Holiday 2020 Consumer Spending: Your Questions Answered

Businesses must learn how to take advantage of seasonal spending, while protecting their portfolios and mitigating risk. For the December 10 Market Pulse webinar, our panel of experts discussed consumer spending trends and expectations. Presenters included Amy Crews Cutts, President and Chief Economist at AC Cutts & Associates; Nick Mangiapane, Chief Marketing Officer at Commerce Signals, a Verisk Financial Business; Jennifer Cox, Risk Solutions and Consulting Leader at Equifax; and Tom Aliff, Senior Vice President of Data Analytics and a Consulting Leader at Equifax. Panelists followed up with audience members’ questions about consumer spending, inflation, delinquency rates, online purchasing trends and more. Read their responses below or watch a replay of our webinar, “Market Pulse: Consumer Spending Trends and Expectations.” Jump ahead to a specific topic:

Economy

Can you share thoughts on inflation?

Amy Crews Cutts: Inflation is not a concern today given the massive (no, bigger than massive) decline in aggregate demand. This is not a normal recession, and it wasn't caused by the normal business cycle. We are far from having enough fiscal stimulus, as the number of unemployed is still devastatingly large and businesses are buckling under the weight of the pandemic's effects on their revenues. We can quibble about how inflation is measured and whether there is more of it than what is recorded, but it is not enough to cause any concern and likely won't be for at least a year.

Credit and Lending

With COVID-19 impacting travel and entertainment, and the general lack of a "must have" consumer good or service for Christmas this year, how is pent up demand forecast to drive lending demand and usage on credit cards?

Amy Crew Cutts, President and Chief Economist at AC Cutts & Associates

Amy Crew Cutts: People are not traveling and have room in their budget that they might have otherwise been spending on holiday travel that they might be able to funnel into better or different purchases for gifts. I don't think the pent up demand really is being met with so many people avoiding shopping and changing their shopping methods. I don't see any cure for this right now. I certainly think that consumers are still a little bit in a savings mode, even if they're spending down their savings. They're trying to be frugal because the risk to their jobs is quite high for many folks who are tied in any way to the retail or consumer business services side of things. I'm not seeing the big push of pent up demand being met in the moment.

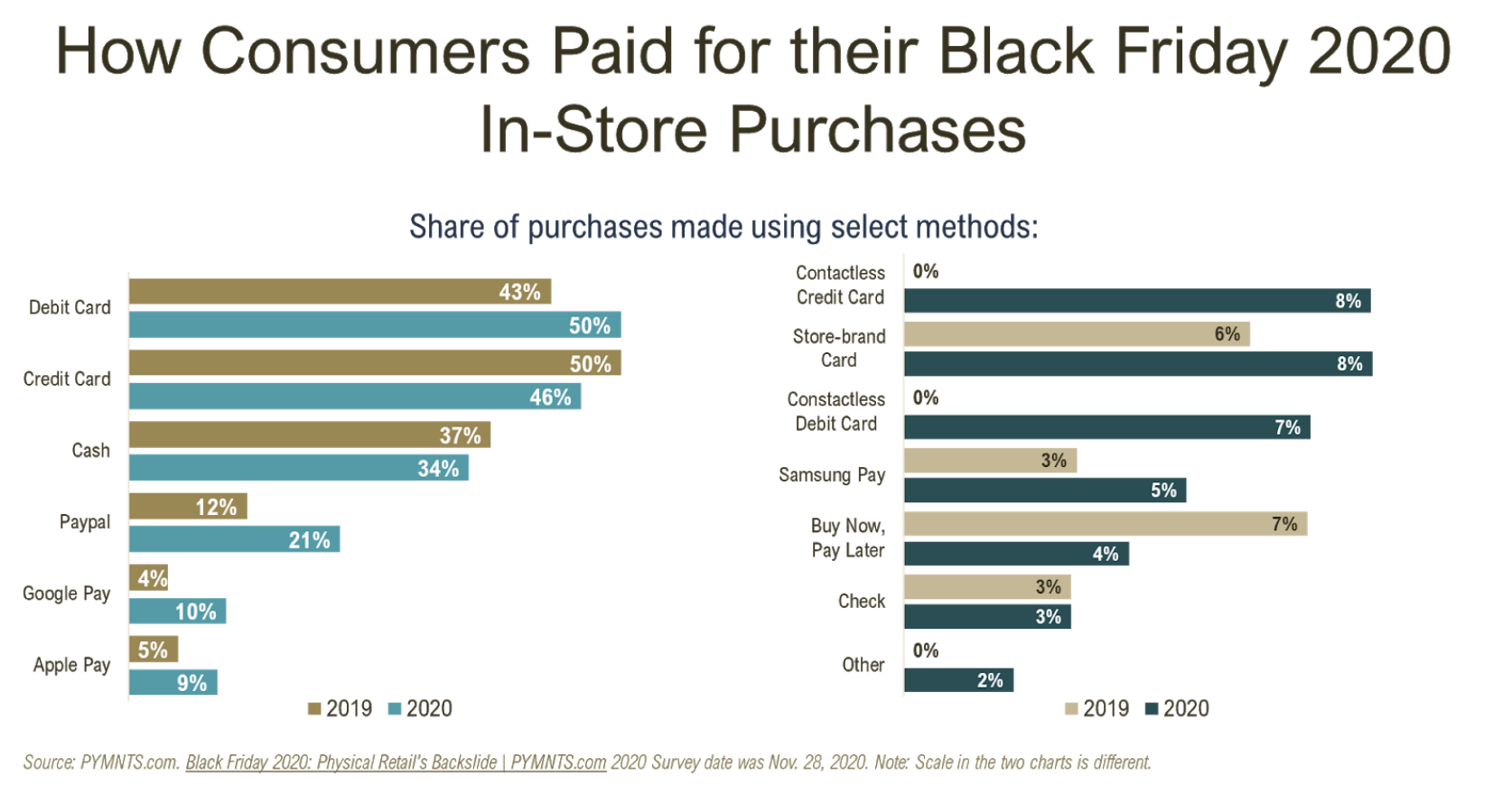

Isn't the rise in PayPal, Google, etc. an embedded credit card? Is it just a rise of wallet increase?

Amy Crew Cutts: Yes, wallet increase, but it could be tied to the bank account too.

What's the reason for the Vantage score to drop when the pandemic started?

Jennifer Cox, Risk Solutions and Consulting Leader, Equifax

Jennifer Cox, Risk Solutions and Consulting Leader, Equifax

Jennifer Cox: A couple of factors we think led to that. One is that a lot of the marketing and proactive channels were temporarily suspended when that hit, so some of the population was impacted. Also, we believe that consumers who needed to ensure they had a line for insurance or were trying to get ahead of the curve from a risk perspective, went ahead and applied during that time where most of the point-of-sale activity and those kinds of channel preferences were shut down. It was just a shift at a lower to a non-marketable, non in-store kind of population. That was the reason for that original drop that we've seen recovered today.

Which loans market do you see growing the most in 2021? Which ones do you think have the most risk associated with them?

Amy Crew Cutts: I don't think mortgage will grow next year because even though we talked about the massive increase in mortgage originations this year, it's going to be a very strong and very healthy market next year. I do think that auto is going to have quite a rebound. There was a decline in auto demand this year as people stayed home. That rebounded later in the year, and it's going to close the year pretty well. It is down from last year, but has still done pretty well. I think next year we'll see some of that return as people go back to driving to work and so forth. I think we will see an auto growth next year that's pretty sizable.

Delinquency Rates

Will delinquency rates increase across the board if there is no sizable stimulus package by Q1/Q2 of 2021?

Thomas Aliff, SVP, Analytics Solution Consultant, Equifax

Thomas Aliff, SVP, Analytics Solution Consultant, Equifax

Tom Aliff: We will see the highest risk where someone does have a disruption they have been leveraging, the accommodations, or not, and those accommodations expire. That's where we will likely see some of the risk. Arguably, those that are unimpacted, both from a pay and employment perspective, may not have needed the accommodation. However, if they had a student loan, it could've been placed in the administrative forbearance automatically so they had a little bit of cash flow. We are seeing a major difference in trends nuanced in a way that it was compared before. The populations that I want to highly monitor are those that are levering accommodations, expiring and households disrupted in some way from employment and income.

Do you have any delinquency information on how trades are performing after they exit payment accommodation?

Jennifer Cox: There are a couple of key factors influencing the performance at exit on payment accommodations. One, is how they were put on the program. Was it an automatic enrollment or was it an elected or requested enrollment and payment accommodation? There were some accommodations put on in a systemic basis, and we aren't seeing any change in payments when those have expired. We are seeing where payment accommodations have been requested and the increase in delinquency that we've noted in totality in some of the graphs that we shared. We're also seeing that it depends on which portfolio. Many issuers and lenders have taken different approaches, from how they're offered or what allowances they put on payment accommodations. There are many different factors affecting that. Tom Aliff: There's a couple of things that we've seen. We've definitely seen a higher correlation for those accounts that are in accommodation as correlated with higher risk types of behaviors. For example, we may see at some point if they come off accommodation to have high risk for bankruptcy, less resiliency. We've correlated it with the FICO Resiliency Index that we've featured in prior webinars. Additionally, we have already started observing a slight increase in the roll rates of early delinquency categories from 30 to 60 days, but we are continually and actively engaged in monitoring those that have come off of and rolled into accommodations.

Mortgage

Provide comment on the foreclosure moratorium holding back between one-fifth and one-third of newly available housing stock for retail buyers as "shadow inventory."

Amy Crew Cutts: I have not seen these statistics. I do not think we will see a large foreclosure wave, at least not for a long while. While undoubtedly the foreclosure rate has been suppressed with the wide availability of mortgage accommodations and the moratorium, the rise in home values that has accelerated thus far in the recession means that even if homeowners are financially distressed they will not necessarily end up in foreclosure -- they would be much better off selling and recouping their equity.

Online Retail

From slide 18, when you say there was an increase for PayPal utilization for "in store" purchases, does that mean PayPal was used in true "brick and mortar"? Or was that really just overall online purchasing?

Amy Crew Cutts: Brick and mortar! From what I was able to discern from the PYMNTS article, this is PayPal being used for physical in-store purchase. So, it’s not just the online where we already know they have a pretty good presence, but being used in-store. It was pretty shocking to me because I thought of them as something that you would use online, but they definitely are making inroads there.

You can find more related insights and register for upcoming webinars on our Market Pulse web page.

Recommended for you