Financial firms are focusing on risk mitigation during the pandemic, but that doesn't mean financial marketers should simply wait it out. While budgets may be impacted, marketers can help their companies move forward with the right data-driven financial insights. They can help both retain and acquire the right customers right now by focusing on customer engagement, growing assets and maintaining their brand presence.

The key is having better consumer financial insights. It’s no secret that many customers spread their assets across various investment providers and institutions. And as we already know, some consumers may have experienced significant losses from a spiraling downward economy. Having a holistic understanding of consumers’ true financial position -- including their financial potential -- can help guide more relevant marketing communications and more appropriate messaging. Moreover, these insights are critical to identifying the opportunities that lie across your portfolio and prospect landscape.

Here are some ways that we suggest marketers at banks, credit unions, brokerage and insurance firms leverage financial insights for their marketing programs.

1. Offer financial assistance to the right customers

Many firms have been very supportive in offering financial assistance to select customers. And often, determining which customers to assist and how relies on credit-based information.

However, financial marketers can also turn to other economic insights to help better understand customers and determine the correct audience for these programs. By applying additional data, such as estimated measures of investable assets and the ability to pay, marketers can further segment customers for the right offers and assistance options. This minimizes risk by identifying customers likely to have higher assets and ability to pay. Conversely, clients with greater need can be routed to more appropriate programs. Looking ahead, this is a valuable approach in determining how to evolve or even wind down assistance programs.

2. Keep it personal and relevant

The new economic reality has pushed personalization and relevancy to the forefront. Despite historic numbers of unemployment claims, the Consumer Confidence Index is actually up from the previous month. Varying surveys have shown that many individuals went into the pandemic with healthy savings and low debt, allowing them to better weather the storm. Despite that, there are still dual-income households working in the sectors most negatively impacted by the pandemic. Those households will be seeking and accepting far different offers and opportunities from their financial institutions.

Household financial insights provide marketers with a more robust view of their customers. They offer the ability to differentiate customers by their likely financial situations, behaviors and attitudes. For example, which of your customers are more saving-oriented? Which clients have been focused on retirement planning? With these insights, marketers can match the right products with the right customers. Furthermore, they can develop relevant and appropriate messages that will resonate with audience segments. This data enables financial advisors and bank representatives to reach out with personal calls explaining investment strategies to customers likely to have higher financial capacity. Whereas customers with more moderate financial capacity can receive emails detailing loan options.

3. Hang on to high-asset customers

Companies work hard to identify, acquire and onboard their customers. And now more than ever, they want to keep them -- especially their high value customers. With so much volatility in the financial markets right now, retaining and even growing the best customers is key.

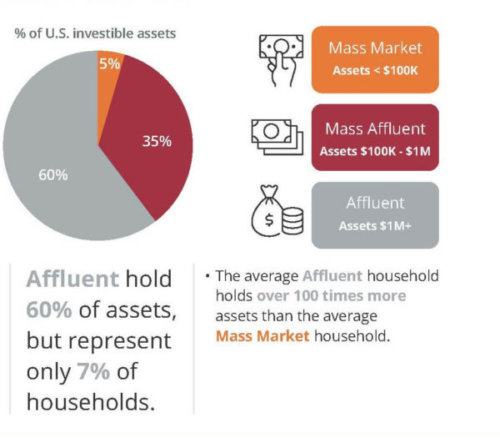

And while firms have a pretty good idea of who their best clients are, having a little extra insight on clients’ total asset potential can go a long way. It can make the difference in determining which clients may have significant assets at other firms and should be prioritized for continuous engagement and larger asset management needs. For instance, our data shows that wealth is highly concentrated: Affluent households with over $1 million in estimated total assets hold about 60% of the nation’s assets, but represent only 7% of households.

Households with high total assets are likely to be most concerned with long-term financial planning. This includes investment and tax strategies, retirement vehicles and insurance needs. By identifying high-asset potential clients, financial advisors can develop frequent communication plans that include continuous advice -- and even attract additional assets under management.

Households with high total assets are likely to be most concerned with long-term financial planning. This includes investment and tax strategies, retirement vehicles and insurance needs. By identifying high-asset potential clients, financial advisors can develop frequent communication plans that include continuous advice -- and even attract additional assets under management.

4. Dare we say it? Capture new investments

“Why did my financial advisor not warn me about this?” shrieks a disgruntled investor. There are plenty of dissatisfied investors out there who are not pleased with their financial advisors. Affluent investors holding over $1 million in invested assets are likely to have had about 85% of their portfolio in the market before the pandemic. Deposits make up just 15% of total assets. These invested assets have taken a huge hit as markets have declined drastically.

Most firms are focused on providing assistance to their current customers. But, financial advisors can still be on the lookout for new clients that could offer significant asset-growth opportunities. Even though asset values may be much lower than before the pandemic, financial advisors can leverage household asset insights to prospect for new clients. Specifically, advisors can use estimates of households’ total assets to find investors likely to have significant assets at other firms. Then firms can incent those investors to transfer accounts to their firm.

5. Gather deposits and help maintain liquidity

Understandably, financial institutions are concerned about liquidity these days. Growing deposits from both existing and new customers can be one way to help address this. Financial marketers can use insights on estimated total household deposits to identify two important audiences:

- Existing Customers - Identify those who may hold significant deposits at other firms.

- Potential Customers - Look to the right data to reveal new potential customers that are likely to hold high deposits, possibly from cashing out of the market during the pandemic.

By differentiating these customers, marketers can provide offers to incent deposit and other asset transfers to the firm. Additionally, this can help firms obtain brand new accounts.

6. Use financial insights to drive digital targeting and advertising

Digital advertising can help whether your goal is to maintain engagement, gather deposits or investments, deliver ITA messages or continue brand promotion. Powering digital ads with consumer financial insights can be an economical way to achieve these objectives. Companies can leverage hundreds of existing, financially-driven digital targeting segments (or onboard their own customer lists) to reach desired audiences. These could include households likely to have high assets, select investment or banking preferences, or those interested in new credit or insurance products.

Customers can receive messages via display, social, mobile, addressable TV and other digital channels where they are spending much of their time these days. Financial marketers want consumers to remember their brand in the months and years to come. Maintaining a digital presence can help firms to stay in front of optimal audiences. These may be times of upheaval in your business, but marketing continues to play an important role.

For more information, visit here to learn more about powering your marketing with the right data

Recommended for you