Whether deployed overseas for a decade or just wrapping up their first enlistment, members and veterans of the United States military face a series of adjustments as they transition from the military back into civilian life.

This may involve searching for a new job or career, re-establishing social dynamics, and developing new schedules and routines. It may also mean navigating new financial responsibilities like leasing or purchasing a vehicle, paying rent or a mortgage, handling utility bills and managing credit.

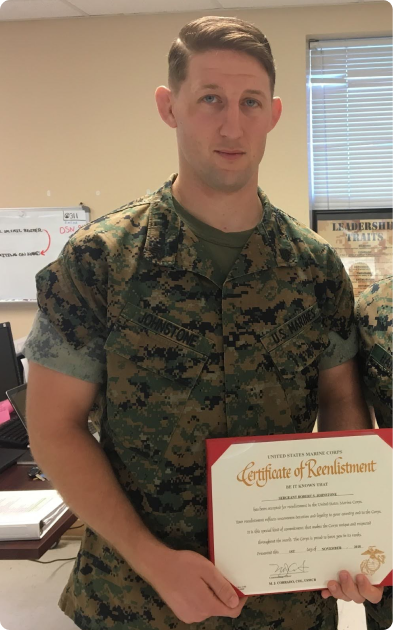

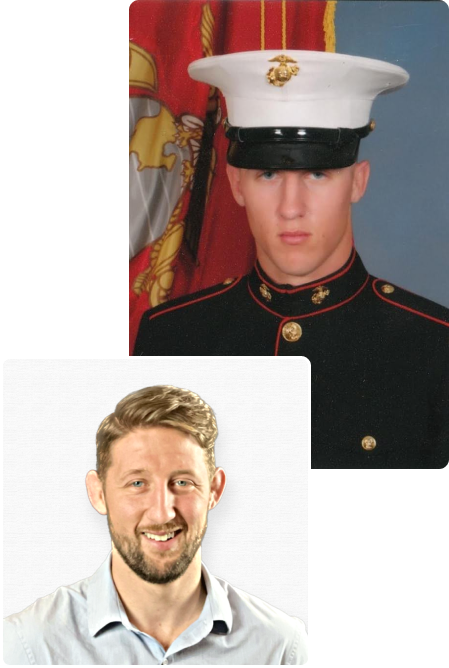

“When you’re enlisted, housing is provided—and for many, you might not need a personal vehicle to get to or from work. If you use base dining facilities, you won’t even pay for food directly,” says Robert Johnstone, United States Marine Corps veteran and Equifax Partner Marketing Manager.

Johnstone is one of the approximately 16.2 million military veterans¹ in the U.S., and his experience is one shared by many of those veterans as well as the approximately 1.31 million active-duty U.S. personnel.² “Those benefits are amazing,” added Johnstone, “but you’re disconnected from managing your personal finances. This can leave a knowledge gap for veterans at the end of their service, especially those who enter directly after high school.”

Challenges

In addition to the added responsibilities of civilian life, some service members may have had specific deployments, such as in a theater of operations or aboard a ship, that limited opportunities for experience with credit and finances. And nearly half of active-duty service members are 25 years old or younger,³ meaning that they begin working to establish credit and building and managing assets at a later age.

Johnstone was one of those recruits who joined the military out of high school and had more financial questions than answers when he returned to civilian life.

Johnstone spent nine years in active duty, including two years deployed in Southeast Asia and Japan, experiencing a different culture and financial ecosystem. “When my time in the service ended, returning to a civilian lifestyle was a major shock. I had never worried about being hungry, or homeless. I had bills showing up all of a sudden—things like dental and medical bills that I hadn’t dealt with before. My credit scores fell into the subprime range...I didn’t know what to do, but I knew I had to figure it out if I wanted to achieve my goal of owning a home.”

“The military has great financial resources—every base offers education, financial consulting, and other services. But it’s easy to become sheltered when so much is provided.”

Once he began focusing on his finances, Johnstone was able to raise his subprime credit scores to super-prime credit scores (at the highest end of scores) in just over two-and-a-half years with a goal of reducing his interest rates and increasing his opportunities for new loans and other services. To do so, he began researching personal finance and developed his own “ops plan” for his future. He shares his top tips for service members who want to follow a similar path of improving or maintaining a strong financial situation.

Robert's Tips For Managing Finances

- Learn and understand credit. Knowing how credit works and the components of a credit score are the foundation to a successful financial future.

- There are many online resources available to help build and bolster credit knowledge. For example, the Equifax Knowledge Center provides key information and resources on credit, debt, personal finance, and other financial topics.

- Familiarize yourself with your debt-to-income ratio. Listing out all of his expenses was a real eye-opener for Johnstone and helped him formulate a plan for his future.

- And don’t forget to check for military and veteran discounts whenever you’re shopping to help save on expenses.

- Don’t be afraid to use credit wisely (and begin building your credit scores)! Once you understand your regular bills and budget, Johnstone suggests finding ways to build credit.

- Using credit responsibly—meaning paying on time and not spending more than you’re able to repay—can help increase your credit score.

- Having multiple types of credit can be a good thing for lenders and creditors to see on your credit report.

- Sign up for free Active Duty Military Credit Monitoring and free Active Duty Alerts while still active (or in the reserves or National Guard). This can help prevent fraud and identity theft and help you maintain control of credit while you’re away.

- Take advantage of Veterans Affairs benefits. Beyond the G.I. Bill, which helps pay for education and expenses, the Office of Veterans Affairs provides benefits that many veterans may not be aware of, including healthcare, disability, financial and mental health.

- Johnstone encourages all veterans to take a deep dive on the VA website on a regular basis to stay aware of what’s available.

Other Resources

Today, Johnstone has achieved many of his personal financial goals; he’s purchased a house and, in just a couple years, built his personal and retirement savings from zero to a healthy (growing) amount.

He has adopted a new mission: helping fellow veterans find their own financial footing. As part of this, he volunteers at USA Cares, a national non-profit whose mission is to provide post-9/11 military veterans, service members, and their families with financial assistance and post-service skills training to create a foundation for long-term stability.

He is also Co-Chair of the Veterans Community at Equifax, an internal employee resource group of military members (past and present), their spouses, and allies that provides career development opportunities, community involvement and fundraising, and most importantly a community of support.

Johnstone is not alone in his commitment to supporting military members, veterans and their families in their financial journey. In addition to USA Cares, several local and national non-profit organizations provide important resources for connecting veterans with knowledge and tools to support their post-military journey. Veterans also have access to several financial institutions and instruments that cater specifically to members of the U.S. military.

The government also offers information to help connect military families and veterans to benefits and knowledge, including:

- U.S. Department of Veterans Affairs: Financial Literacy Resource

- Military OneSource: Personal Finance Resource

- Department of Defense: Office of Financial Readiness

Inclusion and diversity is an important aspect of our shared value of Living our Best, and veterans play an important role in our recruiting and hiring process.

Our commitment to financial inclusion includes supporting military veterans who, through consumer education or specialized products, can improve their financial capability by better understanding how to effectively manage their financial resources. It’s part of our Purpose, to help people live their financial best.

In addition to the Equifax Knowledge Center, the Equifax Learn consumer video series provides answers to common questions about credit scores, money management, and more.

"

We appreciate the many sacrifices made by our military service members and their families, and we are committed to helping them live their financial best by providing the tools that minimize their risk of fraud or identity theft. We recognize the burden of service not only lies on the shoulders of the service members but their families as well.”

Mark W. BegorCEO of Equifax

¹ United States Census Bureau. Census.gov. Facts for Features: Veterans Day 2023: November 11, 19 Oct. 2023. Accessed 18 July 2024. Available: https://www.census.gov/newsroom/facts-for-features/2023/veterans-day.html

² Central Intelligence Agency. The World Factbook. Field Listing: Military and Security Service Personnel Strengths. Accessed 18 July 2024. Available: https://www.cia.gov/the-world-factbook/field/military-and-security-service-personnel-strengths/

³ United States Department of Defense. 2022 Demographics Report: Profile of the Military Community, 29 Nov. 2023.