2021 Insights for Small Business and Commercial Real Estate

In this recap of our March 4 webinar, "Market Pulse: Return to Opportunity for Commercial Real Estate," Sarah Briscoe, senior statistical analyst at Equifax; Bill Phelan SVP and general manager of Commercial at Equifax; and Carl Streck, co-founder and CEO at MountainSeed, provide the latest small business and commercial real estate insights.

Small Business Delinquency Trends

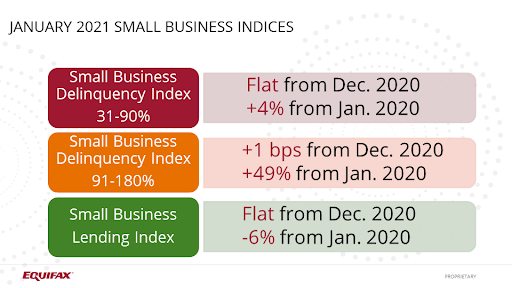

Small businesses are one of the sectors that will experience long-term challenges due to COVID-19. While fewer businesses are experiencing new financial stress, a significant number are still struggling to recover from the pandemic. Case in point, small business delinquency at the measure of 31 to 90 days past due is flat from December 2020, but up 4% over last year. The Small Business Delinquency Index from 91 to 180 days past due showed more severe rates, which were only up slightly from December, but up 49% over last year.

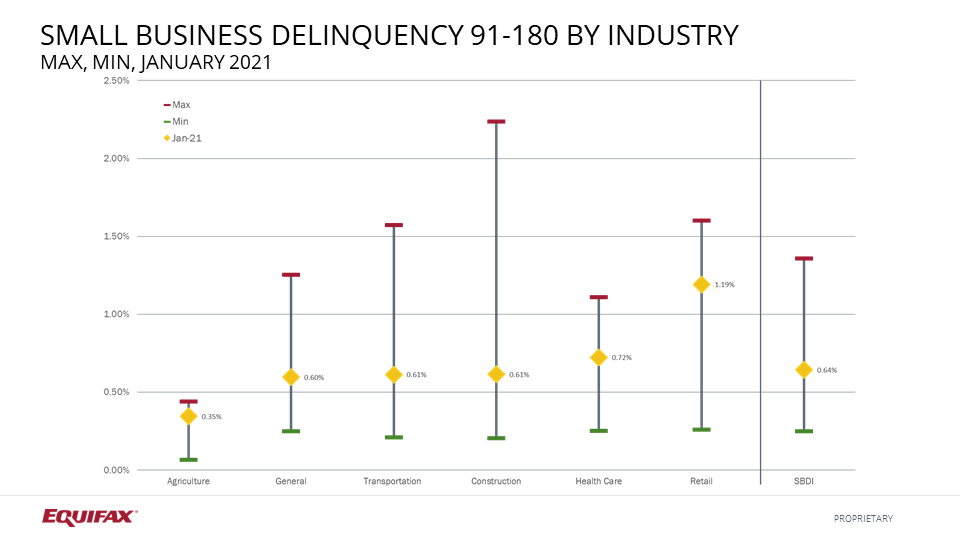

Breaking down delinquencies of 91 to 180 days by industry showed that overall rates are below highs experienced in the Great Recession of 2008. The image below shows the maximum (red) and minimum (green) rates from 2005 to January 2021. The yellow diamond shows today's rates. Retail is one of the closest to its historical maximum, showing an increase in 10 of the past 11 months, Briscoe explained. In contrast, construction saw very deep impacts from the Great Recession, but delinquencies are way below the heights seen in the last recession.

Small Business Lending Trends

Small business lending has improved in recent months, but remained flat from December 2020 and down 6% from last year. However, some states are experiencing higher stress levels than others. The biggest decreases in small business lending were experienced by northeastern states like New York, New Jersey and Pennsylvania. Additionally, Nevada, California and New Mexico all also saw lending decreases. More rural economies performed better and saw lending increases, including Idaho, Montana, South Dakota, Maine and Vermont.

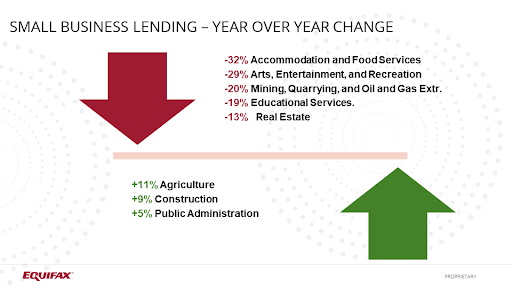

The largest investment decreases (down 32%) by industry were in accommodation and food services. Specifically, hotels and restaurants were most impacted, as well lending for arts, entertainment and recreation, which was down 29%. The real estate business was also down 13% because it struggled with issues like missed or delayed rent payments for both commercial and residential properties. Briscoe pointed to a more positive trend: a lending increase for agriculture (11%) and construction (9%) and a slight increase for public administration (5%). Last summer, construction improved as people bought new homes and made improvements to existing one during the pandemic.

Commercial Real Estate Trends

Phelan and Streck say the CRE sector has been hit hard by COVID-19 and is facing long-term challenges ahead. Currently, forbearance is high, with 59% of commercial real estate executives surveyed reporting an increase in late or missed payments or partial rent payments for office, retail and industrial. This can be costly to businesses. In fact, it can top $60 a square foot during the term of the vacancy, according to Phelan.

Real-Time Accurate Data is Key for Success

The real estate industry needs real-time, accurate data that is easy to obtain, said Streck. Historically, most data was aggregated from cold calls to real estate brokers and agents in small markets throughout the country. This led to biased and inaccurate data. However, moving to data collection from appraisals has been an innovative approach to obtain unbiased, accurate and real-time information. This higher quality data can help with stress testing, portfolio monitoring, inspection tools and tenant risk assessments.

Furthermore, it will help gauge the health of a property and loan. Additionally, Equifax studies have shown that even a 30 point difference in the assessment of a tenant can result in up to a 20% difference in the actual property's cash flow, said Phelan. Just consider the impact of 30 basis points over 30 tenants spread over many months. Interested to learn how your CRE would perform in our Tenant Risk Assessment? Schedule a demo and free assessment.

COVID-19 Impacts on CRE

COVID-19 has made it even harder to get accurate information. Streck said this is due to confusion in the marketplace, challenges validating a P&L and having boots on the ground. He also cautioned that the true impacts of COVID-19 on the commercial real estate (CRE) have yet to unfold, due to government stimulus and other protections like the eviction moratorium and forbearance. Hotels, retail, data centers, single-family construction and home improvement loans or new construction builder loans are all areas to watch. Conversely, certain suburban markets are doing well, as people moved out of urban centers. An increasing number of people also make traditional resort areas their primary residence while working from home.

Is a Return to Office on the Horizon?

As COVID-19 numbers decrease and more people get vaccinated, will there be a push to return to office (RTO)? Phelan cited the Coldwell Banker CEO Richard Ellis as stating that 85% of businesses plan a return to office. But Streck believes there will likely be a hybrid working model that gives people more flexibility to work a few days in the office per week. And employees may not approve of offices that shifted to high-density workbenches and open floor seating, which even after COVID-19 won’t be as accepted. Additionally, Streck added that even if work from home continues, square footage will likely increase by 50% per individual employee. Overall, Streck noted that the net effect of the office might not be impacted too much. Much remains to be seen for both small businesses and CRE, and a lot will depend on the health and economic developments of this year.

Don't miss the first article in this 2-part blog series, "How will Vaccines Impact the 2021 U.S. Economy?"

Watch a recording of our webinar "Market Pulse: Return to Opportunity for Commercial Real Estate" and download a copy of the presentation slides. Contact us to speak to an Equifax representative about any of the data or solutions mentioned in this blog.

Recommended for you