Educating school students about money and building financial understanding not only equips them with essential skills and confidence to navigate life’s journey, but can underpin the financial wellbeing of a nation.

In New Zealand, credit scores and the role they play in accessing credit is not widely known among consumers. However, a partnership between Equifax and financial education platform, Banqer, is working to change that.

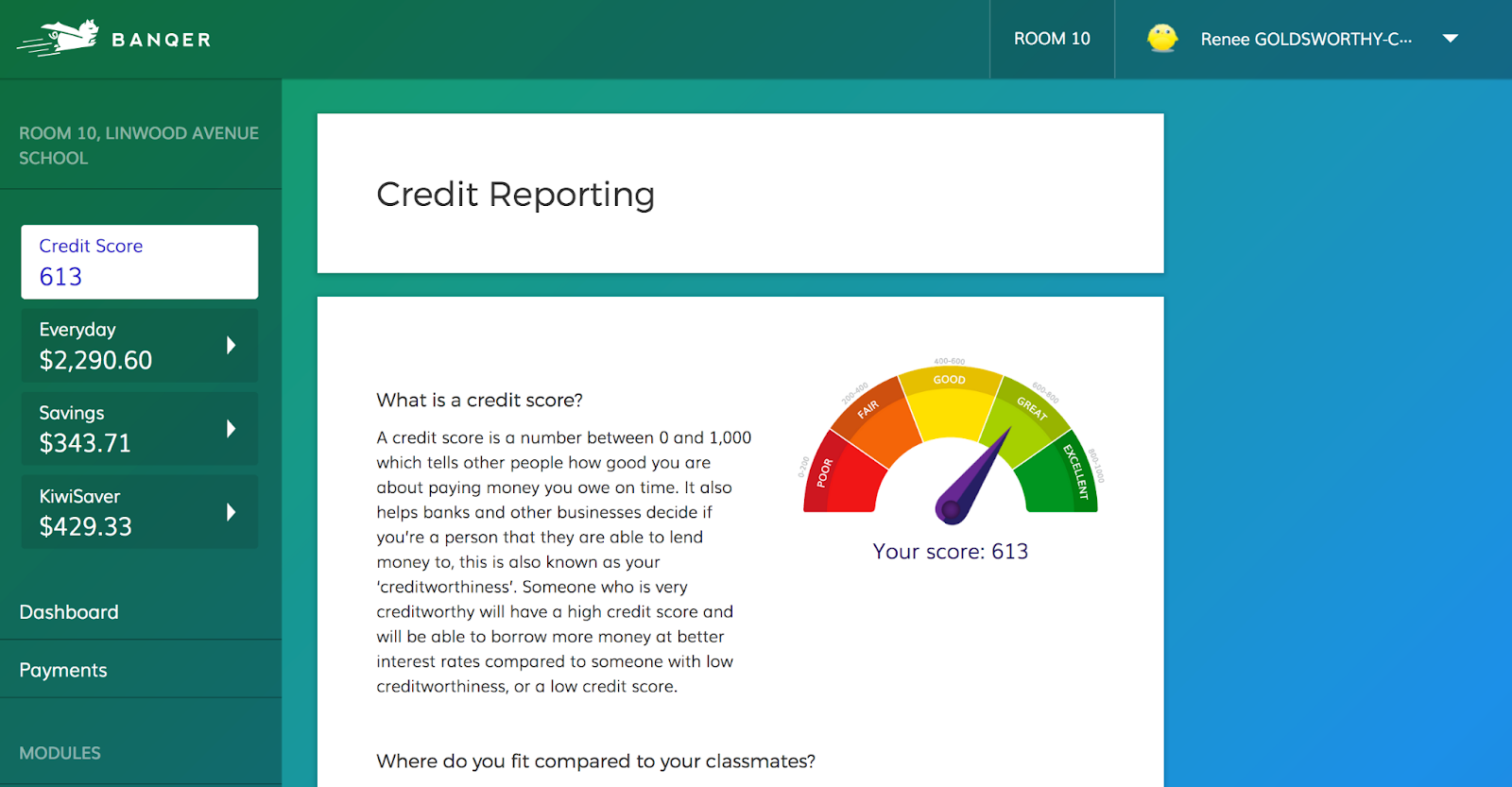

Banqer started with a vision to teach one student about money and is now on a mission to prepare the next generation for their financial future. The innovative online platform builds financial literacy and knowledge through experiential learning. In a simulated and fun environment, students learn about income (even having jobs around school to earn Banqer money), expenses, savings and credit accounts, debt, tax and insurance.

Equifax first partnered with Banqer in 2017 and since then we’ve helped educate nearly 245,000 Kiwi kids across 2,103 schools about credit scores. Our partnership helps provide schools with free access to the Banqer Primary platform (in conjunction with other partners). We also built a credit score module to help students learn what a credit score is, how their financial behavior impacts their credit report and to set goals to improve their score over time. In Q2 2023 the average credit score for students was 643 and 1,469 students earned the Credit Score Superstar achievement, with a credit score of more than 900.

- Angus Luffman, Managing Director Equifax New Zealand

Setting the younger generation up for financial success later in life is core to our purpose of helping people live their financial best. Learn more about our financial inclusion efforts at equifax.com/financialinclusion.

- Simon Brown, Co-CEO, Banqer