Analysis: How Buy Now, Pay Later can Impact Consumer Credit Scores

For our February 10 Market Pulse webinar, we discussed Buy Now, Pay Later and their effect on consumer credit scores, plus consumer credit trends, the recent U.S. economy, and new commercial insights.

This month’s presenters included Suna Hafizogullari, Senior Director of Data Science at FICO®; Amy Crews Cutts, President and Chief Economist at AC Cutts & Associates; Sarah Briscoe, Lead Commercial Statistical Analyst at Equifax; and Bob Hofmann, Risk Solutions & Consulting SME at Equifax.

As previously announced, Equifax will be accepting Buy Now, Pay Later (BNPL) trades as part of credit reports, and a new industry code has been created for this purpose. We have completed a thorough analysis of the impact that incorporating these trades can have on the FICO® Score based on a data sample of actual trades provided by a popular BNPL provider. During the webinar, FICO® shared their insights on the results of the analysis.

Watch a replay of our webinar, “Market Pulse: Buy Now, Pay Later Credit Score Impact Analysis” or download a copy of the presentation.

For more information on Buy Now, Pay Later check out our other blogs:

BNPL is meeting many needs

Amy Crews Cutts, President and Chief Economist at AC

Cutts & Associates, displayed the many reasons why people are

using Buy Now, Pay Later (BNPL). The pie chart below displays the

most common reason people use BNPL is to make a purchase that

would not usually fit in their budget, followed by the consumer

using the service to avoid paying credit card interest. However,

there are many other reasons why this service has become extremely

popular over the last few years (shown below).

(1).png)

Next, Cutts analyzed how consumers over the last three years have paid for their Black Friday in-store purchases. BNPL may have had the highest share when comparing the last three years in 2019 at 7.2%, but it continued to rise with 5.6% of consumers using BNPL on Black Friday in 2021. However, debit cards continue to be the most popular form of payment on Black Friday, followed by credit cards (shown below).

(1).png)

In 2021, when it came to Black Friday online purchases, the fifth most popular payment option was BNPL. This concludes that more people use BNPL when online shopping than in-store. 8.2% of consumers on Black Friday in 2021 used BNPL as their payment option as opposed to only 3.7% in 2020. That being said, there was a decent increase in BNPL users from 2020 to 2021. Amy Crews Cutts projects that this increase will continue to rise in 2022.

.png)

FICO® Score Impact Analysis

Before Bob Hofmann, Risk Solutions & Consulting

SME at Equifax, introduced Suna

Hafizogullari, Senior Director of Data Science at FICO®, he

defined what Buy Now, Pay Later is. Buy Now, Pay Later (BNPL) provides

short-term installment loans that typically are paid in four bi-weekly

installments. One benefit of BNPL is that often no interest is charged

on the loan. This type of loan is typically used for retail purchases

like electronics, clothing, household goods, and more. The types of

people that use this form of payment usually have less prime credit

and thin files.

Equifax researched the effect on the FICO® Score distribution of consumers with BNPL line of credit trades on their credit files. The methodology is shown below, which Hofmann went into more detail about in our webinar.

(1).png)

Next, Hofmann shared the profile of the BNPL tradelines used in

this study. 5.5 months of repayment history was reported on these BNPL

trades, on average. There was also an average utilization of 17.9% on

these BNPL trades, and there was a high concentration of subprime

consumers (FICO Score 8 <670). To be exact 91% of BNPL consumers in

the analysis dataset had a FICO® Score 8 <670. The FICO® Score 8

distribution graph is shown below.

(1).png)

FICO® Score 8 Impact Results

Suna Hafizogullari, Senior Director of Data Science at FICO®, emphasized that the precise impact to FICO® Score from the inclusion of BNPL tradelines depends on a number of factors: the consumer’s overall credit profile, their payment behavior on the BNPL tradeline(s), and how the BNPL account is reported.

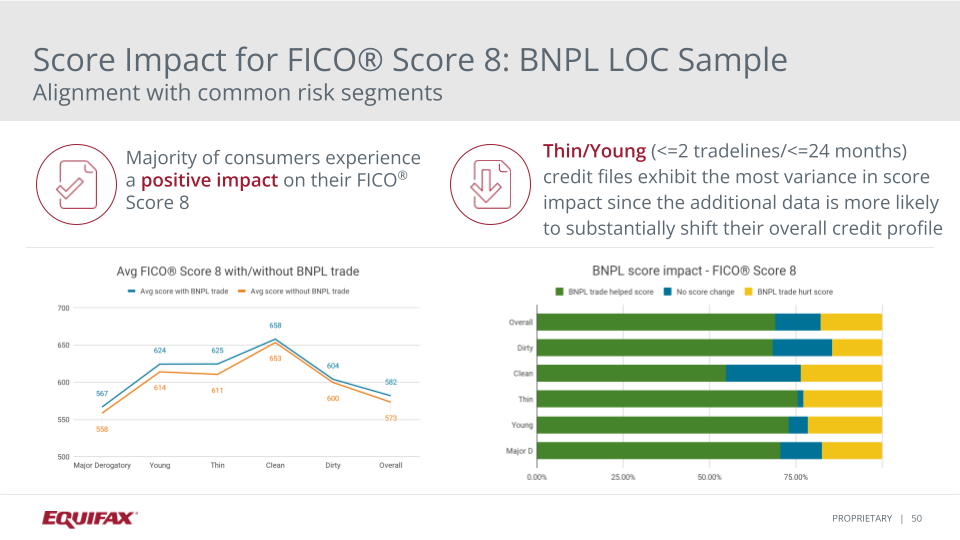

Next, Hafizogullari went over the impact of the FICO® Score 8 distribution with the BNPL tradelines. The starting FICO® Score for this portfolio is 573 and the average utilization on BNPL is 17%, while the average repayment window is five and a half months. In the Equifax study, we observed the majority of the consumers saw a positive impact on their FICO® Score from the inclusion of these BNPL tradelines. The graph on the left (shown below) shows an orange line, which is the average FICO® Score without BNPL tradeline. The blue line, on the same graph, shows what consumers scores looked like when including the BNPL tradeline: the average score increased from 573 to 582.

The chart on the right shows the percentage of the population whose FICO® Score was helped, hurt, or not impacted due to the BNPL tradeline. The green bar shows the percentage of the population that was helped by the inclusion of BNPL tradeline. These results are not surprising given that the BNPL tradelines were generally characterized by low utilization and an established history of on time payments. Hafizogullari concluded that consumers with thin and young profiles (referring to age of profile, not age of consumer) could bebe most impacted by the BNPL tradelines– -there was a 14-point average increase to a FICO® Score 8 when including BNPLs.

Hafizogullari continued by looking at the score impact for FICO® Score 8 current consumers versus non-current (30+DPD) BNPL LOC sample. She stated that the inclusion of on-time BNPL payment behavior during the study drove an increase in FICO® Score 8, which is the blue line on the left chart below. However, the inclusion of delinquent BNPL payment behavior (shown on the right chart) had a negative impact of around 21 points on FICO® Score 8. Delinquent behavior, regardless of product type (credit card, mortgage, etc.) will be penalized in the FICO® Score algorithm. In summary, the precise impact to FICO® Score of the inclusion of the BNPL tradelines depends on the consumer’s overall credit profile, their payment behavior on BNPL tradelines, and the approach taken by the furnisher in reporting that BNPL tradeline.

%20(1).png)

For more information and data from our February Market Pulse webinar including our consumer credit report and commercial insights you can download our powerpoint deck, or watch our replay of the webinar.

For additional related insights, check out our Market

Pulse hub.

And, for more information on Buy Now, Pay Later

check out our other blogs:

* The opinions, estimates and forecasts presented herein are

for general information use only. This material is based upon

information that we consider to be reliable, but we do not represent

that it is accurate or complete. No person should consider

distribution of this material as making any representation or

warranty with respect to such material and should not rely upon it

as such. Equifax does not assume any liability for any loss that may

result from the reliance by any person upon any such information or

opinions. Such information and opinions are subject to change

without notice. The opinions, estimates, forecasts, and other views

published herein represent the views of the presenters as of the

date indicated and do not necessarily represent the views of Equifax

or its management.

Recommended for you