September Update: How to Navigate the 2020 Economy

[Last update: Sept. 10, 2020] In this article:

- Economic Stress Mounts; Fraud Increases

- Two Phase Recovery Tools

- State of the Mortgage Industry

- Economic Contraction and Unemployment Woes

- Housing Rebound

- Consumer Credit Trends

- Housing Market Outlook

- The Shifting Tide of Marketing Strategy

- Proactive Portfolio Managing

- Scenario Forecasting

Our August 20th webinar was focused on fraud mitigation across the buying cycle, from onboarding to account opening all the way to account servicing. We also discussed the overall economic environment and our latest consumer credit trends. Special guests included Mike Urban, Identity Solution Consulting at Equifax and Hrishi Talwar, U.S. Identity, Fraud and Compliance Leader at Equifax. Amy Crews Cutts, President and Chief Economist at AC Cutts & Associates opened the panel with insights on the U.S. economy.

Economic Stress Mounts; Fraud Increases

New applications for unemployment benefits decreased to one million for the week ended Aug. 22, according to the Labor Department. While initial unemployment claims remain well below the recent March peak of about seven million, they are far higher than pre-pandemic levels of approximately 200,000 claims a week. Meanwhile, the recent surge in bankruptcies and a wave of large enterprises announcing job cuts, raised additional concerns about the employment outlook going forward.

High unemployment is adding to the financial stress on households. As of August 13, 13.1% of renters did not pay their monthly rent. That compares to 12.4% of households who did not pay their rent during the same period the prior month. After savings at depository institutions reached historic highs of $1.44 trillion in June, household savings have started to decline for the first time since the onset of the crisis. Between June 8 and August 3, household savings dropped $305 billion.

One bright spot in this uncertain environment is housing. Pending home sales increased 5.9% in July compared with June, according to the latest National Association of Realtors (NAR) data. Sales were 15.5% higher on a year over year basis according to NAR.

Fraud Increases

According to the Federal Trade Commission, year-to-day fraud incidents reports have resulted in a financial loss of $112 million during the COVID-19 period. While only about 88% of those reports include a payment method associated with the incident, wire transfers and credit cards are the top two methods for fraudulent activities.

Two Phase Recovery Models

Moody’s breaks down their recovery models into two phases: the pre-vaccine and post-vaccine phase. The pre-vaccine recovery phase is where the economy is expected to move sideways until we get some sense of a vaccine, an effective therapeutic or are able to control the virus in some way. Once a vaccine arrives, which Moody’s projects will occur in the first quarter of 2021, they expect an economic acceleration.

Phase One Recovery Stalls, Outlook Darkens on Unemployment and “Benefits Cliff”

With COVID-19 cases continuing to increase in the U.S., a number of states have backtracked on their reopening plans, slowing the phase one recovery. There has also been a wave of bankruptcies during this pre-vaccine phase with expectations that more business failures are coming. While U.S. unemployment claims fell below one million for the week ending August 8, unemployment remains elevated.

“The fact that we still see close to a million people filing for unemployment every week is an indication that the market is far from healthy at this point,” commented deRitis.

With the expiration of the extended employment benefits from the CARES Act, many households will see their income fall. Congress and White House officials are discussing a new stimulus package to provide Americans with additional financial support.

The two competing pieces of legislation are the Health and Economic Recovery Omnibus Emergency Solutions Act (HEROES Act) and the Health, Economic Assistance, Liability Protection and Schools (HEALS) Act. Differences between the HEALS Act and HEROES Act include the overall amount of financial assistance to be provided, as well as some of the specific measures that should be included like eviction protections and moratoriums. Both proposals include some form of direct stimulus payments to households.

State of the Mortgage Industry and the Road to Recovery

The economic environment of recent months has posed challenges for industries across the board, and the mortgage industry is no exception. Yet, based on the latest trends and data, the U.S. mortgage industry appears uniquely positioned to weather this economic crisis.

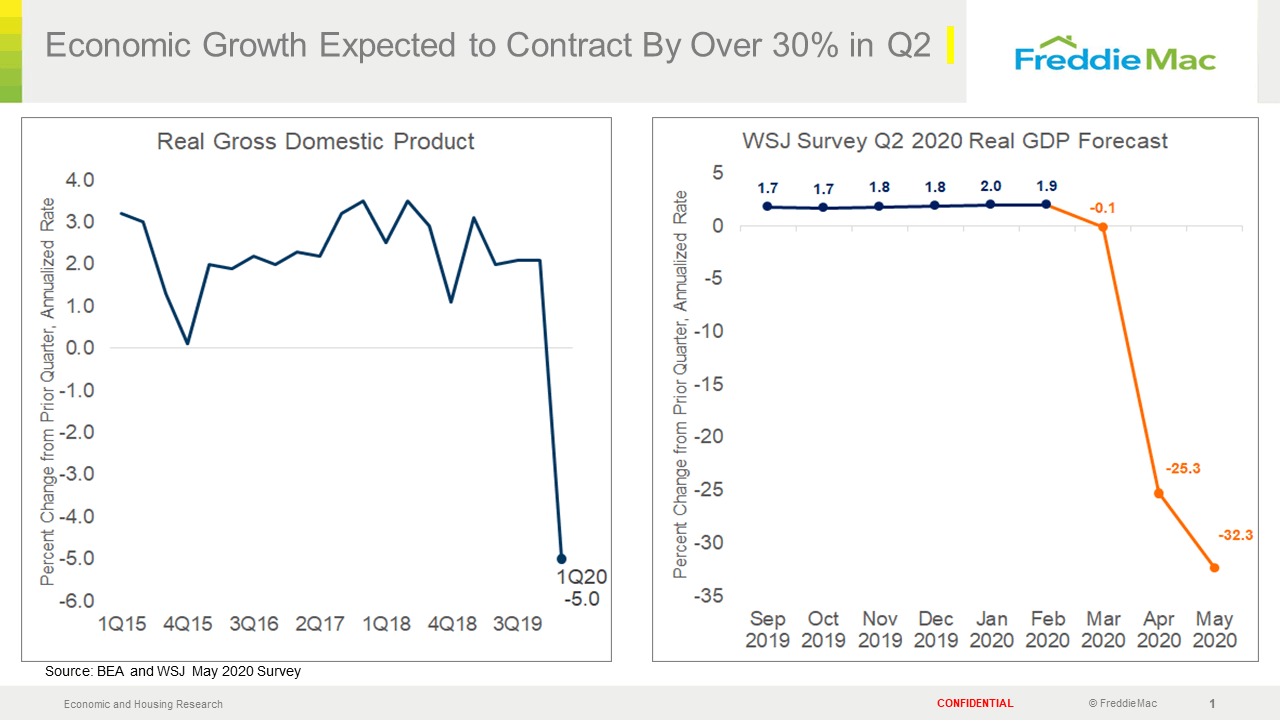

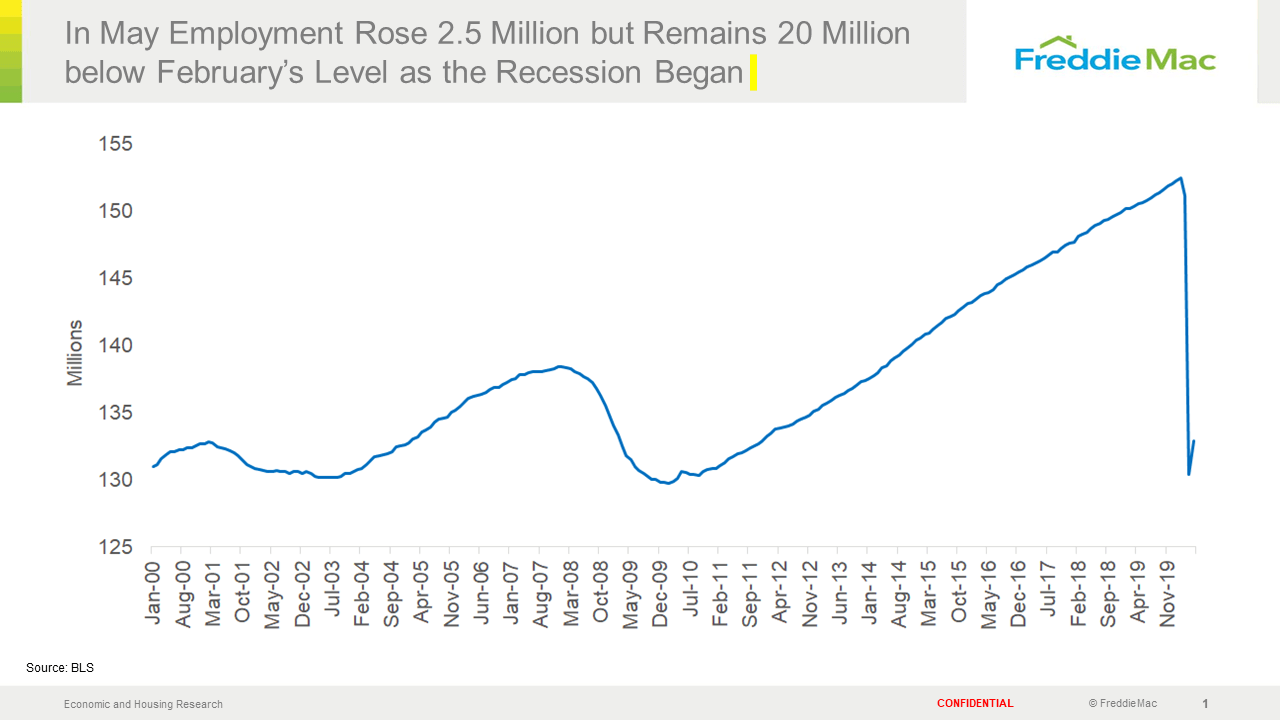

Economic Contraction and Unemployment Woes

The economy shrunk by 5% in Q1, and it is expected to contract by over 30% in Q2, according to Sam Khater, Vice President, Chief Economist and head of Economic & Housing Research Department at Freddie Mac. He also noted the impact on the labor market, citing historically high unemployment rates as well as the recent data showing jobs are rebounding faster than expected. Employment is 20 million below where it was in February, but it is 2.5 million off the low reported back in early April.

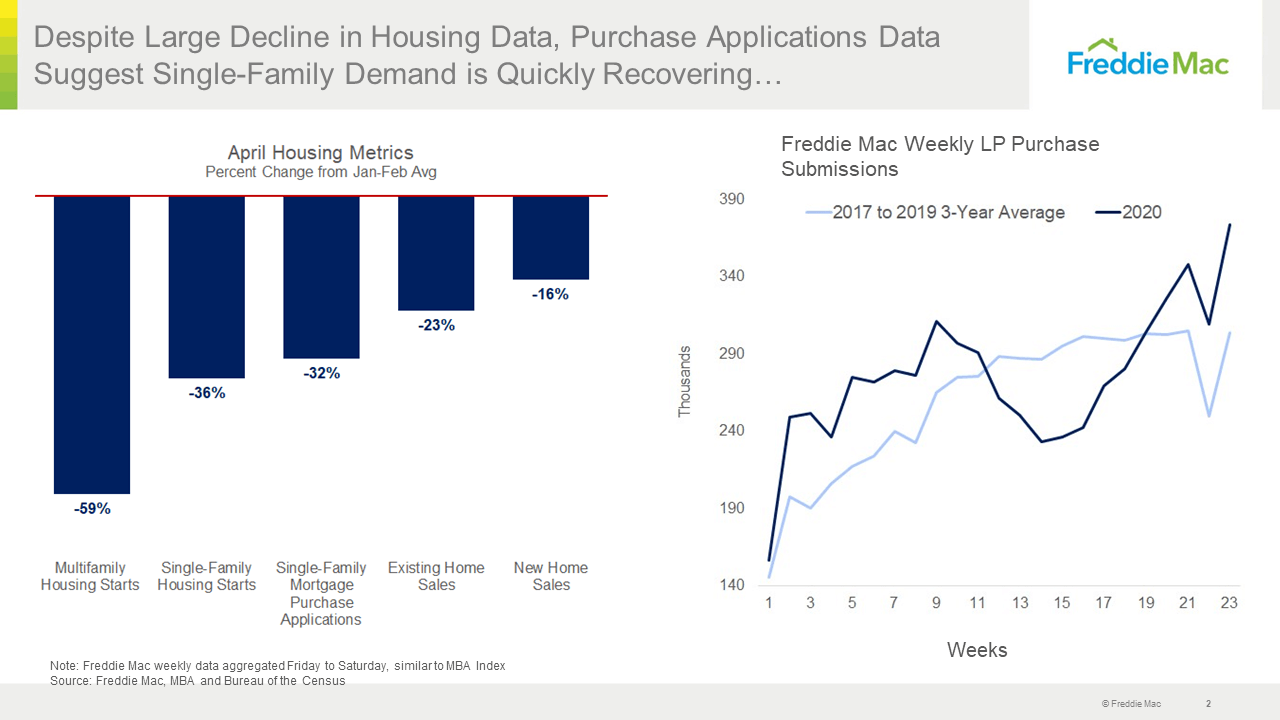

Housing Rebound

Khater noted the housing market’s rapid recovery. Purchase applications fell in mid April, declining 35% in Freddie Mac’s data. As of June 9, purchase applications were up over 20% from a year ago. “It's really remarkable that we've made a recovery in 10 weeks, because if you compare it to the last decade, it took over 10 years to make nearly the same recovery,” noted Khater. While housing inventory is down approximately 10%, list prices for homes that are on the market for sale have only declined by about 3%.

Consumer Credit Trends

In addition to publishing key data and insights on the automotive industry from our recent webinar, Equifax also shares its U.S. National Consumer Credit Trends report on a weekly basis. The information shared below reflects data from the August 10, 2020 weekly report, published August 18, 2020. You can access the latest weekly and monthly U.S. National Consumer Credit Trends report here.

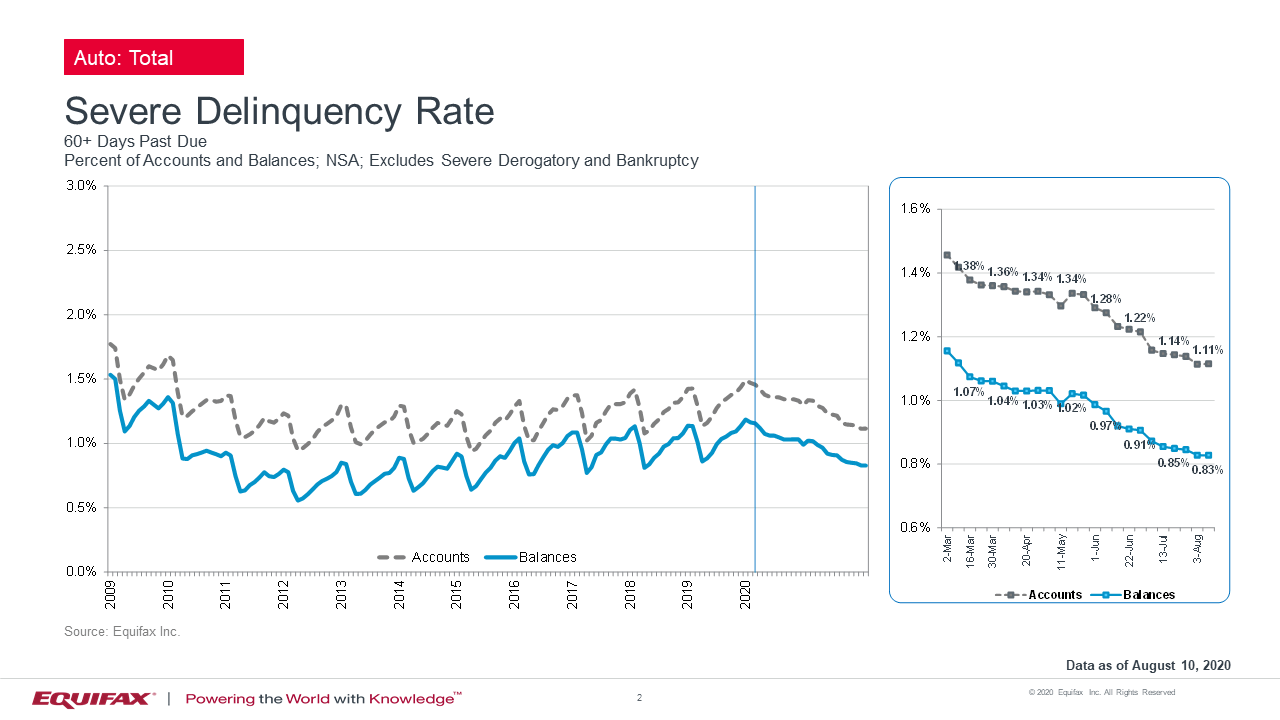

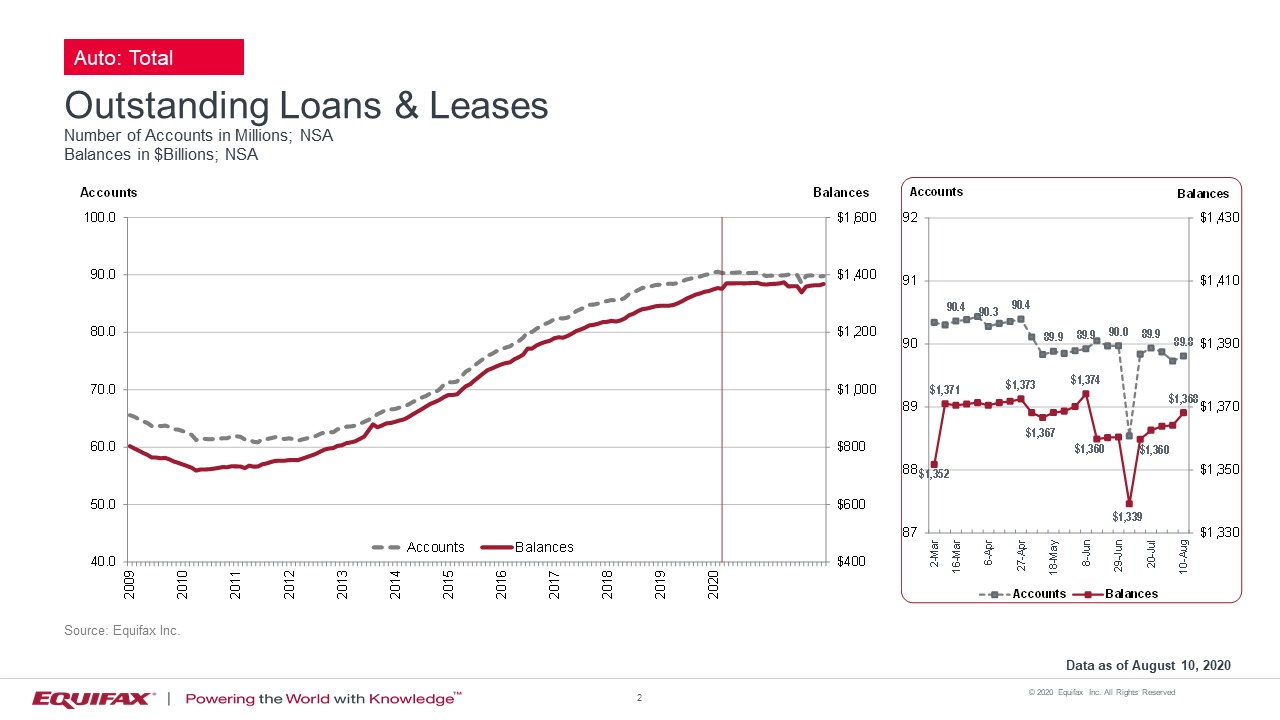

Auto Portfolio

As of August 10, total outstanding balances on auto loans and leases are $1.368 trillion. This is an increase of 0.3% week over week, and also an increase of 1.0% from February 2020 month end. The number of outstanding accounts is 89.8 million, up 0.1% compared to the prior week, and also a 0.8% decrease when compared to February 2020 month end. The severe delinquency rate (share of balances 60+ DPD) is 0.83%, consistent with the prior week. When compared to February 2020 month end, it is a decrease of 33 bps. For the week ending August 9, there were 14,300 auto loans and leases, totaling $387.4 million. Of those, 1,800 auto loans and leases went to consumers with a VantageScore® 3.0 credit score below 620 (generally considered subprime accounts). The average origination balance for all auto loans and leases issued in the week of August 9th was $27,180. The average subprime auto loan and lease amount was $25,308.

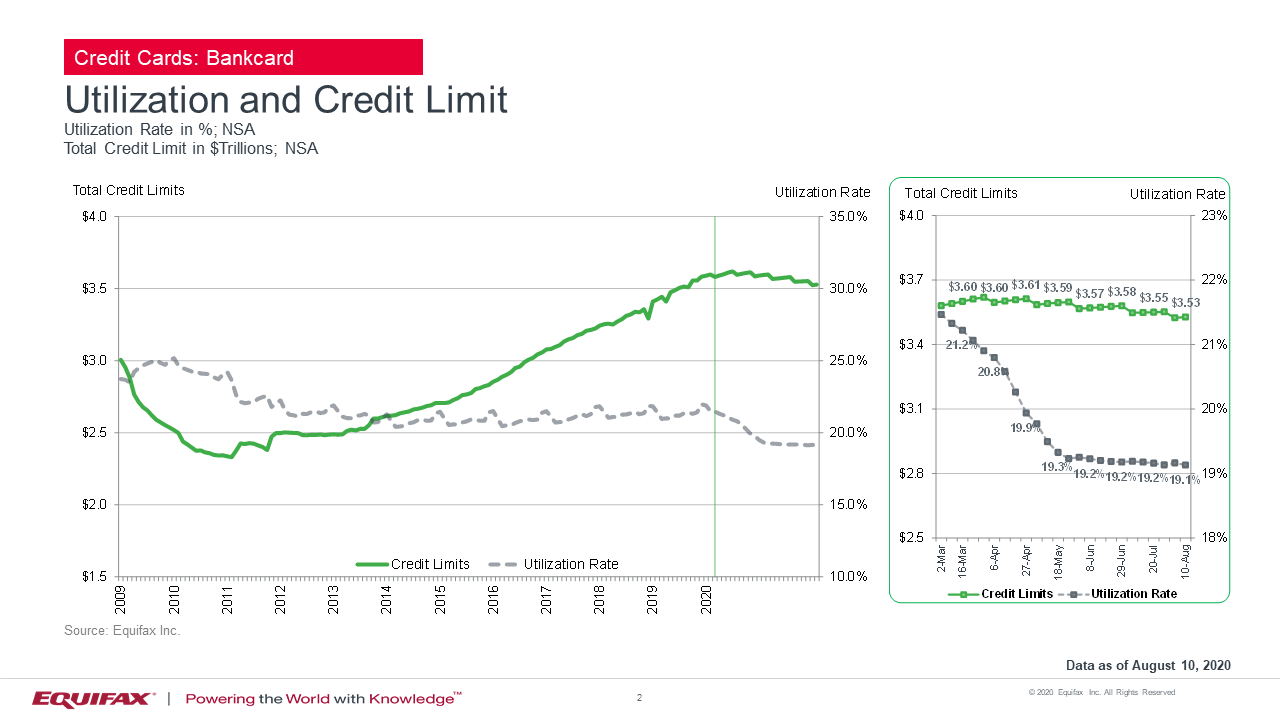

Bankcard Portfolio

As of August 10, outstanding balances on bankcards stood at $724.5 billion, down 0.2% from the prior week, and an 11.7% decrease from February 2020 month end. The number of outstanding accounts is 464.1 million, 0.1% decrease week over week, and a 1.3% decrease from February 2020 month end. The severe delinquency rate (share of balances 60+ DPD) is 1.78%, a 0.8% decrease week over week, and a 30.0% decrease from February 2020 month end when it stood at 2.54%.

Card utilization has remained between 20% and 22% of total credit limits since the spring of 2011, with some seasonal variation. Bankcard utilization stands at 19.1% as of August 10. This is a historical low since Equifax started tracking the data in 2006. Approximately 141,200 bankcards were originated the week ending August 9. Total bankcard credit limits originated during the week ending August 9 were $484.7 million. Around 13,900 bankcards have been issued during the week ending August 9 to consumers with a VantageScore® 3.0 credit score below 620 (generally considered subprime accounts).

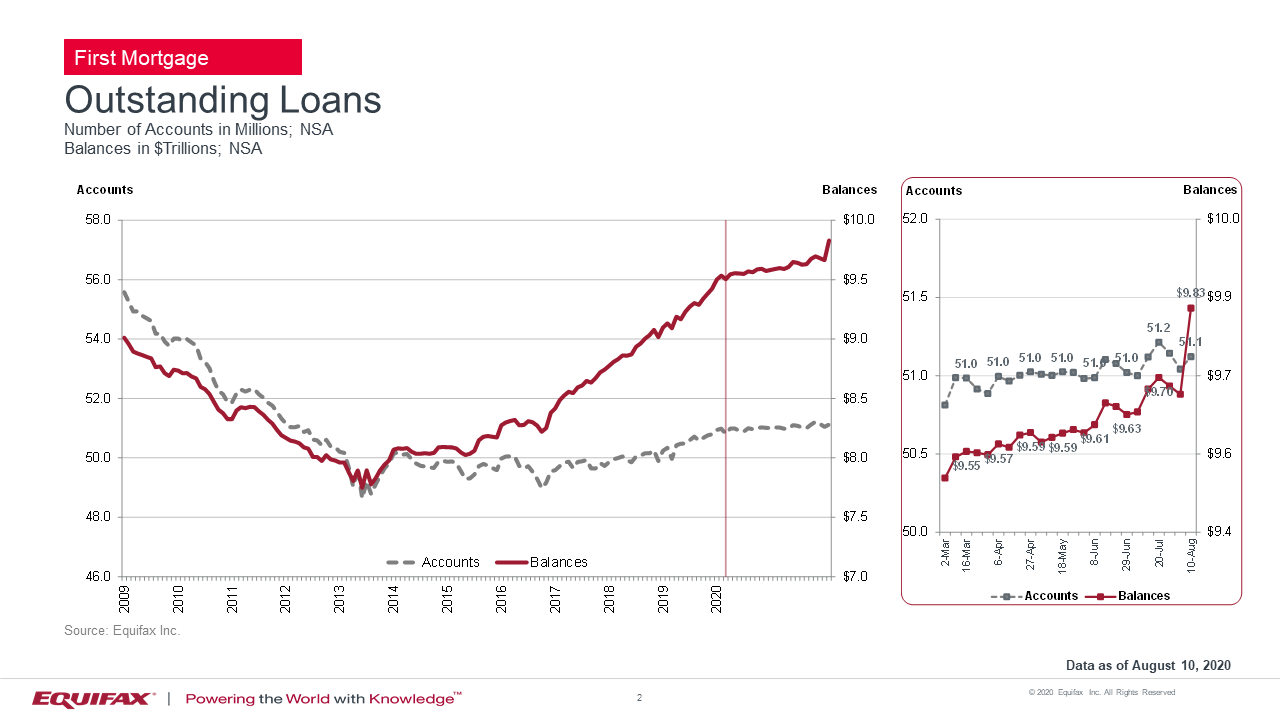

First Mortgage Portfolio

As of August 10, there were 51.12 million outstanding first

mortgage loans, up 0.2% compared to the prior week. This is an

increase of 0.3% from February month end. First mortgage outstanding

balances have risen steadily since June 2013 ($7.747 trillion),

reaching $9.829 trillion this week. This is a 1.7% increase week over

week and 3.1% increase when compared to February 2020 month end. The

severe delinquency rate (share of balances 90+ DPD, in bankruptcy or

foreclosure) is 0.53%, 4.0% higher than the prior week, and a decrease

of 26 bps from February 2020 month end.

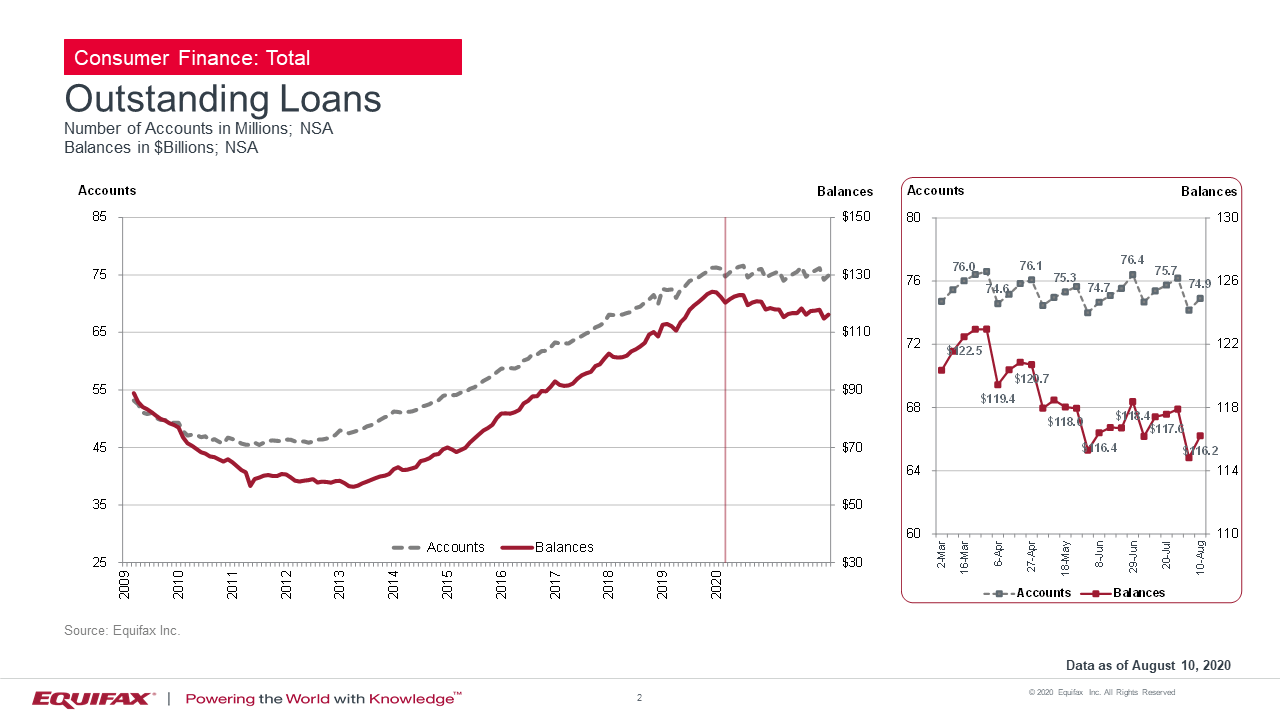

Consumer Finance Portfolio

As of July 27, outstanding consumer finance balances are $117.9 billion, a slight increase of 0.3% from the prior week, and a 3.6 decrease in total balances from February 2020 month end. Outstanding consumer finance accounts are 76.18 million, up 0.6% from the prior week. The severe delinquency rate (share of balances 60+ DPD) is 2.27%, a decrease of 1.6% from the prior week, and a 22.5% decline compared to February 2020 month end.

Fraud Increases as Digital Adoption Grows

During the August 20th Market Pulse webinar, the Equifax team discussed the exponential increase in consumers using digital services during the COVID-19 crisis. In response, businesses are continuing to shift their focus to servicing customers online, and transforming how they interact with consumers digitally. While this shift is happening, fraudsters are taking advantage of any digital security weaknesses they find. Key takeaways from their discussion include:

- Consumers are using different digital channels to access basic offerings, led by digital banking.

- Businesses are highly focused on ensuring a great online consumer experience by providing a true omni-channel and uniform experience across digital platforms.

- There are new challenges to overcome with digital customer acquisitions, including fraud. There has been an 88% increase in new account fraud since 2018.

- Application abandonment is another challenge. In some instances, digital transaction abandonment rates are as high as 70%.

- In the last five years, the cost of acquiring new customers has increased by over 50%.

- Identity fraud is growing during the COVID-19 pandemic including instances with the Payroll Protection Program, unemployment insurance and credit cards.

- Since 2018, credit boosting and reporting schemes are up 36%, while compromised identity risks are up 20%.

Effective Fraud Mitigation Strategies

With fraud on the rise, organizations need to strike the fine balance between making sure that the right customer can easily and seamlessly access the account while mitigating and preventing the wrong customer from committing fraud. As Talwar noted during the discussion, “It's going to be a lot about minimizing the amount of information that you ask a consumer to provide up front, as we have seen fraudsters seem to have access to a lot more information than they should.” Talwar suggested organizations consider three strategies to ensure a strong customer experience and minimize fraud:

- Ask consumers to supply less personal information upfront and instead establish identity with behind the scenes data collection and identity resolution

- Conduct passive checks to establish trust in the identity and digital information before conducting authentication

- Use trust to give consumers choices on how to authentic themselves

When these strategies are deployed, organizations can see very tangible benefits that positively impact their bottom lines. For example, when Equifax deployed some of these strategies through its products, they have seen a 73% reduction in fraud risk while still seeing a double digit lift in credit approvals. These strategies can also reduce operational expenses. In some cases, Equifax has seen up to 30% reduction. By deploying some of these strategies - making it easy for consumers to open and access accounts yet catching fraudsters at the right moment and time - business can strike the right balance of delivering a strong customer experience and minimizing risks.

Tracking Accommodations and Changes to Incomes

During the August 6 Market Pulse webinar, the Equifax team and guests shared details on accommodations, employment and income trends. Key takeaways from their discussion include:

- In July, loans under possible accommodation (PA) have fallen slightly, but remain well above the levels observed before the COVID-19 pandemic. Across all account types, a total of 3.2% are under PA.

- There was a slight dip down in auto and mortgage accommodations based on the number of accounts and loans on record.

- Balances under PA have fallen slightly in July, but remain elevated from Pre-COVID-19 levels. A total of 8.2% of balances are under PA.

- Manufacturing, Leisure and Hospitality and Financial Activities had the most impact in terms of income reductions. Education and Health Services had the least impact.

- Consumers with income less than $40K are 2.5X more likely in loan accommodations than those who make more than $40K.

- Moody’s is forecasting credit cards to have the largest drop balances going forward.

- While auto spending has been very healthy to date, there is a concern that there will be less demand going forward as a result of the weak labor market and fewer miles driven.

Consumer Confidence Outlook

During this week’s Market Pulse webinar, Denise Dahlhoff and Gad Levanon, both from The Conference Board, shared their perspectives on the state of today’s consumer. Key takeaways from their discussion include:

- COVID-19 changed consumer habits, many of which may be permanent and have lasting impacts on spending, and a variety of industries.

- Temporary consumer shocks like supply shortages and shelter in place regulations pushed consumers toward do-it-yourself models and digital activities to manage through the health crisis.

- People making their own masks, disinfectants and tackling home repairs became major trends as consumers worked to overcome supply shortages.

- On the lockdown experience, consumers shifted to “digital everything” - from online learning and e-commerce to digital fitness classes.

- Longer-term consumer changes associated with health risks and the potential for another financial crisis may have lasting effects, impacting a cross section of industries.

- Consumers are likely to embrace social distancing behavior as a new norm, turning away from group activities like mass transit, gyms, movie theaters and retail environments.

- A weak economy will also keep consumers “value-minded” and cost conscious about premium prices, goods and experiences.

Alternative Data Trends

Executives from Urjanet and Yodlee joined our alternative data webinar and presented several points including:

- Lenders are adding new strategies around consumers who are active in the specialty finance space. Lenders are interested in how specialty finance and alternative data sets can help them with universe expansion, risk mitigation and higher campaign response rates.

- The National Consumer Telecom and Utility Exchange (NCTUE) provides insight into a consumer's payment habits for such things as pay TV, home security, utilities, internet service and telephone.

- Using the NCTUE, which includes data on 38 million consumers who are not found in any other traditional credit file, can help increase consumer scores, especially for subprime borrowers.

- This and other alternative data sources are also increasingly being used for financial inclusion, and as a tool to help lenders better manage risk in new account acquisition and portfolio management.

- An Equifax and Yodlee analysis found that adding customer permission alternative data to traditional credit models, provided a significant lift in KS. By adding certain attributes in combination with Advantage score 3.0, data showed a 7.3% lift in KS from the general population. For sub segments such as thin file and near prime, sub prime, there was a 13.2% lift in KS and an 8.6% lift in KS for those two populations, respectively.

Housing Market Outlook

During this week’s Market Pulse webinar, our Equifax team was joined by Andrew Davidson, President of Andrew Davidson & Co.. Davidson shared his forecasts and scenarios for the overall economy and housing industry, including:

- Two of Davidson’s economic scenarios project a rapid snapback and then a longer pace until we get to full economic recovery.

- A COVID19 resurgence is a top risk to the economy. Finding ways of social distancing in a more economically favorable way, will potentially enable the economy to open sooner.

- Expectations that mortgage rates will continue to decline with Fed funds and treasury rates so low.

- How servicers handle growing forbearance demands will impact how far mortgage rates will fall.

- Expectations that home prices will remain stable and possibly even rise, depending on improving employment gains.

The Shifting Tide of Marketing Strategy

During the May 7 Market Pulse webinar, our Equifax team was joined by special guest Laura Ziemer, Director of Insights at Mintel Comperemedia. Laura discussed how to think about marketing given current economic trends and consumer behaviors. The following points were shared by Laura during the discussion:

- Financial services brands may have changed their marketing volumes in digital channels, but they are still marketing.

- Credit cards that are rooted in travel and entertainment rewards are being restructured to encourage consumers to continue using their cards during this time.

- Marketing for deposits has been relatively stable. There are a lot of communications focused on bank branch updates, and how customers can use online platforms and mobile apps for banking and deposits.

- For lending, specifically personal loans and mortgages, digital acquisition volume is up. There are a few big pushes from some key players and some challenger brands offering loans.

- Investment marketing volumes are down, but not as drastically as some categories like credit cards. Communications have been focused on the stock market with very aggressive messages and bonus offers. For example, some fintech brands are offering large $25,000 incentives for new account openings.

Laura also discussed the importance of targeting strategies in this shifting environment. She encouraged brands to think about modeling, and expects more sophistication in reaching the most credit worthy customers, through both direct mail and across the omni-channel landscape. She also expects brands to lean on social media for communicating with existing customers.

In closing Laura said, “There's a lot you can do with your first party data to communicate about things going on with branches, for example. And with that depth and bonus for deposits, people are really focused on savings and so we're seeing a lot of competition here in terms of cash bonuses for offer strategies.”

Proactive Portfolio Management Strategy

During the May 7 Market Pulse webinar, John Fenstermaker, Equifax Vice President and Chief Innovation Architect, put our latest Credit Trends report into perspective. Our team conducted a deep analysis on the impact of accommodation on credit scores, and ways to mitigate those impacts. By simulating different scenarios, it’s possible to measure the impact the loss of information caused by accommodation will have on credit scores. For example, John shared the results of a recent Equifax analysis on the score distributions and score performance under six different accommodation scenarios.

The results showed that even in the most extreme situation, with 12 months of accommodation applied on 50% of consumers, there are about 78% of consumers with no change to their credit score. In 89% of consumers, the change is within plus or minus 10 points. In 92% of consumers, the change is within plus or minus 20 points. Historically, credit scores do a very good job of capturing both a consumer's willingness to pay, and a consumer's ability to pay. When a credit score might not reflect an ability to pay is when a consumer has had a major life change like unemployment or medical crisis. These are attributes that have a high impact on credit scores, and as a result, need to be closely monitored.

Conducting regular reviews using simulated scenarios and predictive analytics can help mitigate portfolio risks and help navigate the changing economic environment. Tune in to our weekly Market Pulse webinar series for updates on the economy, credit trends and additional timely insights aimed at helping businesses navigate these uncertain economic times.

Scenario Forecasting to Better Manage Risk and Expectations

During this unprecedented time, lenders and service providers are striving to predict losses and better manage risk in their portfolio. One of the main themes we are focused on to help them navigate this fast changing environment is a concept we call “monitoring with agility.”

It’s a data-driven approach that can improve modeling and forecasting by simulating different economic scenarios. For example, on our most recent Market Pulse webinar, we conducted a forbearance simulation on credit scores. That simulation enables lenders and providers to have a better view of what a six month go forward score would look like under an individual forbearance scenario. We can do that with dozens of different elements.

Through our partnership with Moody’s, you can also take Equifax credit trends data and merge it with Moody's economics scenarios through our CreditForecast.com platform. Having the ability to look at different credit elements over time in various economic environments, gives you a clearer picture of potential outcomes. In this fast changing environment, we’re encouraging our clients and partners to “monitor with agility” by leveraging the power of credit data and analytics in different simulated environments.

Additional Resources

Our Equifax Response packages have been developed from our full suite of differentiated data and solutions (including credit, alternative data, employment & income, and wealth information) to address the evolving needs of businesses in the wake of COVID-19. Newly-launched in August, Equifax Response Recovery was built from the ground up to enable financial institutions to responsibly offer consumers and small businesses access to credit. This solution offers the ability to:

- Identify consumers with at least one accommodation type

- Get real time alerts on consumer credit behavior changes to manage risk and deliver timely offers

- Understand consumer credit, delinquency, spending, employment, and income trends

- Get reliable predictors of small business fitness, advance signals of business cycle inflection points, and statistically valid indicators of unemployment change

Tune in to our weekly Market Pulse webinar series to gain the latest updates on the economy, credit trends and additional timely insights on the economy.

Recommended for you