Product Overview

VantageScore is the first and only tri-bureau credit scoring model to incorporate trended credit data and advanced machine learning for deeper risk assessments. It's capable of predicting the likelihood of a consumer becoming 90+ days delinquent within 24 months of scoring.

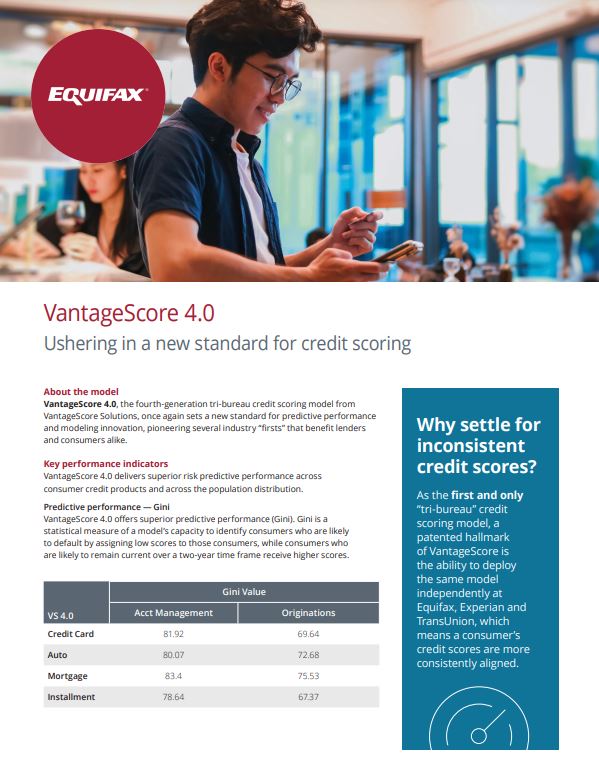

A patented hallmark of VantageScore is the ability to deploy the same model independently at Equifax, Experian and TransUnion, which results in a highly predictive and consistent consumer credit score.

A patented hallmark of VantageScore is the ability to deploy the same model independently at Equifax, Experian and TransUnion, which results in a highly predictive and consistent consumer credit score.

Solution

Trended Credit Data Supports Deeper Risk Assessments

Trended credit data reflects changes in credit behaviors over time, in contrast to the static, individual credit history records that have long been available in consumer credit files and used in generic scoring models.

With VantageScore, you'll get deeper, more meaningful insights into consumers’ credit risk profiles with trended credit data.

With VantageScore, you'll get deeper, more meaningful insights into consumers’ credit risk profiles with trended credit data.

Key Benefits

Trended credit data

Takes into account the trajectory of borrower behaviors for better risk assessment.

Innovative machine learning techniques

Generate a more accurate credit score for those with sparse credit histories.

National Consumer Assistance Plan (NCAP)-related considerations

Aligns with changes in credit-bureau handing of public records and collections data.

Improves consistency across all three nationwide credit reporting agencies

Uses an identical tri-bureau credit score algorithm for more consistent scores.

Related Resources

VantageScore Creates an Instant Competitive Advantage

VantageScore sets a new standard for predictive performance and modeling innovation. Trended credit data takes into account the trajectory of borrower behaviors for deeper risk assessment, while innovative machine learning techniques deliver accurate and consistent consumers scores — even for those with sparse credit files.

Strengthen predictive ability, evaluate thin- and no-file consumers with confidence, improve portfolio performance and mitigate risk with VantageScore.

Strengthen predictive ability, evaluate thin- and no-file consumers with confidence, improve portfolio performance and mitigate risk with VantageScore.

Related Products

Bankruptcy Navigator Index 5.0

Maximize your portfolio profitability and protect against the immediate, long-term or surprise risk of bankruptcy

Insight Score for Personal Loans

An innovative, FCRA risk score optimized for unsecured personal loans

contact

Contact Us

Connect with our sales team and discover how this product can meet your business needs.

Contact Us

Connect with our sales team and discover how this product can meet your business needs.

Learn More

Visit VantageScore.com to find additional information about this tri-bureau offering.