Learning how to manage finances at a young age can help empower people with the knowledge and skills necessary to build a successful future. In the UK, just one in four children receive some sort of financial education in school, and around half of adults say they lack the confidence to be able to manage their finances¹.

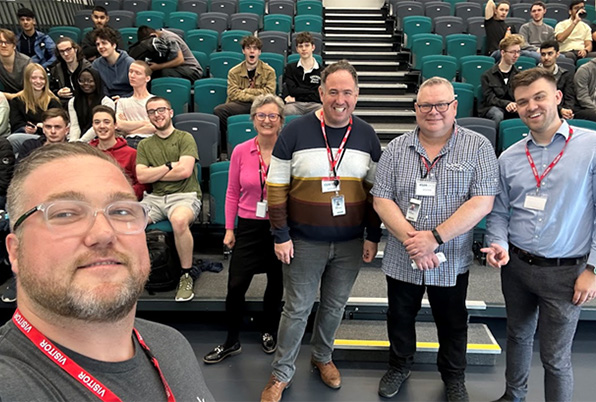

Speakers for Schools is a UK-wide youth charity on a mission to help young people find their financial footing and get the best possible start in life. In 2023, Equifax UK partnered with Speakers for Schools to design and deliver a pilot education outreach program for teenagers.

The initiative matches volunteers with local schools to share financial education and skills that help people make informed financial decisions and avoid common pitfalls. The sessions cover basic information on credit scores, budgeting, debt, and how to protect against online scams.

The program has helped educate over 170 young people through workshops in Nottingham and Leeds. Each attendee leaves the session with a budget planner to help manage finances as they leave secondary school and embark on living as independent young adults.

-Sue Owen-Bailey, Equifax Social Innovation and Sustainability Manager

Building a strong foundation in financial capability early in life can unlock greater access to financial opportunity later. Establishing good credit habits, understanding how to borrow responsibly and proactively avoiding fraudulent scams are great ways to chart a path toward a successful financial future.

Credit education is an important tenet of our purpose to help people live their financial best. It’s part of our commitment to building a more inclusive financial ecosystem. Learn more about our financial inclusion efforts at equifax.com/financialinclusion.