit risk by carefully evaluating requests for an increased credit limit on a credit card or other loan.

Take action now - before auto loan delinquencies creep up even more

For assistance with managing auto loan delinquencies and risk across your portfolio, reach out to your account representative or connect with our team of risk advisors at riskadvisors@equifax.com. Ask us about how Credit Trends can help you analyze delinquency trends in your region for all of your lending products. Plus learn additional tips to elevate your account management.

(c) Equifax Inc. 2024. Statistics provided herein are for information and illustrative purposes only and are not to be relied use or relied upon for any other purposes.

Sources:

-

Equifax Credit Trends, June 2024.

-

Equifax Analytics

Recommended for you