SPOTLIGHT: Neural Networks for Next Level Performance

Data Scientists:

Do you love the new machine learning techniques but still can’t wrap your head around how to explain your results?

Have you been wondering how to use the latest machine learning techniques to generate better scores and increase the profitability for your organization?

There is now a way to do this, while still allowing you to meet your regulatory and compliance obligations and explain your results. In the credit risk industry, we have noticed an appetite to explore new machine learning approaches.

Imagine being able to improve approval rates by 7%* by using machine learning techniques like neural networks. Now you can make that dream a reality. Let’s take a look at how it works:

Traditional methods versus Neural Networks

Consumers sometimes struggle to pay back their loans, creating financial stress for both the credit provider and the borrower. In anticipation of this, credit providers have traditionally used past behavior and predictive statistical techniques to determine if a consumer has the capacity to service the loan.

Using traditional methods

Traditional methods like logistic regression allow a credit grantor to predict the likelihood of an adverse activity and then provide clear reasons for why a score was given. The challenge with these traditional techniques is that they don’t provide the accuracy and speed that is available in machine learning techniques like neural networks.

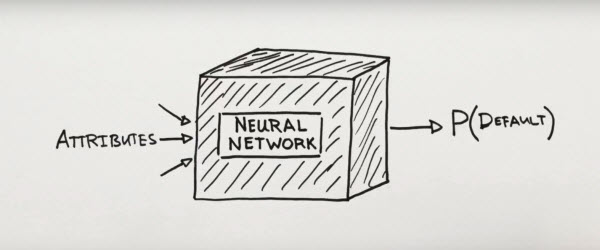

Neural Networks lack explain-ability

While popular machine learning techniques offer improved model performance and accuracy rates, they inherently lack the explain-ability and transparency that is required for compliance and regulatory purposes. For example, in a logistic regression framework, a factor like the level of income may only be a positive contributor to a score while in a neural network scenario, it could sometimes be a positive contributor to a score, and in other scenarios be a negative contributor to a score, without an explanation as to why. This may lead to compliance or regulatory risk.

Solution: Going ‘Neural’ with NeuroDecision® Technology

Using NeuroDecision in a model or score allows for traditional model output, scores and reason codes, the latter being the critical missing component from popular machine learning techniques and the primary barrier to achieving improved model accuracy and increased profitability.

The results speak for themselves

Market results show an improvement over and above logistic regression techniques of 7% increase in approval rates* and 13% increase in detecting bad customers*, improving profitability.

The benefits of NeuroDecision can be realized in the knowledge that the scores are explainable and that reason codes can be provided to consumers or businesses where requested. NeuroDecision® Technology is available through Equifax Ignite.

* Based on a Commercial Insight Delinquency Score improvement achieved by Equifax in 2017.

Recommended for you