December 2024 Key Consumer Credit Insights

In the December 2024 Market Pulse Webinar, our panelists shared the takeaways from 2024’s economic outcomes. For a recap of that information, read the blog.

Equifax Risk Advisor Jesse Hardin explained current consumer credit trends as we head into 2025. While this overview is meant to be a snapshot of the larger discussion, you can receive full access to the standard charts and graphs by reaching out to the Equifax Risk Advisory team: RiskAdvisors@Equifax.com.

December 2024 Consumer Credit Trends

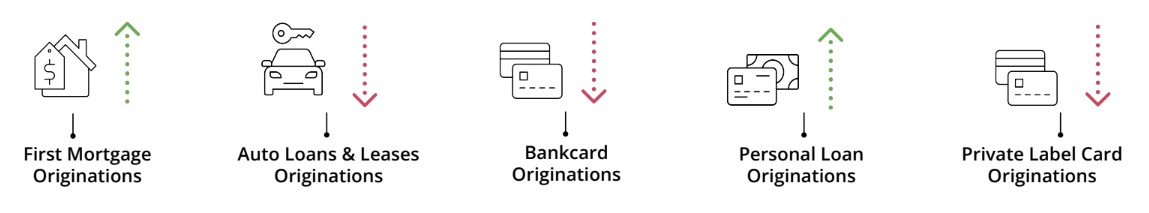

As of August 2024, consumer originations slowed across

several lending categories as higher interest rates, higher prices,

and tougher lending standards weigh on consumer demand.¹

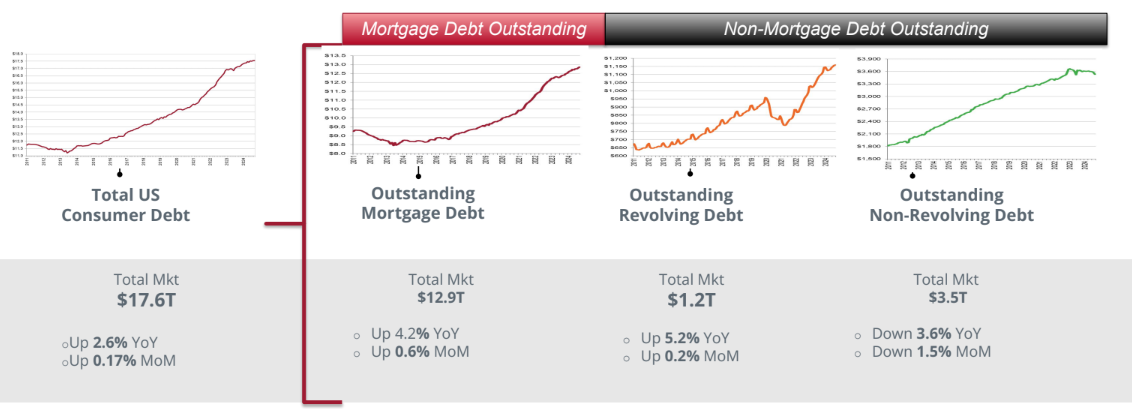

As of October 2024, outstanding mortgage and revolving

consumer debt continues to climb year-over-year while non-revolving

debt outstanding has slowed.²

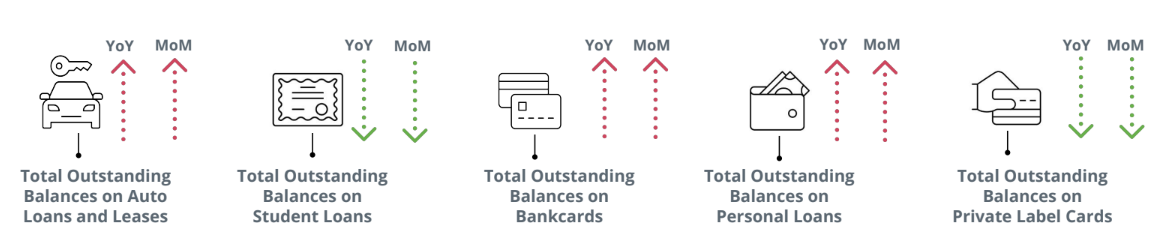

As of October 2024, non-mortgage outstanding consumer debt

has increased for auto, bankcards, and personal loans. Other

categories, including student loan debt, have fallen.²

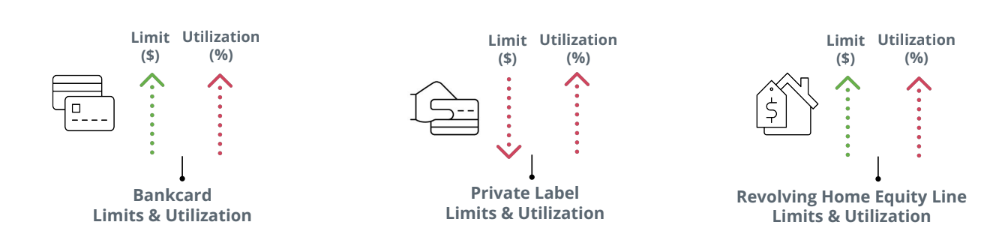

October 2024 saw utilization and credit limit increases for

bankcard and home equity, but these were mixed for private label

card.²

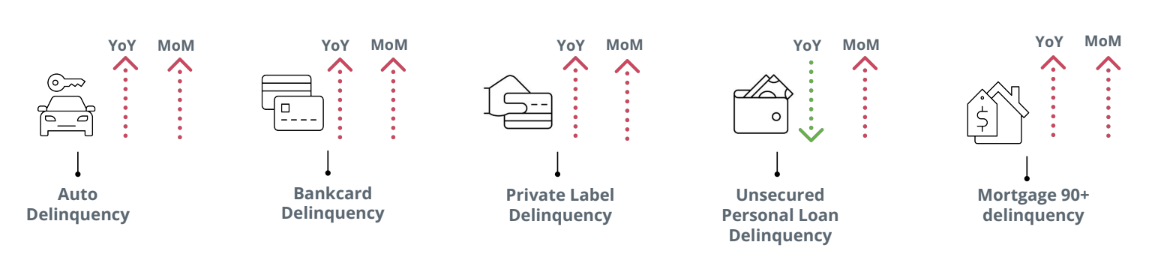

October 2024 delinquencies increased year-over-year,

confirming continued consumer stress.²

Stay in the know

To receive full access to the standard charts and graphs referenced in this report, reach out to the Equifax Risk Advisory team: RiskAdvisors@Equifax.com.

Want to learn more? Read an overview of the full December 2024 Market Pulse webinar or watch the full webinar.

We hope you will join us for our January Market Pulse Webinar taking place on Thursday, January 23, 2025. We will be focused on how to prospect to Gen Z, the audience that is at or near the start of their credit journey either as a consumer or as a business owner.

You can find our monthly Small Business Insights, National Consumer Credit Trends reports, the Market Pulse podcast, and more at our Market Pulse hub.

Finally, connect with us on YouTube and LinkedIn for even more content to help you focus on forward.

Sources:

-

Equifax US National Consumer Credit Trends Originations Report - Published Dec ’24 - Originations through August ‘24

-

Equifax US National Consumer Credit Trends Portfolio Report - Published Dec 2024 - Data as of Oct 2024

(c) Equifax Inc. 2024. All Rights Reserved. The statistics provided herein are for informational and illustrative purposes only and shall not be used for any other purpose.

*The opinions, estimates, and forecasts presented herein are for general information use only. This material is based upon information that we consider to be reliable, but we do not represent that it is accurate or complete. No person should consider distribution of this material as making any representation or warranty with respect to such material and should not rely upon it as such. Equifax does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice. The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

Recommended for you