April Market Pulse: Supply Chains’ Impact on the Economy

This is a recap of our April 14 Market Pulse webinar, where our panel of experts discussed the recent supply chain crisis, as well as the latest economic update, small business insights, and consumer credit trends. The recent update of our global supply chain shows the impact and factors which have taken the toll to cause such a crisis. Below, our expert provides the many reasons why we are having a supply chain problem and which markets are being affected.

This month’s presenters included Daniel Pickett, Chief Data & Technology Officer at Freight Waves; Robert Wescott, President & Founder of Keybridge; Sarah Briscoe, Lead Commercial Statistical Analyst at Equifax; and Tom Aliff, Risk Consulting Leader at Equifax.

Where have we gone since February 24?

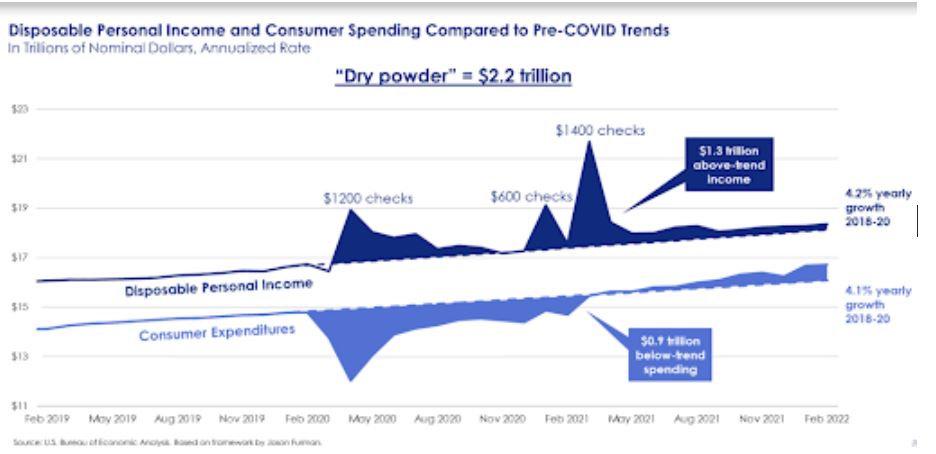

For the first time in a while, the U.S. economy was on track for healthy growth with consumers and manufacturers leading the way. Yet on February 24, 2022, Russia invaded Ukraine and the GDP growth declined from 3.5% before February 24 to 2.8% post-February 24. According to Robert Wescott, President & Founder of Keybridge, since the invasion of Ukraine, U.S. consumers have been largely on solid ground, sustained by stimulus checks, and savings from foregone spending. That being said, the U.S. still has $2.2 trillion of “dry powder.”

As seen in Figure 1, Wescott explained that the chart shows when the problems hit over the last few years especially due to COVID and people staying home. The top line is disposable personal income, the bottom line is consumer spending, and the left third of the consumer spending line is what happened before COVID-19 hit. The shaded area on the consumer expenditures line shows all the money consumers did not spend by not eating out, going to movies, and traveling.

On the income side, (the top line) Wescott stated, that it

is interesting that we put trillions of dollars in people's pockets

with the three checks, but still have $2.2 trillion. This will keep

driving the economy as consumers still have money in their pockets

continuing into 2022.

Figure 1

Is the labor market crisis resolved?

The U.S. labor market has officially recovered. As of recently, more sectors of the economy have recovered the jobs they lost in April 2020. The unemployment rate is down to 3.6%, which is back to its pre-pandemic level. Looking at the jobs that were lost in April 2021 on the left of Figure 2, we can conclude that 20 million jobs were lost that month, but a year later we have almost gained all the jobs back. We have not hit the number yet, but we are getting there rapidly, especially for 15 different occupational fields (shown on right of Figure 2). In December none of the occupational fields had retained their last job in that one month and now half the sectors have, concluding we are seeing a rapid healing of the labor market.

Figure 2

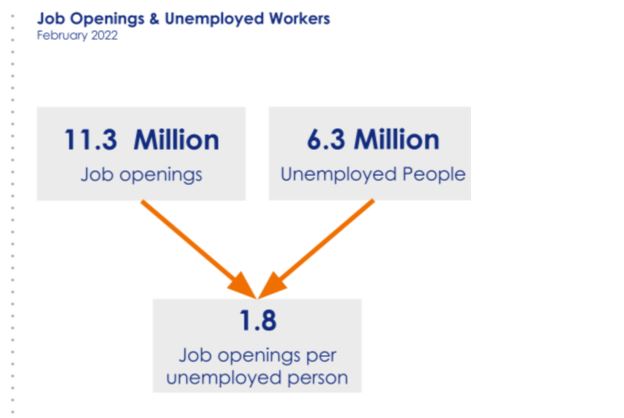

Labor markets are now in a rapid transition to the great resignation. With 11.3 million job openings, many of these workers are feeling empowered, making them more likely to want to quit their job. According to Figure 3, we have 11.3 million job openings and only 6.3 unemployed people.This is the highest ratio we have ever seen in 70 years. However, we are concerned about a few factors that can affect the supply chain, including COVID-19 developments, the Russia and Ukraine war, and inflation.

Figure 3

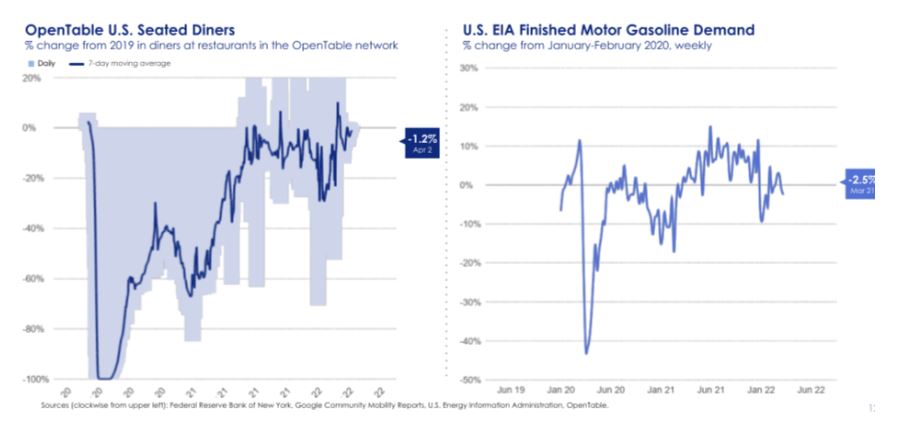

Factors affecting the supply chain

Though many of us may feel the pandemic is practically over,

recently there have been 20,000 COVID-19 cases a day in China.

Unfortunately, these growing infections could cause a disturbance in

our global supply chain. With 45 cities in China in lockdown (reported

on April 14, 2022) we are concerned that China will continue to go

through more disruptions that could continue to affect the global

supply chain.

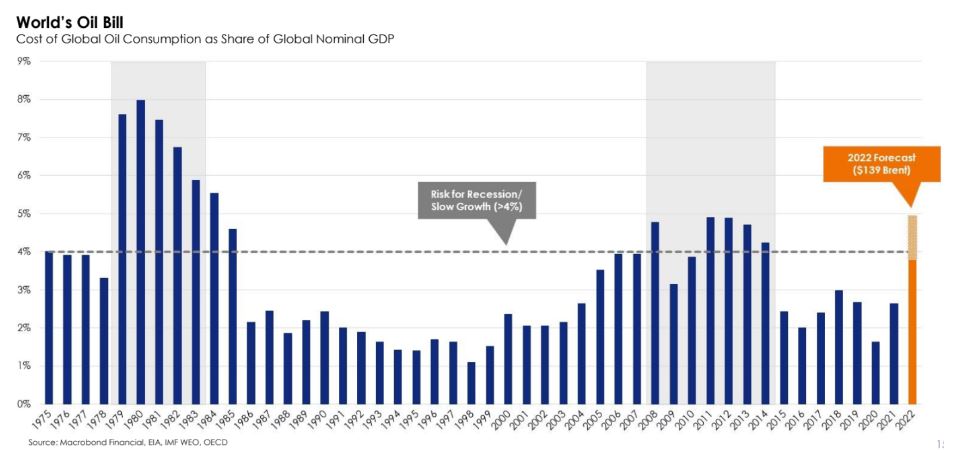

The other factor affecting the global supply chain

is the Russia and Ukraine war. This recent war has increased oil

prices which will negatively impact consumers, businesses, and

financial markets. For more on the expected effects, please refer to

Figure 4.

Figure 4

The World's Oil Bill is the value of all the oil in the world divided by global GDP. The World’s Oil Bill is a great way to assess how Russia is impacting the economy. From previous times when it tops 4%, the world GDP growth tends to slow down. Figure 5 shows what is happening right now.

Other effects from Russia's invasion of Ukraine include the supply chain of metals. German auto companies are shutting down. Wescott mentioned how expensive gas prices are in Europe, which is causing shutdowns of aluminum shelters. This could lead to Europe going into recession. Wescott continued by mentioning that the war is also affecting aluminum, nickel and copper supply as well as the global fertilizer market and food supply. Russia and Ukraine together produce 30% of the world's wheat, which caused problems in Cyro.

Figure 5

Is there inflation in the U.S.?

Higher oil prices have given a boost to inflation in the U.S. In Figure 6, Wescott described how inflation continues to be on the rise. Keybridge, where Wescott is President and Founder, has created a list called, “Top 25 CPI Categories to Watch,” which is the measurement of underlying inflation, which is now running above 6%.

Some examples of items in Keybridges’ “Top 25 CPI Categories to watch” include:

- Rent

- Owners’ rental equivalent

- Wireless telephone service

- Limited-service restaurants

- Insurance

- Electricity

- Trash collection/water

- Grocery store items

- Financial services

- Veterinarian services

- Boys and girls clothing

- Household operations

To learn more about the recent economy and other material we presented during our April 14 Market Pulse webinar, including consumer credit trends, and small business indices, watch our webinar recording or download the slides.

* The opinions, estimates and forecasts presented

herein are for general information use only. This material is

based upon information that we consider to be reliable, but we do

not represent that it is accurate or complete. No person should

consider distribution of this material as making any

representation or warranty with respect to such material and

should not rely upon it as such. Equifax does not assume any

liability for any loss that may result from the reliance by any

person upon any such information or opinions. Such information and

opinions are subject to change without notice. The opinions,

estimates, forecasts, and other views published herein represent the

views of the presenters as of the date indicated and do not

necessarily represent the views of Equifax or its management.

Recommended for you