Auto Insights: How to Move Forward Given Current Trends

In the ever-evolving landscape of auto financing, a multitude of factors shape market dynamics. From shifts in lender strategies to changing consumer profiles, automotive lending is a complex tapestry. That is why we summarized key insights and trends below. You can dive into the numbers in our May 2024 Auto Industry Insights report.

Current Landscape

Here’s what we know: in recent years, the automotive industry has changed vastly. Every facet has been challenged in some way including:

-

shift to more digital auto sales,

-

supply chain disruptions,

-

inventory shortages,

-

high new and used vehicle prices,

-

and so on.

With economic issues like inflation, lenders are facing a rise in loan delinquencies. This means auto lenders and dealers need a full view of customers to help identify those that can afford to buy vehicles. Using traditional credit and marketing data can help dealers and lenders find customers who can afford vehicles. However, there are more strategies that will help optimize the process and profitability. They include: understanding current auto industry trends. And, how to use non-traditional data and strategies well.

Current Trends

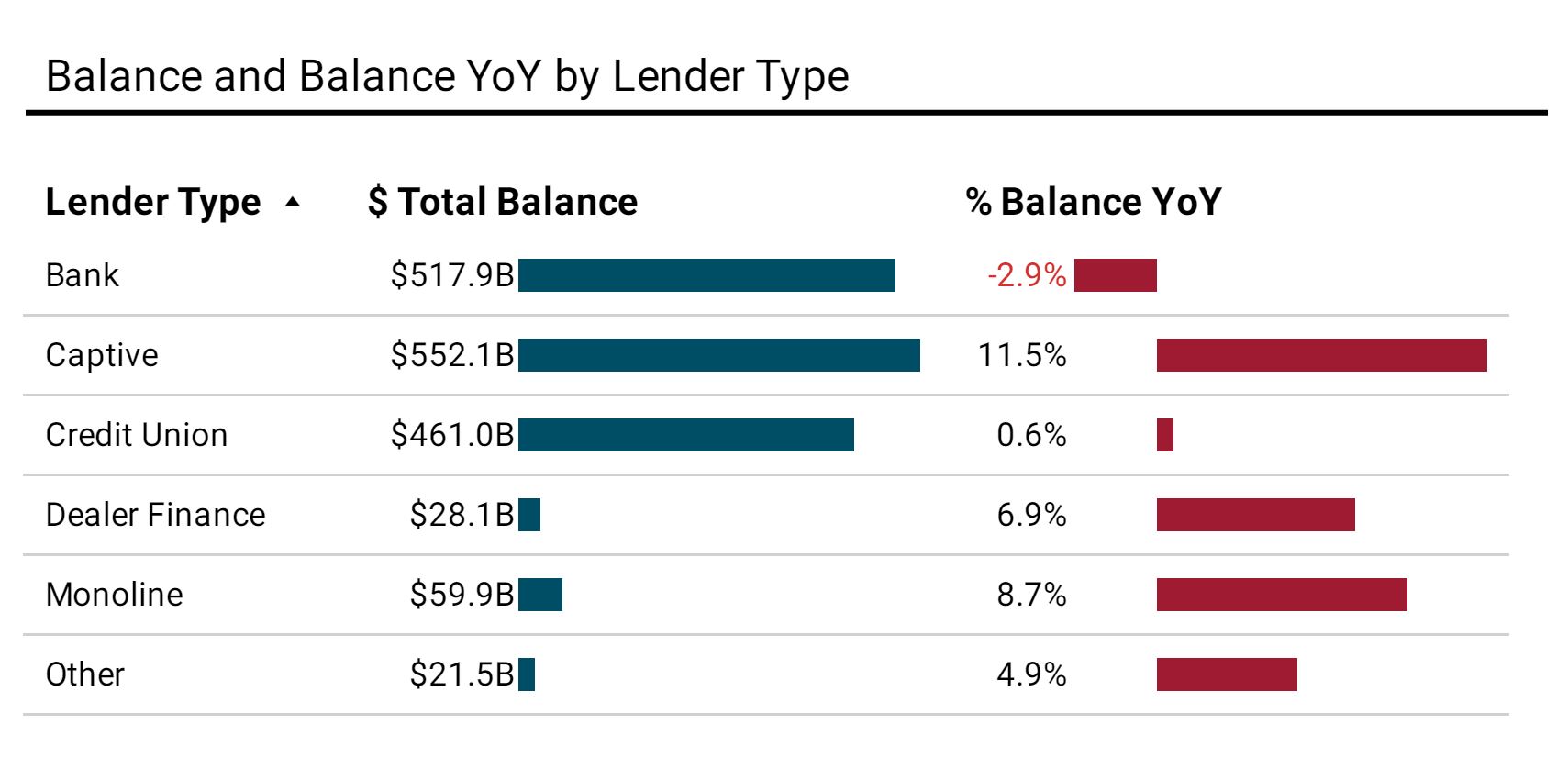

One prominent trend is the increase in year-over-year (YoY) balances held by lenders outside of traditional banks. This accounts for approximately one-third of outstanding balances. This expansion signifies a diversification in the lending market. It offers consumers more options beyond conventional banking institutions.

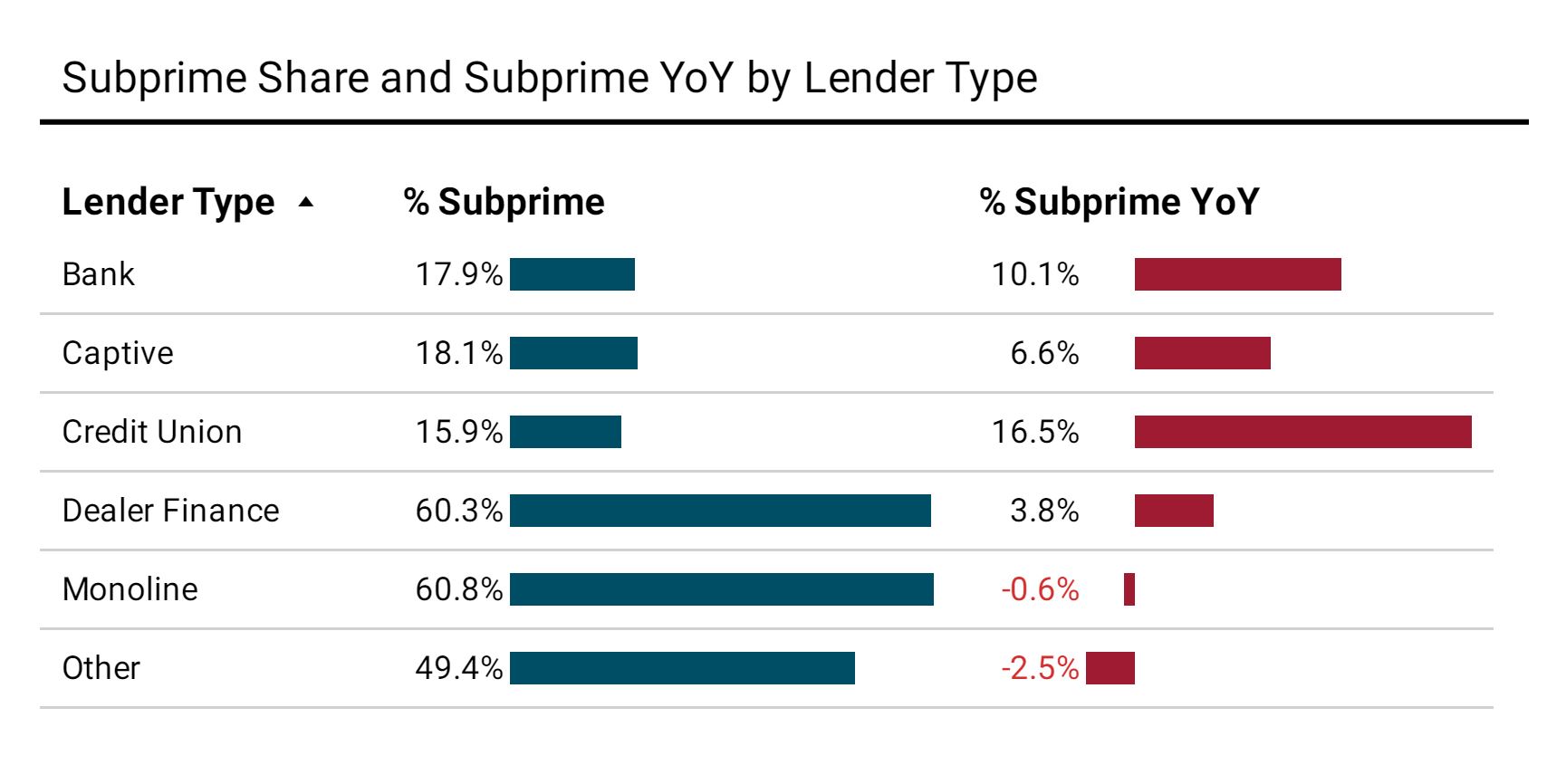

Interestingly, while credit union subprime shares have risen, much of this uptick aligns with their consistent strategic approach rather than a sudden shift. However, credit scores do not tell the whole story. Factors like payment-to-income ratio and loan-to-value ratio play pivotal roles in structuring deals and approval strategies that provide a more nuanced understanding of risk.

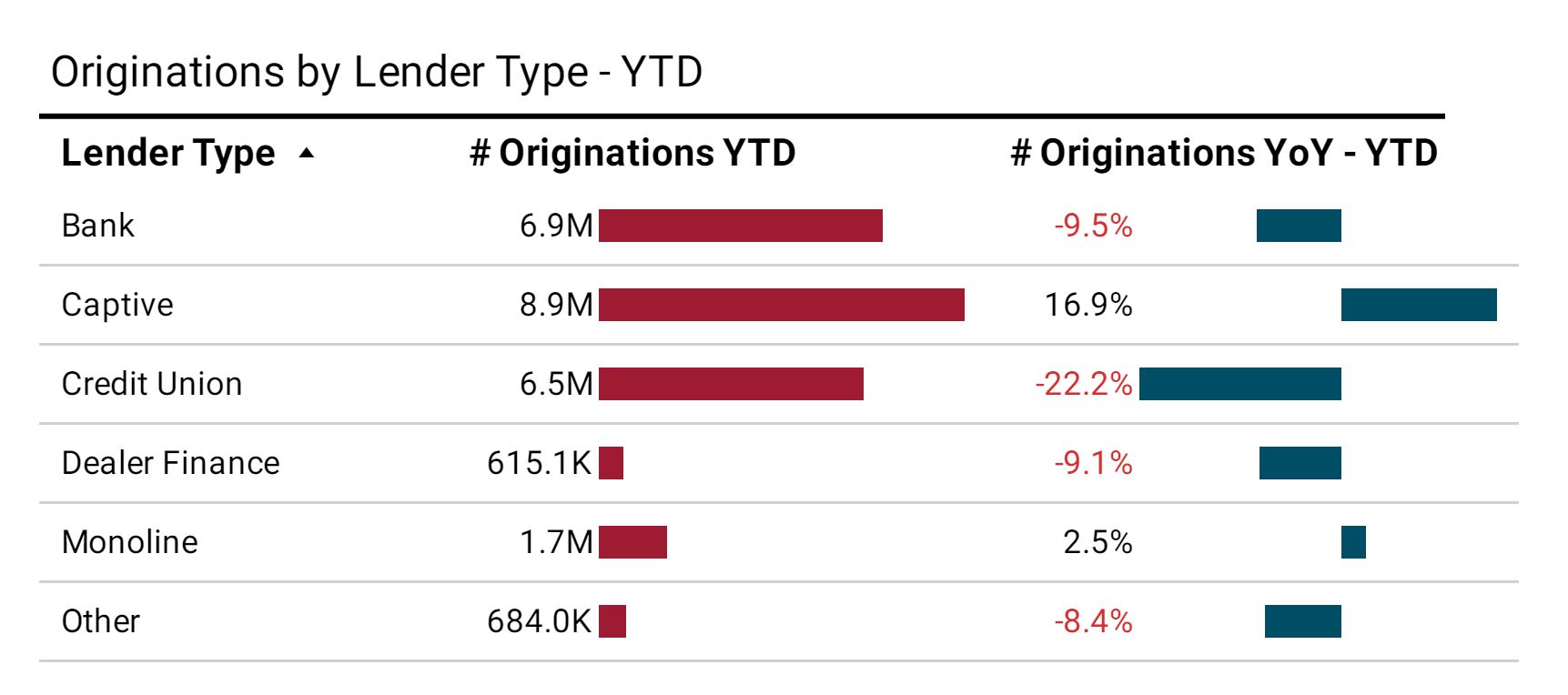

Despite an overall decrease of 5.3% in originations YoY, captive and other monoline lenders stand out as segments experiencing growth. This growth is particularly pronounced in super-prime lending, reflecting a preference for high-quality borrowers in the auto loan and lease markets.

(c) Equifax Inc. All Rights reserved. The statistics and information contained in these materials are illustrative for informational purposes only, and shall not be used for any other purpose.

Recommended for you