Many businesses operate in a transactional environment that requires fast credit decisioning. However, a variety of obstacles prevent them from quickly accessing the data needed to make confident lending decisions:

- Credit reports are typically too lengthy, complex and difficult to read

- Relevant details are often buried in the document

- Getting income, employment and credit data may require contacting multiple resources

- The time and effort to gather information is not always practical in an “approve or lose” sales environment

In today’s world of shutdowns and economic uncertainty, it is even more difficult to get reliable insights. Therefore, records on employment, income, assets, and bankruptcies that were valid a few months ago may no longer be current. The current economic environment makes it more crucial than ever for businesses to minimize their exposure. But while market conditions have changed, consumer expectations haven’t: consumers still want fast credit decisions. And, if credit decisioning is declined, they want to understand how and why that decision was reached.

Time for Better Reporting

The primary problem that businesses face is the fact that credit reports and credit decisioning haven’t changed substantively in decades. To meet today’s needs, the industry must push forward to deliver solutions that improve performance in five key areas.

1.) Deeper data. Today, credit bureaus are able to tap into a deeper realm of data that goes beyond traditional credit reports, and in near-real-time. This data includes income verification, rent payment history, utility payment history, and records from cell phone, cable and internet providers. With The Work Number®, lenders can see the consumer’s available income and employment data, while gaining a more informed financial picture of each individual in order to help consumers get the credit they need. The Work Number database includes nearly 115 million, easy to view, active employee records of real-time income and employment data making it the largest commercial source of consolidated employment information. The ability to access this information in near-real-time is important for two reasons:

-

First, businesses often find themselves dealing with consumers who have thin or no credit files. This deeper data can help them make more informed decisions about these consumers and potentially approve more customers.

-

Second, deeper data can help provide more up-to-date insights in today’s rapidly changing economy.

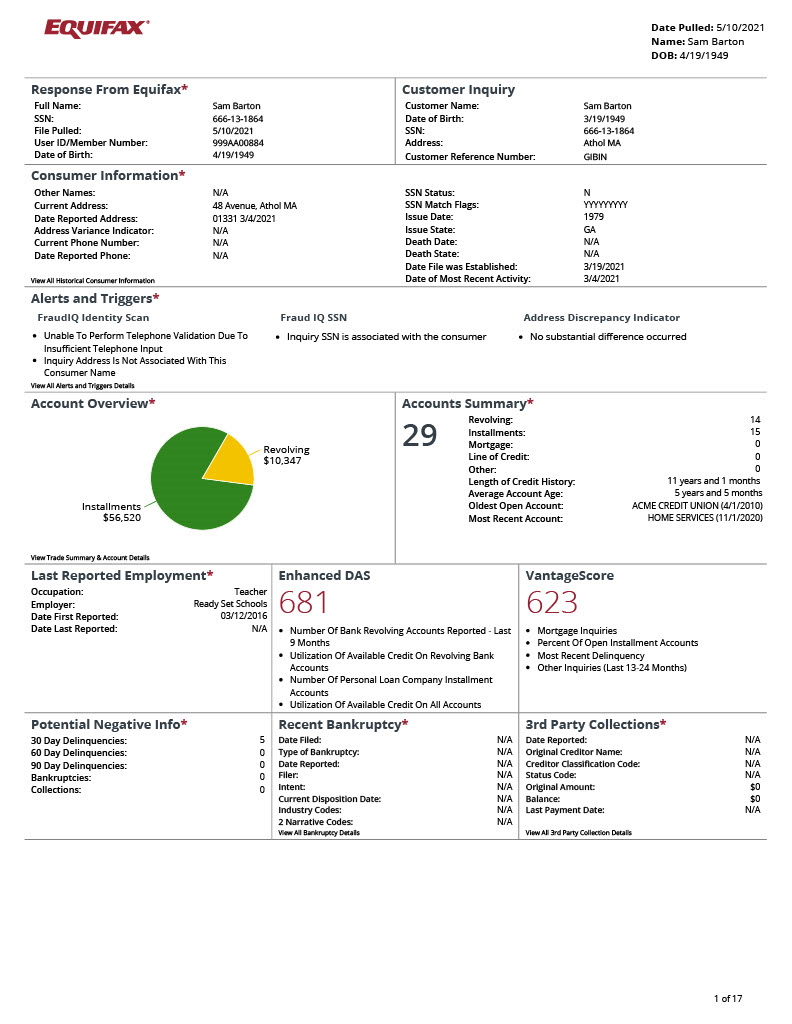

2.) ‘Human friendly’ report formatting. Businesses need reports that are not only shorter and better organized, but easier to interpret. That means prioritizing information so that the important data is presented upfront in a clear, concise format. It is also important to give individuals a choice between graphic or text-only formats, so they can select whichever they deem easier to analyze.

3.) Customization. Because different businesses base their decisions on different criteria, “one size fits all” reports are not an optimal solution. Therefore, a more effective approach would enable individual businesses to customize their reports to give top-line visibility to the specific data points that drive their credit decisions.

4.) Flexible, responsive report delivery. When speed is a top priority, leveraging the cloud to provide fast, secure delivery can help businesses mitigate risk and meet customer demands for fast approvals. However, some businesses may be set up for a more traditional API/system-to-system delivery. An ideal solution would give businesses the ability to choose either.

5.) Improved customer interaction. When a consumer’s application for credit is declined, their first response is to ask “Why?” Reports that are easier to understand by lenders can be easier to explain to the consumer. This helps consumers to better understand how and why the business arrived at their decision. It may not be the outcome that the consumer hoped for, but it makes the dialog between businesses and consumers more transparent and open.

As a result, to meet the challenges that businesses face, the ideal consumer report would offer substantial improvements in all five of these areas.

OneView: The New Standard for Clear, Concise Reporting

Equifax OneView has launched in response to the pressing need for clear, concise reporting for business. This easy-to-understand multi-page report that includes data from multiple sources features a standardized first page that contains all the information most businesses need to support their credit decisions. Users can customize and prioritize subsequent pages. The report can be viewed in graphic or text-only formats, and accommodates both cloud and API delivery.

OneView summarizes certain information on a single page to help financial institutions focus on the information that matters most to their decisioning. Powered by the industry's first drag and drop configuration engine, OneView allows businesses to customize their reports to focus on the information that best suits their decision models and priorities. Graphical charts provide historical credit data analysis and directional insights, helping lenders more quickly visualize key credit decisioning drivers.

Leveraging the Equifax Cloud, OneView is the next generation of the Equifax TotalView product, which provided the industry's first full view into credit, employment, and income status, with traditional credit data delivered alongside employment and income data. Current Equifax OneView customers with existing access to The Work Number service for digital verifications can leverage this new functionality today. The Work Number database, which is separate from the Equifax credit reporting database, is the largest commercial source of consolidated employment information, with nearly 115 million active employee records.

“We understand that every business is singular, and every customer interaction must be highly personalized. Two people with exactly the same credit score can have very different financial profiles and very different financial needs. Two businesses may have different appetites for risk and different underwriting guidelines. The Equifax Cloud enables us to create unique, multi-data source solutions like OneView to provide the tailored, customizable insights each lender needs to power more intelligent decisions for their business and their customers.”

- Mark Luber, Chief Product Officer for Equifax United States Information Solutions (USIS).

Finally, There is a Better Way

In conclusion, OneView provides an opportunity for

businesses who want to reduce risk, while remaining responsive to

their customer base. OneView helps

businesses access the data they need in a clear, concise, customizable

format. For more information or to request a demo, contact us today.

Recommended for you